Exeno.com is an progressive world e-commerce for a quickly rising group of shoppers.

It allows buying all items with cryptocurrencies (BTC, ETH, BTCV).

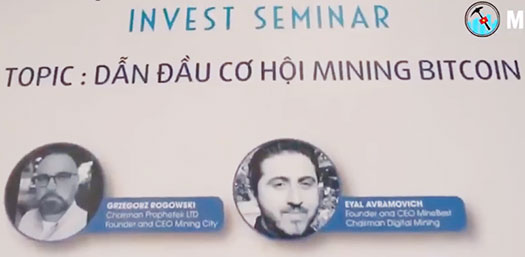

BTCV refers to Bitcoin Vault, a Ponzi shitcoin launched by Mining Metropolis proprietor Eyal Avramovich.

A Mining Metropolis replace from early 2021 references Exeno’s integration:

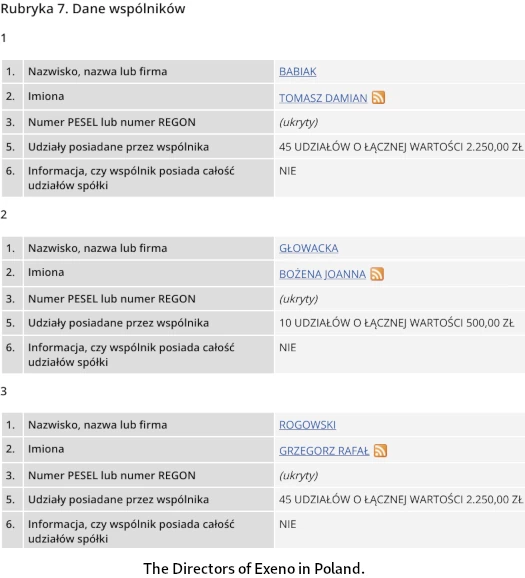

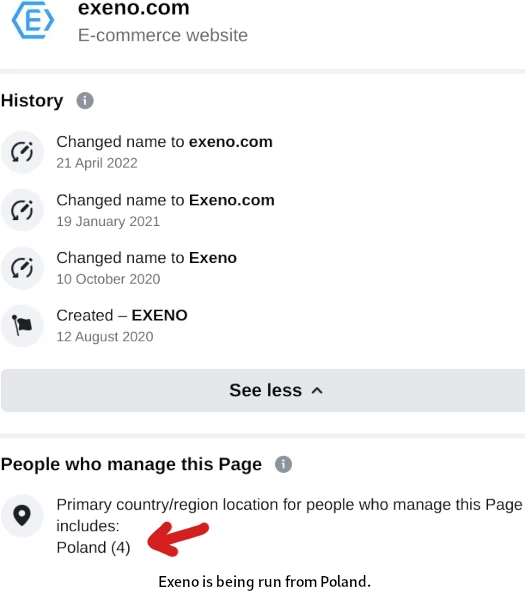

Exeno was integrated as Exeno sp. zo.o. (EXENO SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ), in Poland on November third, 2020.

The Administrators of Exeno are:

- Tomasz Damian Babiak

- Bozena Joanna Glowacka and

- Grzegorz Rafal Rogowski

We all know “Grzegorz Rogowski” as Mining Metropolis’s Greg Rogowski.

Moderately than simply be sincere about proudly owning and operating Mining Metropolis himself, Eyal Avramovich appointed Rogowski, a former worker of his, as CEO.

You could or could not have famous this paragraph from the early 2021 Mining Metropolis press-release above:

Mining Metropolis doesn’t personal or assume any accountability for Exeno. The rig is a very totally different firm with no ties to Mining Metropolis.

Greg Rogowski being CEO of Mining Metropolis and proudly owning Exeno makes the “fully totally different” declare farcical.

To cover his possession of Exeno, Rogowski eliminated himself as a Director in March 2021. Michael Piotrowski was additionally faraway from Exeno’s Board of Administrators.

On its web site in the present day, Exeno cites

- Tomasz Babiak as its CEO

- Bozena Glowacka as its CLO (Chief Authorized Officer?) and

- Michael Piotrowski as its Lead Designer

Greg Rogowski doesn’t characteristic on Exeno’s web site.

All through 2021 Exeno introduced itself as an ecommerce platform Mining Metropolis buyers might launder BTCV by means of for merchandise.

Mining Metropolis collapsed in October 2021. In November 2021 Rogowski disappeared.

In March 2022 Rogowski reappeared to attribute his disappearance to a coronary heart assault.

He then disappeared once more and hasn’t been seen in public since.

Avramovich continues to defraud customers with iMine, which he’s merged Mining Metropolis sufferer bagholders into.

Greg Rogowski has been changed by iMine puppet CEO Jorge Mesquita.

On or round October 2022, Exeno changed its defunct ecommerce web site with its present web site.

This coincided with the launch of Exeno Coin.

Exeno got here to me from presumably a former Mining Metropolis investor, claiming Rogowski was behind it. Past the analysis above, I haven’t been in a position to definitively confirm this declare.

If affirmation does floor that Rogowski is behind Exeno, I’ll depart an replace under.

Moderately than acknowledge it’s a Polish firm run out of Poland…

…Exeno pretends it’s “based mostly within the Marshall Islands”.

Learn on for a full assessment of Exeno’s MLM alternative.

Exeno’s Merchandise

Exeno has no retailable services or products.

Associates are solely in a position to market Exeno affiliate membership itself.

Exeno’s Compensation Plan

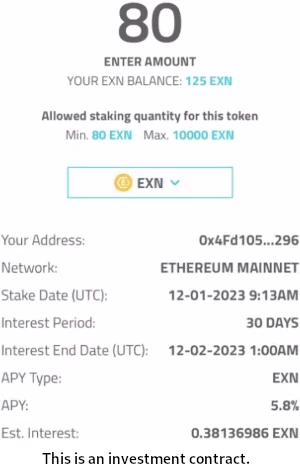

Exeno associates put money into Exeno Coin (EXN). That is performed on the promise of annual returns, paid in EXN.

Exeno’s EXN funding scheme is dressed up in “staking” terminology.

A person makes a purchase order designated as eligible for stake again with the quantity displayed in EXN.

As soon as person makes the acquisition, very like cashback, this quantity is pending for a sure time period to make sure the order absolutely goes by means of. At exeno, this time period will quantity to 30 days after the acquisition is made.

EXN is routinely staked for this era, on the finish of which the person receives the quantity plus stake earned.

The MLM facet of Exeno is run by means of “Exeno Finance”.

Exeno launched with a non-MLM one-tier “Ambassador Program”.

One tier, person can solely refer folks (not different referees) below them.

By default, a person will earn a fee on the web quantity of purchases made by their referrals.

Supposedly Exeno was to launch an MLM compensation plan by the tip of 2022.

A full fledged multi-tier associates program is within the works and the intention is to introduce it by finish of 2022.

No additional particulars are offered on Exeno’s or Exeno Finance’s web site.

Whereas no specifics can be found, we all know Exeno Finance associates might be compensated for recruiting new affiliate buyers.

Becoming a member of Exeno

Exeno doesn’t disclose affiliate membership prices on its web site.

Exeno Conclusion

BehindMLM doesn’t normally publish opinions with out full compensation plan particulars. I’ve made an exception with Exeno as a result of they’ve confirmed an MLM compensation plan has been or is about to be deployed.

Whatever the particular commissions paid out and the way, with nothing marketed and bought to retail prospects Exeno operates as a pyramid scheme.

That’s a minor problem nevertheless compared to Exeno’s “staking” Ponzi scheme.

The enterprise mannequin is thus:

- Exeno associates put money into EXN

- EXN is parked with Exeno (staking)

- Exeno rewards associates with agreed returns as per 30 day funding contracts

- returns are paid to associates, who then money out subsequently invested funds

That is your basic “staking” MLM crypto Ponzi scheme. It’s the identical rubbish Mining Metropolis scammed BTCV and Electrical Money buyers with.

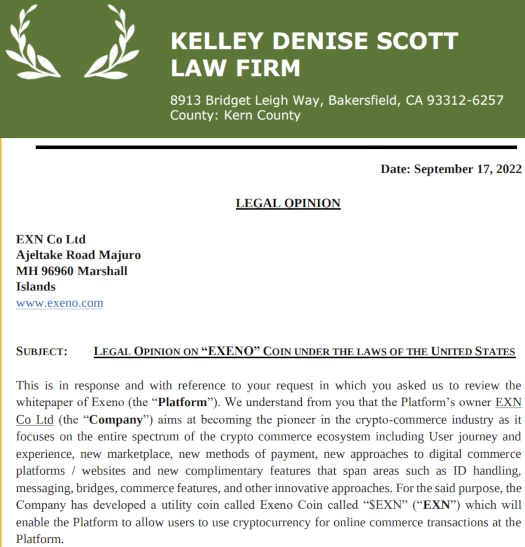

In an try to justify fraud, Exeno affords up a authorized opinion from US legislation agency Kelly Denise Scott.

Kelly Denise Scott’s authorized opinion accurately cites the Howey Take a look at to find out whether or not Exeno is providing a safety.

The take a look at is whether or not the scheme entails an funding of cash in a typical enterprise with earnings to come back solely from the efforts of others.

An instrument might be handled as a safety if all the next are current:

i) Funding of Cash

ii) Frequent Enterprise

iii) Expectation of Revenue

iv) By way of the Efforts of the Promotors

Kelly Denise Scott acknowledges Exeno associates are investing cryptocurrency into EXN. After that although the evaluation falls aside.

With respect to Frequent Enterprise, Kelly Denise Scott writes;

EXN Cash are getting used to alternate sure companies on the Platform, which have been highlighted at the beginning of this Opinion.

Nevertheless, there is no such thing as a requirement for a mutual share within the earnings and dangers of the enterprise.

This can be a strawman protection. Exeno associates make investments EXN after which park (stake) invested in tokens with Exeno.

Exeno pays returns as per an agreed funding contract. Exeno returns invested funds and the ROI after the funding contract expires.

Exeno is thus clearly a typical enterprise associates are investing by means of.

With respect to expectation of revenue, Kelly Denise Scott writes;

Upon reviewing this matter, we word that EXN Coin holders wouldn’t be routinely anticipating revenue merely by holding the EXN Cash.

They would wish to make use of these cash for the companies supplied by the Platform. Like several type of worthwhile, the EXN Coin holder could maintain it

to a time the place the worth of the coin available in the market will enhance, whereby the holder could promote the coin with revenue.However, because the Coin offers an actual consideration and performance, it solely appears affordable (and the token is designed so) that the holders will use the token’s rights for consumption.

Due to this fact, this prong’s requirement of Safety Token/Coin doesn’t appear to have been met.

Um, what?

With respect to “through the efforts of the promotors”, Kelly Denise Scott writes;

On this case, EXN Coin shouldn’t be a software used to anticipate earnings by means of the efforts of the promotors, quite it’s a software to get numerous companies on the Platform.

Moreover, the holders of EXN Cash wouldn’t get something from the efforts of promotors as they’d be utilizing their EXN Cash on numerous aforementioned Providers.

Due to this fact, the final situation of Safety Token/Coin – revenue should be by means of the efforts of the promotors – has additionally not been fulfilled.

Once more, what?

The “numerous companies” Kelly Denise Scott don’t elaborate on is Exeno’s EXN funding scheme – by means of which passive returns are realized by means of no effort on the a part of the investor.

The second paragraph is not sensible in any respect inside the context of this Howey Take a look at prong:

The Supreme Court docket established 4 standards to find out whether or not an funding contract exists.

An funding contract is … to be derived from the efforts of others.

The “others” right here is Exeno, offerer of the EXN funding scheme. Whether or not different buyers do or don’t have something to do with derived returns is once more a strawman protection.

The explanation Exeno have gone out of their solution to falsely signify their passive funding scheme to not be a securities providing, is as a result of securities choices require registration with monetary regulators.

This moreover requires submitting of audited monetary reviews, which might require Exeno to verify the supply of withdrawal income.

Given mentioned income is “new funding”, you possibly can see why Exeno (and Mining Metropolis earlier than them), bullshit their method round securities legal guidelines.

Over the past 12 months particularly, the SEC has gone after a variety of cryptocurrency “staking” funding schemes.

The newest bust was Nexo Finance on January nineteenth.

In or round June 2020, Nexo Capital Inc. (“Nexo”) started to supply and promote the so-called Nexo Earn Curiosity Product (“EIP”) in the US.

The EIP allowed United States buyers to tender to Nexo sure crypto belongings, which Nexo deposited in interest- yielding

accounts after which utilized in numerous methods to generate revenue for its personal enterprise and to fund curiosity funds to EIP buyers.These included staking…

Based mostly on the info and circumstances … Nexo supplied and bought securities within the type of funding contracts and notes.

No matter what cryptocurrency corporations name funding contract (“staking” and “yield are at the moment the 2 prime ruses), it’s nonetheless an funding contract and thus a securities providing.

It must be famous that exterior the US, securities legislation is materially the identical in any nation with regulated monetary markets (principally each nation with a functioning economic system).

Any mixture of MLM and a passive funding alternative is a securities providing. And if an MLM firm providing securities isn’t registered with monetary regulators, they’re committing securities fraud.

Securities fraud lends itself to Ponzi schemes, which is what we now have with Exeno.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

It will starve Exeno of ROI income, finally leaving it unable to pay ROI withdrawal requests.

Being a shitcoin Ponzi, buyers will finally be left bagholding one more nugatory Ponzi shitcoin.

EXN is to Exeno what BTCV, ELCASH and wELCASH had been to Mining Metropolis.