monetary funding alternate options for folks with a promise of a return on their funding.

It’s a draw back, on account of Wakaya Perfection aren’t registered to produce securities throughout the US.

Sanneman claims to have been contacted by Barb Pitcock in September 2016. By the highest of the month Sanneman had signed up as a Wakaya Perfection affiliate beneath Pitcock’s downline.

In or spherical November 2016, Barb Pitclock traveled to Minnesota to educate Wakaya’s Ambassadors about Wakaya and how one can assemble their Wakaya enterprise.

For the time being, Barb Pitcock was already acutely aware of Sanneman proudly proudly owning her private skincare line and skincare enterprise (Essence Pores and pores and skin Clinic).

On or about November 8, 2016, Barb Pitcock suggested Sanneman that Wakaya wished her skincare line.

Barb Pitcock moreover suggested Sanneman she wanted to introduce Sanneman to William J. Andreoli, President of Wakaya.

Between November 8, 2016 and December 28, 2016, Sanneman engaged in negotiations with Wakaya and its representatives as to her doubtlessly being an investor in Wakaya.

Wakaya was actively soliciting a $250,000 funding from (Essence Pores and pores and skin Clinic and Sanneman) all through this time interval.

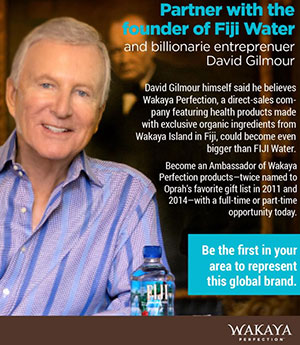

backed by a billionaire who had primarily based the Fiji Water agency and owned the tropical island Wakaya.

Wakaya’s promotional provides moreover appropriated the billionaire’s image and likeness to create the impression that the billionaire financially backed Wakaya.

Barb Pitcock moreover suggested Sanneman that Wakaya was debt free.

Sanneman alleges that primarily based totally on these representations, she ‘decided to place cash into Wakaya‘.

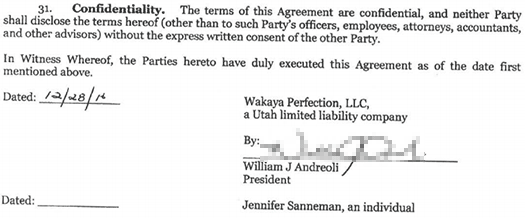

Sanneman entered into an “endorsement settlement” on or about December twenty eighth, 2016.

The endorsement settlement required Sanneman to license her image, title, likeness, and voice for industrial capabilities to Wakaya … as a Wakaya Mannequin Ambassador in alternate for compensation.

The endorsement settlement moreover contained an funding clause, that notably acknowledged Sanneman was to

make investments a sum of $250,000 with Wakaya for the goal of product enchancment, procurement, promoting and advertising and marketing and operational payments.

This was on scenario of a “return on funding” compensation schedule, as reproduced beneath;

Sanneman was to acquire 5% of exact sale value on specific Sanneman branded, Sanneman endorsed, or totally different specified merchandise.

If an Essence Clinic or Sanneman product was a part of a bundle deal to be supplied, then Sanneman was to be paid on “proportionate portion of product sales value your full bundle deal” [sic].

The compensation schedule moreover known as for the earnings share for Sanneman to be elevated from 5% to twenty% until Sanneman acquired cumulative royalty funds equal to $500,00, providing a 50% return on funding.

Sanneman invested $250,000 in Wakaya Perfection, as per the endorsement settlement, on December twenty eighth, 2016.

Sanneman’s securities fraud allegations begin alongside along with her not being prompt that on the time of her funding, Wakaya Perfection had been sued by Youngevity Worldwide.

Sanneman claims Wakaya Perfection “intentionally withheld vital data” referring to Youngevity’s lawsuit whereas they’ve been attempting to get her to take a position.

Sanneman states she

would not have invested $250,000 into Wakaya if (she) had acknowledged regarding the ongoing federal lawsuit.

Furthermore, Sanneman claims she was duped into believing

a billionaire was a companion and financial supporter of Wakaya (with the aim of) deceiv(ing Sanneman) into believing Wakaya was financially regular.

The billionaire is neither a companion in nor an proprietor of Wakaya.

I’m a bit confused over Sanneman’s claims Gilmour is neither an proprietor nor companion, as to at this time Gilmour is credited as founding father of the company on the Wakaya Perfection web page.

Gilmour is simply not a defendant in Sanneman’s lawsuit.

Wakaya Perfection’s merchandise have been moreover some extent of competitors between Sanneman and the company.

Wakaya required Sanneman to promote Wakaya merchandise with no verification of the safety of the merchandise, the place the merchandise acquired right here from or how the merchandise have been bottled.

Sanneman singles out vital oils manufactured by VEO Oils in Kansas, a company owned by defendants Dave and Barb Pitcock.

Wakaya moreover required Sanneman to promote merchandise like Dilo Oil and Aloe as coming from Fiji no matter that being factually false.

Sanneman goes on to say she had no say in packaging utilized by Wakaya Perfection, which resulted in

skincare merchandise arriving to Wakaya ambassadors and prospects damaged, which led to decreased earnings.

Alleged violations of the endorsement settlement between Sanneman and Wakaya Perfection embrace failure to

- reimburse Sanneman for payments incurred at Wakaya Perfection promotional events

- pay Sanneman her share of skincare merchandise purchased by retail prospects (along with hottest prospects)

- reimburse for Essence Pores and pores and skin Care product provided to Wakaya Perfection for “firm testing”

- assist with promotion of Essence Pores and pores and skin Care merchandise

Since her $250,000 funding two years previously, Wakaya Perfection has solely paid Sanneman $41,333.

Sanneman issued Wakaya Perfection with a recission provide on August tenth, which as of October the company had not accepted.

Nor had Wakaya Perfection repaid Sanneman’s $250,000 “securities funding”, prompting her October twenty fourth lawsuit.

Named defendants in Sanneman’s lawsuit are Wakaya Perfection, Todd Smith, William J. Andreoli, Blake Graham, Andre Vaughn, Steve Smith, Barb Pitcock, Dave Pitcock, Patti Gardner, Mike Randolph, Mike Casperson and Brytt Cloward.

Sanneman and Essence Pores and pores and skin Care are suing for violations of the Minnesota Uniform Securities Act, breach of contract, fraud, promissory estoppel and unjust enrichment.

Personally I’m in two minds about lawsuits like this.

Efficiently Sanneman was given a secret backroom deal. Wakaya Perfection aren’t registered to produce securities anyplace throughout the US, so it appears securities fraud would have been devoted irrespective of whether or not or not Sanneman filed her lawsuit or not.

Would Wakaya’s alleged securities fraud be public info had Sanneman have been paid as per the phrases of her unregistered securities contract?

Perhaps not.

On the very least Sanneman is entitled to some of her funding once more, perhaps sans harm to prospects by means of her lying to them and misrepresenting Wakaya Perfection and its merchandise on their behalf.

Although how the court docket docket would calculate that harm in a dollar sense I do not know.

Within the meantime with the endorsement settlement clearly referring to Sanneman’s $250,000 as an funding;

So it seems there’s a clear-cut case for each the SEC or Minnesota Division of Commerce to pursue.

Not withstanding the most likely probability that Wakaya Perfection has made unregistered securities decisions to totally different occasions. The Pitcocks and their VEO Oils agency come to ideas.

No phrase on whether or not or not each firm are investigating.

As per the case docket, a Motion to Dismiss for lack of jurisdiction or throughout the varied compel arbitration was filed by the Wakaya defendants on October thirty first.

A listening to on the motion has been scheduled for January seventh, 2019. Hold tuned…

Substitute eighth January 2018 – The January seventh listening to befell, at which the Motion to Dismiss was taken beneath advisement.

A selection stays pending.

Substitute twelfth April 2020 – The Wakaya Perfection securities fraud lawsuit was settled through arbitration in February 2020.

Particulars of the settlement between the occasions has not been made public.