DigiCoin Markets’ website domain (“digicoinmarkets.com”), was privately registered on August 18th, 2021.

In an attempt to appear legitimate, DigiCoin Markets provides a UK incorporation certificate for “DigiCoinMarkets LTD”.

An MLM company operating or claiming to operate out of the UK is a red flag.

UK incorporation is dirt cheap and effectively unregulated. On top of that the FCA, the UK’s top financial regulator, do not actively regulate MLM related securities fraud.

As a result the UK is a favored jurisdiction for scammers looking to incorporate, operate and promote fraudulent companies.

For the purpose of MLM due-diligence, incorporation in the UK or registration with the FCA is meaningless.

In addition to UK incorporation details, DigiCoin Markets puzzlingly provides an incomplete corporate address in Norway on its website.

On October 21st the Philippine SEC issued a DigiCoin Markets securities fraud warning.

As part of the SEC’s investigation, the regulator uncovered DigiCoin Markets

investments shall be deposited/credited to the respective Gcash accounts and Union Bank accounts of Mr. JIM MARK DELOS SANTOS and Mr. RAMIR TULISANA.

These appear to be Philippine nationals, suggesting that, as opposed to the UK or Norway, DigiCoin Markets is being run from the Philippines.

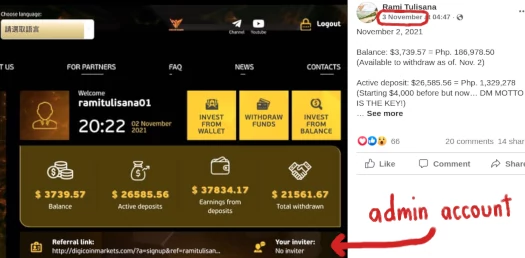

Despite the SEC’s warning and threats of fines and prison time, as of November 2021 Ramir Tulisana is still promoting DigiCoin Markets:

Jim Mark Delos Santos appears to have gone underground.

Despite only existing as of a few months ago, DigiCoin Markets falsely represents it launched in February 2020.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

DigiCoin Markets’ Products

DigiCoin Markets has no retailable products or services.

Affiliates are only able to market DigiCoin Markets affiliate membership itself.

DigiCoin Markets’ Compensation Plan

DigiCoin Markets solicits investment on the promise of advertised returns:

- Standard Package – invest $20 to $1000 and receive 5% a day for 30 days

- Medium Package – invest $1200 to $7000 and receive 6% a day for 30 days

- Professional Package – invest $8000 to $20,000 and receive 7% a day for 30 days

DigiCoin Markets pays referral commissions on funds invested by recruited affiliates.

Referral commissions are paid out via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

DigiCoin Markets caps payable unilevel team levels at four.

Referral commissions are paid as a percentage of funds invested across these four levels as follows:

- level 1 (personally recruited affiliates) – 5%

- level 2 – 3%

- levels 3 and 4 – 1%

Joining DigiCoin Markets

DigiCoin Markets affiliate membership appears to be free.

Full participation in the attached income opportunity however requires a minimum $20 investment.

DigiCoin Markets solicits investment in USD and various cryptocurrencies.

DigiCoin Markets Conclusion

DigiCoin Markets claims to be a “trading platform for crypto investors”.

The problem with this is DigiCoin Markets fails to provide evidence it is using trading revenue to pay withdrawals with.

Notwithstanding that if DigiCoin Markets was able to legitimately generate 7% a day via trading, they wouldn’t be selling access for just $20.

As it stands the only verifiable source of revenue entering DigiCoin Markets is new investment.

Using new investment to pay daily returns makes DigiCoin Markets a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment slows down so too will new investment.

This will starve DigiCoin Markets of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.