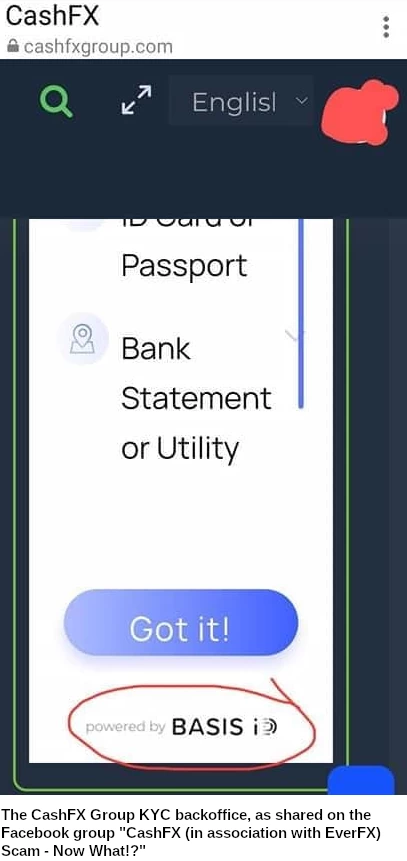

CashFX Group represented on its web site that it had carried out KYC software program from the third-party service provider Foundation ID.

Naturally this was accomplished by means of a dodgy shell service provider, with Foundation ID having no thought their software program had been hooked up to a Ponzi scheme.

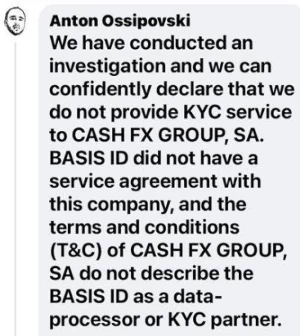

We’ve performed an investigation and we are able to confidently declare that we don’t present KYC service to Money FX Group, SA.

Foundation ID didn’t have a service settlement with this firm, and the phrases and circumstances (T&C) of Money FX Group, SA don’t describe the Foundation ID as a data-processor or KYC companion.

Through the investigation, we discovered which firm transferred its verification instruments to Money FX Group, SA.

That is strictly prohibited by the Foundation ID service settlement.

In the mean time the verification capabilities are disabled, and the corporate that violated the phrases of the contract has already acquired claims and a discover of the beginning of taking measures in opposition to it.

We see as our aim the combat in opposition to fraud and (are) fully on the facet of the victims of Money FX Group, SA.

Ossipovski invitations anybody who offered identification paperwork previous to CashFX Group being lower off, to contact Foundation ID for clarification.

Whether or not CashFX Group finds a dodgy KYC service provider substitute, or comes up with a brand new withdrawal denial ruse stays to be seen.

The take-away right here is CashFX Group can’t join below its personal title with a reputably KYC answer supplier, as a result of CashFX Group itself would fail KYC.

Replace eleventh August 2021 – Following this catastrophe launch, CashFX Group has knowledgeable associates it’s pausing its KYC roll out.