Geton International supplies no info on its web site about who owns or runs the corporate.

Geton International’s web site area (“geton.international”) was privately registered on August twenty third, 2020.

It’s value noting that Geton International’s web site area makes use of a Slovenian name-server supplier.

Advertising movies on Geton International’s official YouTube channel function Kari Wahlroos.

Wahlroos is finest identified for being one of many extra distinguished faces of the OneCoin Ponzi scheme.

Final we heard Wahlroos was working promotion for the Wantage One Ponzi scheme. Guess that didn’t work out.

Wahlroos’ involvement in Geton International led me to “Geton Information”, which seems to be an official Geton International advertising weblog.

I wasn’t capable of pin Kozlevčar to any MLM corporations. He’s nonetheless behind a variety of failed cryptocurrency initiatives.

A Reddit publish made two years in the past ties Kozlevčar to Socratescoin, Proncoin and Piplcoin.

The 2 latter shitcoins have been repurposed to be used in Geton International (extra on this within the assessment conclusion).

As per Kozlevcar’s Twitter profile, he’s primarily based out of Ljubljana, Slovenia.

Replace ninth January 2021 – A reader despatched in an archived scan of the June 2nd 2000 run of the Slovenian newspaper GorenjskiGlas.

On web page 39 of the paper there’s an article detailing Milan Kozlevčar being busted for heroin smuggling:

In line with my supply, Kozlevčar was busted smuggling heroin from Croatia to Germany.

He was 28 on the time and sentenced to 9 years in jail.

Sometimes I don’t embrace non-MLM associated historical past in our evaluations.

Throughout the context of Geton International being a Ponzi scheme nonetheless, I imagine that is related due-diligence info. /finish replace

Learn on for a full assessment of Geton International’s MLM alternative.

Geton International’s Merchandise

Geton International has no retailable services or products, with associates solely capable of market Geton International affiliate membership itself.

Geton International’s Compensation Plan

Geton International’s web site particulars one funding plan. Via Geton Buying and selling, the corporate additionally affords extra funding tiers.

Collectively Geton International’s funding alternatives are known as “Geton Investments”.

For the sake of simplicity I’ve grouped all of them collectively under.

Geton International

Geton International associates make investments funds on the promise of an marketed 100-day return:

- make investments €1 to €499 EUR and obtain 0.5% a day

- make investments €500 to €2499 EUR and obtain 0.75% a day

- make investments €2500 to €9999 EUR and obtain 1% a day

- make investments €10,000 to €12,500 EUR and obtain 1.25% a day

Observe that if Geton International associates dare put in a withdrawal request earlier than 100 days, the corporate costs an exorbitant 50% charge.

Every Geton International affiliate is required to pay a €50 EUR affiliate membership charge, which the corporate makes use of to pay recruitment commissions.

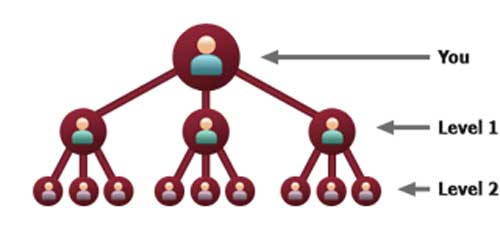

Geton International pays recruitment commissions by way of a 5×9 matrix.

A 5×9 matrix locations an affiliate on the high of a matrix, with 5 positions immediately underneath them.

These 5 positions kind the primary stage of the matrix. The second stage of the matrix is generated by splitting these 5 positions into one other 5 positions every (25 positions).

Ranges three to 9 of the matrix are generated in the identical method, with every new stage housing 5 occasions as many positions because the earlier stage.

Recruitment commissions are paid out as a share of funds invested throughout the matrix.

Particular recruitment fee percentages are decided by what stage of the matrix new funding is made:

- stage 1 (5 positions) – 6%

- stage 2 (25 positions) – 5%

- stage 3 (125 positions) – 4%

- stage 4 (625 positions) – 6%

- stage 5 (3125 positions) – 5%

- stage 6 (15,625 positions) – 4%

- stage 7 (78,125 positions) – 3%

- stage 8 (390,625 positions) – 2%

- stage 9 (1,953,125 positions) – 1%

Geton Buying and selling

Funding tiers via Geton Buying and selling begin at €1 EUR.

- make investments €1 to €2499 EUR and obtain 0.75% a day

- make investments €2500 to €9999 EUR and obtain 1% a day

- make investments €10,000 to €12,500 EUR and obtain 1.25% a day

Funding phrases are the identical as Geton International. A 50% withdrawal charge is charged should you withdraw earlier than the 100 day time period finish.

Geton Buying and selling associates pay both €100 EUR or €12,500 EUR for normal and premium membership respectively.

Each membership tiers have their very own recruitment commissions construction.

Common tier Geton Buying and selling recruitment commissions are paid out by way of a 4×8 matrix.

A 4×8 matrix locations a Geton Buying and selling affiliate on the high a matrix, with 4 positions immediately underneath them:

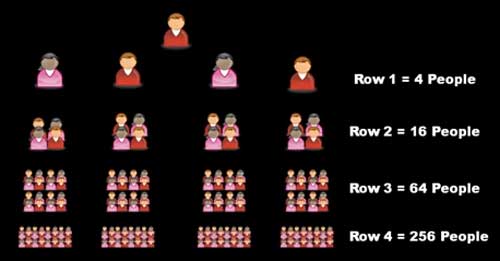

These 4 positions kind the primary stage of the matrix. The second stage of the matrix is generated by splitting these 4 positions into one other 4 positions every (16 positions).

Ranges three to eight of the matrix are generated in the identical method, with every new stage housing 4 occasions as many positions because the earlier stage.

Recruitment commissions are paid out as a share of funds invested throughout the matrix.

Particular recruitment fee percentages are decided by what stage of the matrix new funding is made:

- stage 1 (4 positions) – 6%

- stage 2 (16 positions) – 5%

- stage 3 (64 positions) – 5%

- stage 4 (256 positions) – 6%

- stage 5 (1024 positions) – 5%

- stage 6 (4096 positions) – 4%

- stage 7 (16,384 positions) – 3%

- stage 8 (65,536 positions) – 2%

Geton Buying and selling Premium tier prices €12,500 EUR.

Geton Buying and selling Premium recruitment commissions are paid by way of a 3×6 matrix.

A 3×6 matrix locations an affiliate on the high of a matrix, with three positions immediately underneath them:

These three positions kind the primary stage of the matrix. The second stage of the matrix is generated by splitting these three positions into one other three positions every (9 positions).

Ranges three to 6 of the matrix are generated in the identical method, with every new stage housing thrice as many positions because the earlier stage.

Recruitment commissions are paid out as a share of funds invested throughout the matrix.

Particular recruitment fee percentages are decided by what stage of the matrix new funding is made:

- stage 1 (3 positions) – 9%

- stage 2 (9 positions) – 8%

- stage 3 (27 positions) – 9%

- stage 4 (81 positions) – 8%

- stage 5 (243 positions) – 6%

- stage 6 (729 positions) – 5%

Past recruitment commissions, there doesn’t look like any distinction between Geton Buying and selling common and premium membership.

Becoming a member of Geton International

Geton International affiliate membership prices are tied to funding tiers:

- Geton International affiliate membership is €50 EUR

- Geton Buying and selling affiliate membership is €100 EUR

- Geton Buying and selling Premium affiliate membership is €12,500 EUR

Full participation within the hooked up revenue alternative requires a further €1 to €12,500 EUR funding.

Conclusion

So the ruse goes, Geton International associates are investing to obtain “711% marketcap development of hosted blockchain corporations.”

That’s an odd declare to make, seeing as the one blockchain corporations on provide are Milan Kozlevčar’s failed shitcoins.

Geton International doesn’t precisely go into how returns might be generated, however does tout PiplCoin and PronCoin as “blockchain corporations”.

PiplCoin launched in 2017 and is principally a pointless coin pegged to the world’s inhabitants.

The mission of PiplCoin is to supply excessive grade liquidity for a blockchain-based mission PiplShare.

The 7.531.907.537 PiplCoins cash characterize the utmost quantity of cash ever exist throughout the lifetime of the PiplCoin cryptocurrency, and correspond to a world inhabitants estimate on 15 July 2017.

PiplShare is pitched as a “worldwide freelancing platform”. Or not less than that was the unique plan.

Now it seems like a smart-contract Ponzi;

Make investments to affluent human sources [sic] transparently, primarily based on Sensible Contract.

Yeah, simply your typical shitcoin hype word-salad sandwich.

As per Alexa, PiplCoin’s web site visitors is lifeless. PiplShare was dormant up till April, however is now again in decline.

PiplCoin is publicly tradeable. PIPL debuted at round 9 cents. Did the shitcoin pump for just a few months, dumped and is sitting at $0.000655.

PronCoin’s web site hits you with a blown up inventory picture of a lady in lingerie.

We want to invite you to be part of the longer term and assist to herald a brand new period for the web grownup business that may lastly give authority to the individuals, the individuals who like to have a look at porn on the web.

Riiiiiiiiiight.

PronCoin has additionally been round since 2017 and functionally is as pointless as PiplCoin.

PronCoin doesn’t look like publicly tradeable. Such to the extent it’s tradeable on Geton International’s inside Geton Alternate, no inside worth is offered.

I did discover a chart exhibiting purported inside values on Geton International’s web site, nonetheless these look like made up (primarily based on PIPL’s verifiable pretend worth):

Geton Alternate is principally the place Geton International associates will money out their nugatory PIPL and PRON.

Because the creator of all this, Milan Kozlevčar is of course holding boatloads of PIPL and PRON.

Geton International’s final aim is to recruit new bagholders, pump the worth up once more and make Kozlevčar wealthy.

Don’t simply take my phrase for it although, the pump and dump mannequin is actually spelled out in Geton International’s “roadmap”:

-more tokens distributed greater the token worth

-more customers on the platform

-more worth to the platform

-more tokens distributed greater the token worth

-after distribution the platform is owned by the group and powered by the blockchain

-token itemizing on the exterior change

Look, so far as cryptocurrency shenanigans go that is par for the course. Though it’s a lot tougher to get individuals to take a position into your shitcoins now than it was in 2017.

My concern with Geton International is the funding alternative.

Clearly each PiplCoin and PronCoin aren’t producing income to fund marketed Geton International returns.

Meaning new funding is the probably supply of ROI income, making Geton International a Ponzi scheme.

At a minimal neither Geton International or Kozlevčar are registered to supply securities in any jurisdiction, which means Ponzi or no, that is all unlawful from the get go anyway.

And there’s the difficulty of Geton International functioning as a pyramid scheme, and the involvement of serial scammers corresponding to Kari Wahlroos.

As with all MLM Ponzi schemes, as soon as recruitment dies down so too will new funding.

This may starve Geton International of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that after they collapse, the vast majority of contributors lose cash.