The ticket additionally reveals Steynberg evidently had a warped understanding of securities regulation within the US.

FXChoice is a third-party buying and selling dealer with no identified direct ties to Mirror Buying and selling Worldwide.

Mirror Buying and selling Worldwide represented it generated buying and selling income via FXChoice.

This got here to an finish when FXChoice shut down MTI’s accounts in August 2020.

The next is the help electronic mail FXChoice despatched to Steynberg on August seventh, 2020;

Expensive Cornelius Johannes Steynberg,

We’re writing to tell you that your account has been marked as ‘Fraud’.

This implies you’ll not have entry to your Backoffice or any of your accounts.

The current Stop and Desist order from the Texas State Securities Board, coupled together with your incapability to show the supply of your funds, has introduced us to this place.

Do you have to satisfactorily attraction the Stop and Desist order towards you, and supply us with monetary statements from Mirror Buying and selling Worldwide confirming that you’ve got filed Annual Returns, we’ll take away the ‘Fraud’ standing in your account.

Yours sincerely,

FXChoice Affiliate Division

On the time FXChoice revealed MTI hadn’t engaged in any vital buying and selling exercise.

FXChoice had shut down MTI’s account following a securities fraud stop and desist issued by Texas.

FXChoice closing MTI’s account(s) successfully noticed 1282 BTC within the account frozen.

Steynberg would flee South Africa in direction of the tip of 2020. This adopted affirmation of a number of regulatory investigations into MTI.

MTI would formally verify Steynberg’s disappearance on December twentieth. Cheri and Clynton Marks, suspected homeowners of MTI, claimed they hadn’t heard from Steynberg since December 14th.

That very same day Steynberg emailed FXChoice, requesting the dealer launch the 1282 BTC held in MTI’s frozen account.

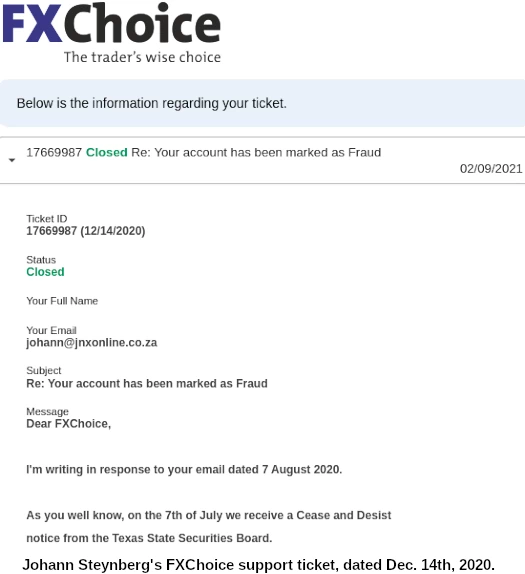

Ticket ID: 17669987 (12/14/2020)

Topic Re: Your account has been marked as Fraud

Expensive FXChoice,

I’m writing in response to your electronic mail dated 7 August 2020.

As you properly know, on the seventh of July we obtain a Stop and Desist discover from the Texas State Securities Board.

Our authorized staff have responded to their discover and since then, nearly 5 months later, we’ve got not heard something once more from the Commissioner of the State of Texas.

It was a wild goose chase introduced up by disgruntled competitors in our business. Our authorized staff has confirmed that this case is now closed.

For the report, MTI didn’t problem Texas’ discover. This meant that after 30 days it turned everlasting.

Securities fraud stop and desists issued by US regulators don’t have a timed expiry.

In response to queiries concerning the supply of MTI’s frozen bitcoin, Steynberg directed FXChoice to MTI’s filed “annual returns”.

I’ve additionally connected screenshots that reveals the submitting of our annual returns.

I hereby formally request that our account standing be rectified and that the account stability of 1282 BTC be despatched to our pockets tackle beneath.

34FuYYSWbikidcYRgfMfvoddnzXeGTqqLj

I belief that all the things is so as and await your reply.

Type regards,

CJ Steynberg

The provided bitcoin pockets hasn’t been used. It seems to be a brand new pockets Steynberg arrange particularly to obtain bitcoin from FXChoice.

FXChoice forwarded Steynberg’s request to their authorized division.

As of February fifth they hadn’t bought again to him, prompting Steynberg to succeed in out once more.

Good day

I nonetheless haven’t acquired a reply on this ticket.

Regards,

Johann Steynberg

FXChoice responded on February eighth;

Expensive Cornelius Johannes Steynberg,

Thanks on your electronic mail.

The FSCA of South Africa has knowledgeable us that you’re topic to a prison investigation. We’re not allowed to disburse any funds to you pending the investigation’s end result.

We strongly advocate you contact them with any questions you will have concerning the funds deposited to your account.

Greatest needs,

FXChoice

Information of the FSCA, South Africa’s prime monetary regulator, investigating MTI appeared to upset Steynberg.

Wow. That is insane. FSCA doesn’t have any jurisdiction over you.

FXChoice responded by closing Steynberg’s help ticket with out additional touch upon February ninth.

Seeing because the FSCA confirmed a prison investigation into MTI on December seventeenth, we’re unsure why Steynberg was nonetheless in denial come February 2021.

In any occasion nothing has come of the FSCA’s investigation so far. Final July the FSCA introduced they “would possibly” advantageous MTI – evidently six months later that call remains to be into account.

On the time of his December 14th, 2020 request, bitcoin was buying and selling at $46,481. This meant had FXChoice of launched the bitcoin, Steynberg would have made off with $59.8 million USD.

In March 2021 liquidators introduced they’d recovered 1200 BTC from FXChoice.

Civil liquidation proceedings pertaining to MTI are ongoing.

Steynberg was arrested in Brazil final month.

We’re nonetheless unclear on whether or not he’s being extradited to the US or South Africa.

In associated information Louis Nel, a blogger from South Africa, has revealed “MTI – The Lacking Items”.

In his submit Nel explores varied facets of Mirror Buying and selling Worldwide, with enter from an nameless supply.

“On 20 July 2020 Johann Steynberg and Tom Fraser, enterprise advisor to MTI, had a gathering with Gerhard van Deventer and Andrea Coetzer from the FSCA”, Nameless relates concerning the regulators stepping in.

“Each Steynberg and Fraser acknowledged beneath oath that they partook in prison exercise and no one at MTI was certified to be working there, however I’m focusing extra on the subtext right here and flagged a number of issues.”

Value a learn in case you’ve been following the MTI saga.