As an alternative of doing that although, the corporate is pushing forward – on the gamble that different states and the SEC is not going to take any additional motion towards it.

Securities legislation in Texas is immaterially totally different to different US states, or certainly the Securities and Alternate Act at a federal degree.

That implies that if one state determines an organization is providing unregistered securities, there’s a 99.99% likelihood every other US state, or the SEC at a federal degree, will too.

Moderately than acknowledge this and take the mandatory steps in the direction of working legally within the US, Nui is urgent forward as if nothing occurred in Texas.

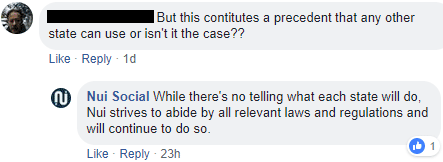

After Nui printed a hyperlink to its “Nui efficiently resolves Texas State Securities Board Investigation into crypto mining” press-release on Fb, one in all their traders requested;

However this constitutes a precedent that every other state can use or isn’t it the case?

To which Nui gave a misleadingly elusive reply;

Whereas there’s no telling what every state will do, Nui strives to abide by all related legal guidelines and laws and can proceed to take action.

What a load of baloney.

As I’ve already said, with a view to function legally within the US, Nui must register with the SEC. Or on the very least in each state the corporate operates in (all of them besides Texas).

This, amongst different issues, would see Nui put in writing that they’re doing what they are saying they’re doing, and go away them legally liable in the event that they weren’t.

Compliance with securities legislation within the US will not be non-compulsory, any extra so than it wasn’t in Texas.

Nui’s Texas securities fraud effective isn’t some new legislation the corporate had no thought of, it’s the upholding of securities legislation at a state degree that has been round since 1957.

Each single US state has comparable securities legal guidelines, with the Securities and Alternate Act giving the SEC federal jurisdiction in any state.

The take away for Nui’s present and potential traders is that if Nui is against the law in Texas, it’s unlawful everywhere in the US.

Whereas the Texas Securities Board has gotten Nui to supply refunds to its Texas traders, the remainder of the corporate’s investor-base received’t be so fortunate.

We don’t have any official figures but it surely’s a given Darren Olayan and the remainder of Nui administration aren’t working totally free.

It’s unimaginable for Nui to refund all traders (the place do you assume the cash Nui is refunding Texas traders is coming from?). That means that ought to different states and/or the SEC transfer to implement securities legislation and take additional motion, there’s going to be losses.