After saying a December tenth launch deadline that got here and went, Hyperverse has delayed launch of its NFT Ponzi sport till Q1 2022.

Fairly than make the announcement themselves, homeowners Ryan Xu and Sam Lee had “neighborhood presenters” announce the delay.

Pitched as a “World Presentation Launch” (of what we’re undecided), high HyperFund net-winners took to webinars on Monday.

For reference we’ve got:

- Keith Williams, London UK

- Brenda Chunga, US

- Goran Hemstrom, Melbourne Australia and the Netherlands

- Kalpesh Patel, UK hiding out in Dubai

- Tami Jackson, NJ US

- Mick Mulcahy, Cork Eire

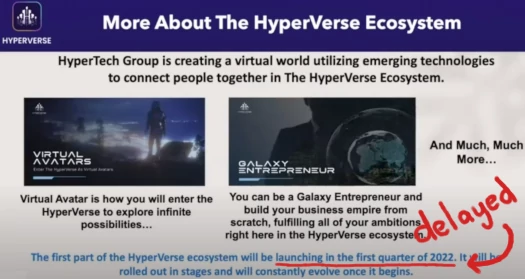

Hyperverse was initially purported to launch someday between December sixth and tenth.

That has now been pushed again to “the primary quarter of 2022”.

That went down like a ton of bricks, prompting HyperTech Compliance Officer Hope Hill (aka Ronae Jull), to concern a comply with up announcement yesterday.

IT initially estimated that the total improve to HyperVerse can be accomplished by 10 December. Clearly that estimate was not met.

There are greater than 1,000 IT professionals working around the clock to kind the glitch that appears to have an effect on some individuals and never others.

Nothing is thought about Hyperverse’s IT division. Not to mention the 1000 “professionals” Jull claims are employed there.

Based mostly on its web site being a low cost off-the-shelf $79 template, it’s uncertain Hyperverse IT is something greater than a handful of outsourced devs.

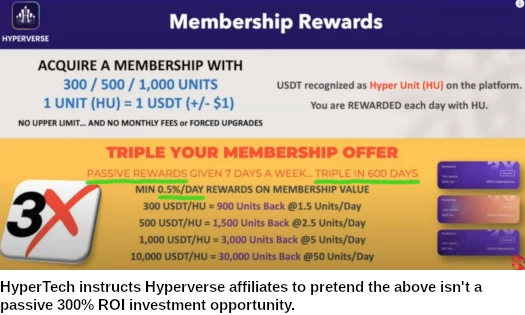

How precisely Hyperverse’s NFT Ponzi sport will play out stays to be seen. The corporate has solely introduced it’ll characteristic avatars and working round pewpew’ing planets.

Personally I wouldn’t anticipate something above the standard low cost cell gaming expertise. That’s if something launches in any respect.

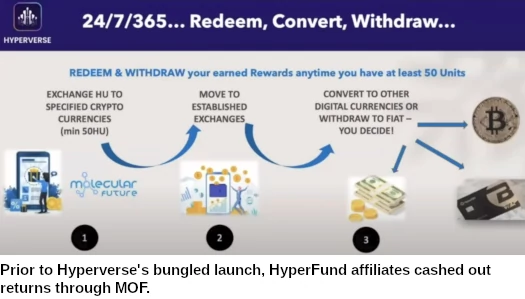

With Hyperverse delayed, successfully the Ponzi scheme has needed to fall again on its unique HyperFund mannequin.

The Hyperverse twist is no person can withdraw. HyperTech disabled withdrawals in late November.

Transitioning MOF, the internally owned token HyperFund buyers money out by means of, noticed its buying and selling worth plummet by 98.98%. From ~$2 in HyperFund, Hyperverse’s bungled launch has MOF sitting at $0.0035 (roughly a 3rd of a cent).

This noticed HyperTech scramble to disable MOF withdrawals. Buyers fell again HDAO, one other internally owned shit token, till HyperTech disabled HDAO withdrawals too.

That’s what really occurred. Right here’s the fiction Jull from compliance put out:

Right here’s what we all know for these with failed withdrawals: it isn’t a few browser concern, it has nothing to do with rank, it has nothing to do with the scale of withdrawals, and IT has not turned off withdrawals for sure members.

So what we do NOT know but is what the precise glitch is (that’s the job of the IT crew) or what it should take to kind it (once more, the job of the IT crew). If they’d a transparent estimate of once they imagine they’ll have this finished, they might inform us.

These two issues: work out what the glitch is and repair it – is the overall focus of the IT crew proper now.

So uh, “1,000 IT professionals working around the clock” can’t repair a week-long withdrawal “glitch”?

Have they tried simply turning withdrawals again on?

Whereas rank-and-file Hyperverse buyers are unable to withdraw, high earners don’t appear to be having any points.

In one other social media put up made earlier at the moment, Burton gushes over a gaudy collection of watches in Dubai:

HyperTech/Hyperverse homeowners Ryan Xu and Sam Lee haven’t been seen in public for months.

The pair are on the run from liquidators in Australia, in search of to recuperate $48.9 million AUD in Blockchain World losses.

Web site visitors evaluation suggests the vast majority of Hyperverse victims are primarily based within the US, adopted by the UK and Canada.

Whereas UK authorities have issued securities fraud warnings towards HyperFund and Hyperverse, the US and Canada have but to take motion.