MLM cryptocurrency corporations and securities fraud virtually go hand in hand.

It’s simply the most important regulatory menace going through the trade and, for that purpose, you’ll see me emphasizing it in so much of our opinions.

More often than not the businesses in query aren’t registered with the SEC and, due to that, I lower the regulator some slack.

They will’t hold monitor of every part and investigations take time. Much more time when the businesses are working via offshore shell entities and puppet abroad administration.

However when a US based mostly firm that’s registered with the SEC flaunts and continues to flaunt securities legislation, has been fined as soon as and continues to function illegally, I’ve no phrases.

How is that this occurring?

Kuvera International operates within the US via father or mother firm Investview.

BehindMLM first sounded the alarm over Investview’s obvious securities fraud again in December 2017.

Again then they have been working as Wealth Mills.

Certain sufficient, it got here to gentle Investview acquired a subpoena from the CFTC in February 2018.

The regulator subsequently fined Investview $150,000. It was later revealed the rationale for the wonderful was Investview failing to register its foreign currency trading alternative.

A month after receiving the CFTC subpoena, Investview renamed Wealth Mills to Kuvera International.

BehindMLM sounded a second Investview securities fraud alarm in June 2018. This time over Kuvera International’s cloud mining passive funding alternative.

Up to now neither the SEC or CFTC has carried out something about Kuvera International’s unregistered securities providing.

Within the wake of suspending crypto mining ROI funds in October 2018, Kuvera International has launched a number of new funding alternatives – none of that are registered with the SEC.

These embrace FX One, Crypto One. Equities and Equities Professional, cryptocurrency mining, a brand new tech startup funding service and Apex.

FX One is a handbook foreign exchange indicators service for $229 after which $149 a month. Given FX One is handbook, it’s not a securities providing and from a regulatory perspective is a non-issue.

Issues go downhill from right here.

Crypto One seems to be a handbook cryptocurrency buying and selling indicators service, nonetheless it’s clearly marketed as a “dump cash on this and acquire a return” product.

It’s priced the identical as FX One, $229 initially after which $149 a month.

Our supply materials from right here on out are shows hosted by Roger Garth.

In response to Garth’s private web site, he

joined Kuvera on Jan 1st 2018, sponsored my first three inside 3 hours and my first 12 inside 11 hours.

Nearly one yr later my workforce spreads throughout the UK, half of mainland Europe, Asia, Africa and North America.

Garth is joined by a lot of his downline on his advertising and marketing webinars (I counted twenty-four at one level), so Kuvera International could be hard-pressed to say ignorance of his advertising and marketing efforts.

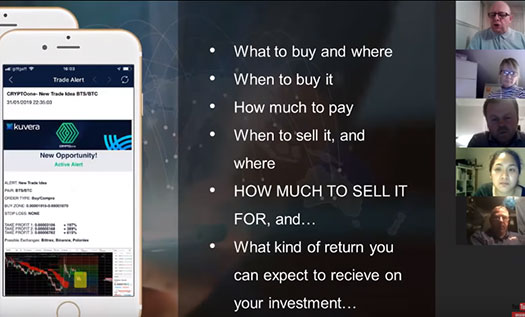

With that in thoughts, right here’s a slide on how Garth personally pitches Crypto One.

For context, Corey Chadwick is credited because the supply of the crypto trades Kuvera International supplies associates.

As you learn via Garth’s pitch for Crypto One, remember his “previous efficiency” pseudo-compliance disclaimer.

Within the final ten months (Corey has) given us twenty-six audited trades.

In case you’d adopted these trades you’d have made greater than 1800% revenue – simply following these trades.

Up to now the trades that Corey has given us have been 100% correct, with no shedding trades.

Now once more, can I inform you these trades are at all times going to be 100% correct?

No I can’t. We make no secrets and techniques of this. We’re not excellent and we have now to say that previous efficiency doesn’t assure future success. Some trades could win, some trades could lose.

Learn over that final paragraph once more, as a result of that is actually the subsequent factor Garth states;

Nevertheless the percentages are stacked in our favor due to our monitor file.

The issue with Crypto One isn’t a lot the handbook sign service itself, it’s totally the way it’s being marketed.

In case you put only one thousand kilos into (Crypto One) this time final yr, by now you’d be sitting on eighteen thousand kilos.

That’s an astonishing return on funding.

If that isn’t implying thousand plus p.c returns based mostly off of previous efficiency than I don’t know what’s.

Shifting on to Equities and Equities Professional, which Garth states ‘will educate you the best way to commerce shares and shares‘.

The specifics of both service aren’t mentioned, however Garth does state

if you happen to go for the Fairness Professional model of it, it’s going to really do the buying and selling for you.

Automated inventory and share buying and selling? Yep, that’s undoubtedly a securities providing.

As beforehand talked about final we heard Kuvera International suspended its crypto mining payouts.

It appears as some level they’ve began them up once more.

Make no mistake, if you happen to’re dumping cash into Kuvera International and amassing a passive return, purportedly via crypto mining or in any other case, that’s a securities providing.

The brand new tech startup funding service feels like passive funding recommendation, with a 100 pound price ticket.

Startups tells you when new corporations come out which might be gonna be sizzling.

Firms like SnapChat, corporations like Uber, corporations like WhatsApp and AirBnB. Firms which have made thousands and thousands and thousands and thousands and thousands and thousands of {dollars} for the traders.

And but you may get concerned with these corporations for 100 kilos when the chance comes out.

Then there’s Apex, Kuvera International’s “latest product” as of late March 2019.

(Apex) will educate you the best way to make a passive revenue.

You make a one off funding and receives a commission each single month for the subsequent 5 years.

Is there actually something left to say?

There’s additionally some monetary administration instrument providers out there, however these appear simple in comparison with the evident regulatory violations above.

Kuvera International and their associates make a lot of being a publicly traded firm, which is thru Investview.

Investview’s final quarterly report filed with the SEC is for This fall 2018.

There isn’t any point out of any of the passive funding alternatives Roger Garth particulars above.

Kuvera, LLC supplies analysis, training, and funding instruments designed to help the self-directed investor in efficiently navigating the monetary markets.

These providers embrace analysis, commerce alerts, and dwell buying and selling rooms that embrace instruction in equities, choices, FOREX, ETFs, binary choices, crowdfunding and cryptocurrency sector training.

Along with buying and selling instruments and analysis, we additionally supply full training and software program functions to help the person in debt discount, elevated financial savings, budgeting, and correct tax administration.

The report does nonetheless notice Investview’s $2.8 million in working losses for the present monetary yr.

The closest Investview involves disclosing its a number of securities choices is with reference to one thing referred to as S.A.F.E.

On December 30, 2018, our wholly owned subsidiary S.A.F.E. Administration, LLC acquired its registration and disclosure approval from the Nationwide Futures Affiliation. S.A.F.E. Administration, LLC is now a New Jersey State Registered Funding Adviser, Commodities Buying and selling Advisor, Commodity Pool Operator, and authorized for over-the-counter FOREX advisory providers.

S.A.F.E. nonetheless wasn’t talked about as soon as by Garth. Personally I’d by no means even heard of the corporate till going via the report.

Equally, what’s on Kuvera International’s web site differs drastically from Garth’s latest advertising and marketing presentions.

The solely merchandise featured on Kuvera International’s web site are the monetary administration providers.

There’s nothing about investing in startups, dumping cash into Kuvera International and getting paid month-to-month for 5 years, or any of the opposite passive funding alternatives Garth detailed.

As I see it Investview will not be solely ripe for an additional regulatory investigation, it’s begging for one.