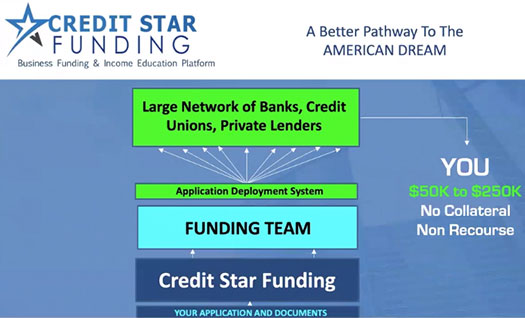

Credit score Star Funding’s enterprise mannequin is easy; the corporate pitches a promise to get its associates funded.

As soon as funded, Credit score Star Funding associates are anticipated to plough their mortgage into “non-collateral funding and Synthetic Intelligence revenue programs.”

And by that Credit score Star Funding is referring to Ponzi schemes. Extra on that later.

What’s essential now could be that Credit score Star Funding seems to withhold the true nature of the mortgage is assists its associates with acquiring.

Or in different phrases, Credit score Star Funding assists its associates with acquiring loans through deception – which is clearly unlawful.

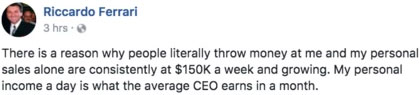

Previous to launching Credit score Star Funding, Ferrari (proper) was selling the BitClub Community Ponzi scheme.

In late 2017 Richard Brooke cited Ferrari for instance of “outright mendacity, silly unlawful claims and cheeseball movies about how cool it’s to be wealthy”.

On the time Ferrari boasted he was making $150,000 every week recruiting individuals into BitClub Community.

By early 2019 BitClub Community gave the impression to be on its final legs, prompting Ferrari to launch Credit score Star Funding.

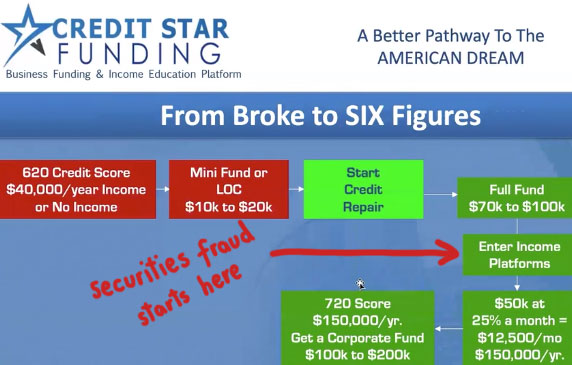

In a nutshell, Ferrari “helps” individuals receive $50,000 to $250,000 loans by way of deception, after which instructs recipients of loans to speculate that cash into fraudulent funding schemes.

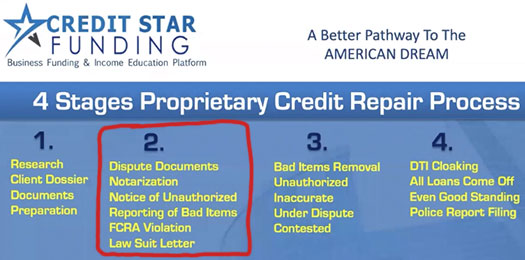

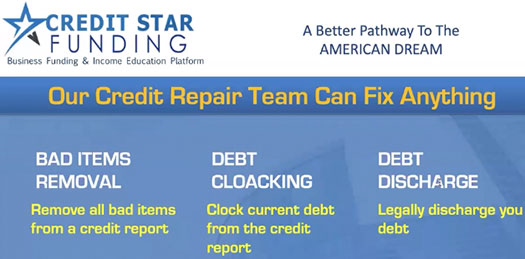

As per Credit score Star Funding’s advertising and marketing materials, particularly a presentation hosted by Ferrari himself roughly two weeks in the past, when you have a rubbish credit score rating then it’s worthwhile to restore it.

Naturally Credit score Star Funding and Ferrari can’t wait to bend over backwards to get you out of debt.

In order that no one can accuse us of misrepresenting Credit score Star Funding’s enterprise mannequin, I’ll be supplementing my very own analysis with quotes from Ferrari himself (something in a inexperienced field is Ferrari’s personal phrases).

One of many causes of our success is we’ve got a patented software program.

We’re related to giant networks of banks. There are 6400 banks in America. Six to seven thousand banks.

However you can’t file an utility with too many banks on the similar time, as a result of it’ll crash your credit score rating.

We are able to take your utility and put it by way of, say um, possibly ten banks, fifteen, generally even twenty, till we discover one, possibly two or three, which are keen to offer you cash. Proper?

In order that’s how we fund people who possibly can solely qualify for $10,000.

We are able to get it out of 5 completely different banks. There’s the $50,000.

In case you’re orange and better tier, you may apply for a mortgage by way of Credit score Star Funding, after which use that cash to repair your credit score rating.

As soon as your credit score is repaired you’re anticipated to get one other mortgage, to pump into numerous funding schemes.

Right here’s an instance of Credit score Star Funding’s offered mortgage phrases and circumstances:

To start out the method, there’s a $199 dedication charge charged to every shopper per utility. Will probably be invoiced on the primary unsecured mortgage or credit score line in case you are accepted.

A mortgage era charge of twenty-two% will probably be invoiced to you after the mortgage is funded to you. That is thought of a low charge for non-collateral, signature-only loans.

The rates of interest are customary charges for non-collateral, non-recourse loans. Might differ from 9% to 18% or greater relying in your credit score circumstances.

Alternatively if you happen to get a inexperienced tier mortgage, you simply leap straight into funding fraud.

Earlier than we get into that although, right here’s the MLM facet of Credit score Star Funding’s personal enterprise mannequin.

Credit score Star Funding presents referral commissions on recruited affiliate loans, paid down two ranges of recruitment:

- 2.5% on loans obtained by personally recruited associates (stage 1) and

- 1% on loans obtained by any associates your stage 1 associates recruit (your stage 2)

These commissions are paid out of the obtained loans which, if you happen to keep in mind, are obtained by obscuring the true nature of the mortgage to lenders.

Alright so that you’ve obtained a $50,000 to $250,000 mortgage through deception, funded Credit score Star Funding referral commissions out of the mortgage – what now?

Select your automobile and earn revenue!

Sadly the primary “bitcoin arbitrate” choice Credit score Star Funding supplies will not be obtainable.

In accordance with Ferrari, regardless of the scheme was it’s already pulled the “we received hacked” exit-scam.

This platform has made me and a few of you uh, some huge cash.

Sadly (although) they bumped into some safety breaches.

The platform is on maintain proper now, we’re not gonna spend lots of time on this.

The second “CTO Arbitrage” choice Credit score Star Funding supplies is the Cloud Token Ponzi scheme.

Cloud Token sees associates make investments funds on the promise of a passive return, purportedly generated through a buying and selling bot.

Not being registered to supply securities wherever on the planet, Cloud Token operates out of Malaysia illegally.

Along with securities fraud, Cloud Token additionally supplies no proof exterior income (derived through bot buying and selling or in any other case) is used to pay affiliate withdrawal requests.

Ferrari advertises a ten% month-to-month return on Cloud Token funding.

His incentive is a referral fee (Cloud Token’s personal MLM compensation plan), paid on funding by anybody who joins Cloud Token by way of Credit score Star Funding.

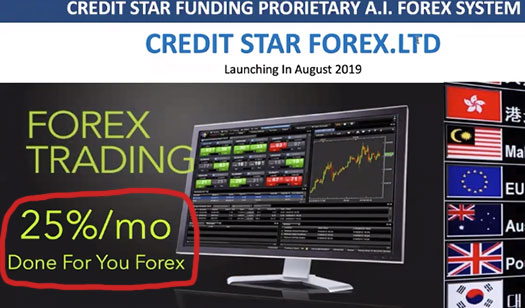

The third “credit score star foreign exchange” choice is an in home funding alternative, by way of which Riccardo Ferrari advertises a 25% a month “carried out for you” return.

That is Credit score Star Foreign exchange LTD. That is the precise identify of an organization that we’ve got included in a British Commonwealth nation.

And uh, that is the Jewel of the Nile so far as I’m involved.

Ferrari had initially meant to solicit funding of $25,000 or extra a pop, however he advises that plan has since been scrapped.

Whereas acquiring loans through deception is illegitimate for what needs to be apparent causes, the remainder of Credit score Star Funding’s enterprise mannequin is not any higher.

Neither Credit score Star Funding or Riccardo Ferrari are registered with the SEC. Which means each events are committing securities fraud through promotion of unregistered securities.

And whereas Ferrari regulatory legal responsibility extends solely to promotion of Cloud Token, the Credit score Star Foreign exchange 25% a month funding alternative is in home.

Meaning Ferrari and anybody he’s working with will probably be legally liable ought to the SEC examine and pursue a case towards the corporate.

Clearly Credit score Star Funding associates go away themselves liable ought to the promote the chance.

That’s on prime of the monetary danger when the Ponzi schemes Ferrari pushes by way of Credit score Star Funding inevitably collapse.

Replace tenth August 2019 – Inside 24 hours of this text being printed, Riccardo Ferrari deleted all of his latest Credit score Star Funding movies from his Ferrari Media Vimeo channel.

This contains the Credit score Star Funding advertising and marketing video referenced on this article.