Crypto Advice’s website domain (“cryptoadvice.com”) was first registered in 2016. The domain registration was last updated in February 2018.

Mark Andrews is listed as the owner, through an incomplete address in California.

Given the generic name, lack of information on Andrews in relation to Crypto Advice and incomplete address, there’s a high chance Mark Andrews doesn’t exist.

Supporting this is a UK incorporation certificate for Mended Minds LTD on Crypto Advice’s website.

UK incorporation is dirt cheap and for the most part unregulated. It is a favored jurisdiction for scammers looking to incorporate dodgy companies.

As for Mended Minds, it appears to be a shell company that doesn’t exist outside of its UK incorporation.

Supposedly the CEO of Mended Minds and Crypto Advice is Jordan Lucas (another suspiciously generic name).

Research into Mended Minds and Lucas lead me to QuickX who, on their own website state Crypto Advice is

developing and promoting the market and community for QuickX Protocol.

CryptoAdvice purchased token in bulk from QuickX and after that it is selling to the small and big investors with a minimum lock-in period of one year, this lock-in period would prevent the dumping of token.

QuickX is supposedly a Maltese shell company.

QuickX are behind the QCX token, which is primarily promoted through Crypto Advice’s MLM opportunity.

Despite the Maltese shell incorporation, QuickX appears to be run by Indians, as evidenced by its default Indian rupee QCX value chart:

On the corporate side of things Secugenius Pvt. Ltd. is cited as the company behind QuickX.

Secugenius is an Indian company that claims to be an “IT Risk Assessment and Digital Security Services provider”.

A blog post on QuickX’s website caught my eye, pertaining to a “head-office opening in Malaysia”:

We are also pleased to inform you that company has opened this office with collaboration of two of its partner in QuickX , Mr. Marcus Dato and Mr. Najib Razak.

The Founder CEO and COO of QuickX Protocol Mr. Kshitij Adhlakha & Mr. Vaibhav Adhlakha and the CEO of *CryptoAdvice* Mr. Jordan Lucas were also present there along with all the achievers of the recent Malaysia tour.

It appears that Jordan is a token white guy, but otherwise QuickX and Crypto Advice are run by a group of Indians, Indians living in Malaysia and Malaysians.

Oh and if it’s not obvious by now, Crypto Advice, Mended Minds, QuickX and Secugenius are all the same company.

Any illusion of separation through shell corporations is smoke and mirrors.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Crypto Advice’s Products

Crypto Advice has no retailable products or services, with affiliates only able to market Crypto Advice affiliate membership itself.

Crypto Advice’s Compensation Plan

Crypto Advice affiliate invest funds in QCX tokens on the promise of advertised returns.

- Standard – 100 QCX

- Special – 200 QCX

- Bronze – 500 QCX

- Silver – 1000 QCX

- Gold – 2500 QCX

- Platinum – 5000 QCX

- Ruby – 10,000 QCX

- Titanium – 25,000 QCX

Note that Crypto Advice do not disclose the internal QCX value.

Once obtained, QCX tokens can be lent back to Crypto Advice in exchange for a monthly return.

- lend back 100 to 999 QCX and receive 4% a month

- lend back 1000 to 2499 QCX and receive 5% a month

- lend back 2500 to 4999 QCX and receive 6% a month

- lend back 5000 to 9999 QCX and receive 7% a month

- lend back 10,000 to 24,999 QCX and receive 8% a month

- lend back 25,000 or more QCX and receive 10% a month

Once lent, QCX tokens are locked up for a year.

Note that returns and commissions detailed below are all paid in QCX.

Referral Commissions

Crypto Advice pays a 5% referral commission on funds invested in QCX.

Residual Commissions

Crypto Advice pays residual commissions via a binary compensation structure.

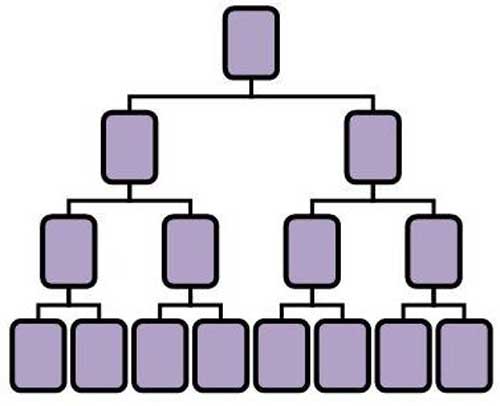

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day Crypto Advice tallies up new investment volume on both sides of the binary team.

Affiliates are paid a 10% residual commission on funds generated on their weaker binary team side.

Crypto Advice caps daily residual commission payouts based on how much an affiliate has invested:

- Standard tier affiliates can earn up to 20 QCX a day

- Special tier affiliates can earn up to 50 QCX a day

- Bronze tier affiliates can earn up to 200 QCX a day

- Silver tier affiliates can earn up to 300 QCX a day

- Gold tier affiliates can earn up to 1000 QCX a day

- Platinum tier affiliates can earn up to 1800 QCX a day

- Ruby tier affiliates can earn up to 2500 QCX a day

- Titanium tier affiliates can earn up to 4000 QCX a day

Once paid out on, volume is matched on the stronger binary team side and flushed.

Matching Bonus

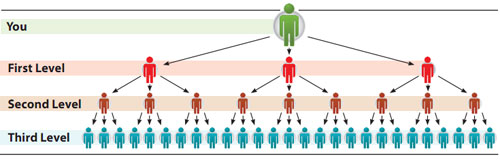

Crypto Advice pays a Matching Bonus via a unilevel compensation structure..

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

The Matching Bonus is paid as a percentage of residual commissions earned by unilevel team affiliates, capped down five levels of recruitment:

- level 1 (personally recruited affiliates) – 10% match

- level 2 – 8% match

- level 3 – 4% match

- level 4 – 2% match

- level 5 – 1% match

Joining Crypto Advice

Crypto Advice affiliate membership is free.

Participation in the attached income opportunity however requires investment in QCX tokens, plus payment of an “activation fee”.

Neither QCX investment costs or activation fee amounts are disclosed.

Conclusion

Crypto Advice is the end result of Indians wanting to run a cryptocurrency scam, in a country in which the use of regular cryptocurrency is seemingly up for debate.

Hence the shell incorporations in the UK, Malaysia and Malta.

Regardless of who runs Crypto Advice though and from where, at its heart its nothing more than a BitConnect Ponzi clone.

Instead of BCC Crypto Advice affiliates are investing in QCX. Instead of “lending” for a return they’re “staking”.

Materially there’s no difference between the two models.

Crypto Advice affiliates invest in QCX tokens, dump them with the company once acquired and receive more QCX tokens for doing so.

Additional QCX tokens are tied to recruitment of new investors, which are needed to fund eventually withdrawals.

Withdrawals are realized when early Crypto Advice affiliates cash out, and paid out of subsequently invested funds.

As with BitConnect, the flow of money from new investors to existing investors makes Crypto Advice a Ponzi scheme.

Rather than just admit that though, Crpyto Advice throws up the usual MLM crypto Ponzi external revenue cliches:

Naturally no evidence of any of these activities is provided. Nor is Crypto Advice and its associated shell companies registered to offer securities in the UK, India, Malta, Malaysia, or any of the other countries it solicits investment in.

Under the lending Ponzi model, when withdrawals exceed new investment, the owners do a runner.

Owing to lent QCX being locked for a year, the company all but guarantees those who get in early with withdraw the majority of invested funds.

This leaves the rest of Crypto Advice’s affiliate investors bagholding a worthless token. Cue the desperate sell off dump (zero interest outside of the scheme), which inevitably sees the propped up public QCX value plummet.

This is exactly what happened when BitConnect collapsed, wiping $2.4 billion in BCC’s public value in just ten days amid widespread losses.

Crypto Advice, QuickX and their “QCX Protocol” won’t play out any different.

Update 8th February 2021 – As suspected, “Jordan Lucas” was a Boris CEO.

Crypto Advice was run by QuickX’s founders, Vaibhav and Kshitij Adhlakha.

Following Crypto Advice’s collapse last year, the Adhlakha brothers went on to launch Riseoo.