Concentrating on buyers determined to money out any means they’ll, Hyperverse has arrange a collection of BTC swimming pools.

Payouts from the swimming pools will see deposited HVT pay out cents on the greenback.

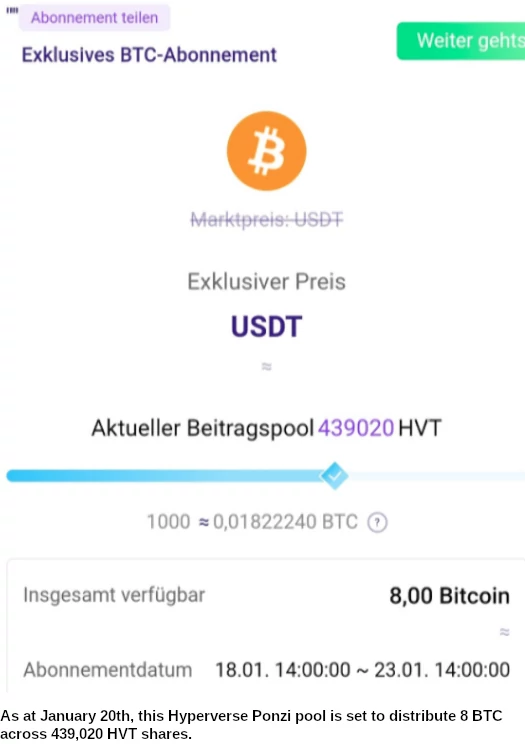

Dubbed “early hen subscriptions”, Hyperverse has created BTC swimming pools it’s funded with 8 BTC.

Affiliate buyers can dump collected HVT into the swimming pools, in trade for a pro-rata share of the 8 BTC.

A Hyperverse backoffice screenshot, taken roughly 24 hours in the past, reveals one pool has 439,020 HVT in it.

After a disastrous launch final month, HVT pumped however has been in a downward spiral for many of January.

HVT is at present sitting at $9.25. As I write this, 1 BTC is buying and selling at $39,089.

If we a number of $39,089 we get a pool worth of $312,712.

Divide $312,712 by 439,020 HVT and we get… 71 cents per HVT.

In comparison with the general public buying and selling worth (which is closely restricted attributable to rejected withdrawal requests), that’s a 92.3% discount in Hyperverse’s withdrawal legal responsibility.

As a substitute of paying out $9.25 per HVT by public buying and selling, Hyperverse is paying out cents by its BTC swimming pools.

Hyperverse associates are in a position to proceed dumping HVT into the 8 BTC pool till January twenty third. The extra HVT within the pool, the much less everybody will get per HVT.

Including to the downward strain are 100 100 HVT airdrops, purportedly given out randomly. This may add one other 10,000 HVT to the pool.

BTC persevering with to fall will in fact additionally scale back fee per HVT.

That can in fact solely matter to Hyperverse in the event that they’re shopping for the 8 BTC on Jan twenty third. In the event that they’ve already dedicated 8 BTC the monetary hit will likely be taken by associates once they money out.

Replace twenty first January 2022 – With 1 day and 17 hours to go, the 8 BTC pool has climbed to 580,309 HVT shares.

Utilizing the identical $39,089 BTC worth, this involves 53.8 cents per HVT.

Replace twenty ninth January 2022 – I don’t have a ultimate pool determine however near the tip there was 631,426 HVT in it.

On January twenty third BTC was about $35,100. This involves 44 cents per HVT within the pool.

Realizing Hyperverse associates are determined to withdraw something they’ll, the corporate has launched one other pool.

This time it’s 30 BTC and runs from January twenty first to February eighth. As of January twenty third there was already 103,465 HVT within the pool.

Replace 2nd February 2022 – The 631,426 HVT quantity quoted above is the ultimate pool worth for the unique January 18th BTC pool.

The second 30 BTC pool’s stability now stands at 959,786 HVT.

Primarily based on BTC’s present $38,637 buying and selling worth, this involves $1.20 per HVT share.

This worth will drop additional, as extra HVT is dumped into the pool between now and February eighth.

Replace tenth February 2022 – The 30 BTC pool closed on February eighth with 4,506,514 HVT in it.

Primarily based on BTC’s present $44,303 buying and selling worth, this involves 29.4 cents per HVT share.

Hyperverse was additionally operating a 200 ETH pool that closed on February eighth.

The ETH pool held 872,609 HVT. Primarily based on ethereum’s present $3225.48 buying and selling worth, this involves 73.9 cents per HVT share.

HVT is at present buying and selling at $6.09 on the open market, nonetheless getting HVT out of Hyperverse continues to be severely restricted.