The dismissal was appealed, ensuing within the Eleventh Circuit overturning the choice on February 18th.

As summarized by the Eleventh Circuit;

After (BitConnect) collapsed, BitConnect consumers sought to carry the promoters liable below part 12 of the Securities Act of 1933 for soliciting the acquisition of unregistered securities.

The entrepreneurs insist that they can’t be held liable as a result of the Securities Act covers gross sales pitches to explicit individuals, not communications directed to the general public at giant.

The District Courtroom sided with the defendants, dismissing the case.

The Eleventh Circuit nonetheless referred to as the defendants out on their bluff.

Neither the Securities Act nor our precedent imposes that form of limitation.

That is much like the “however cryptocurrency!” arguments scammers routinely trot out. My reply to that has all the time been “there aren’t any exemptions for cryptocurrency within the Securities and Trade Act”.

So too is there no exemption of committing securities fraud for those who don’t direct promotion of unregistered securities at anybody particularly.

Solicitation has lengthy occurred by mass communications, and on-line movies are merely a brand new approach of doing an previous factor.

As a result of the Securities Act offers no free cross for on-line solicitations, we reverse the district courtroom’s dismissal of the part 12 declare.

There are two essential concerns right here;

Firstly the BitConnect class-action is again on.

We due to this fact REVERSE the district courtroom’s dismissal of the part 12 declare towards Arcaro and Maasen; VACATE its dismissal of the state-law claims towards them; AFFIRM its dismissal of some other claims and defendants within the orders appealed.

As I perceive it defendants Glenn Arcaro and Ryan Maasen are again on the chopping block.

Arcaro, as the highest BitConnect net-winner and promoter within the US, is a juicy goal.

That stated he’s additionally getting railed by the DOJ and the SEC, so I’m unsure what, if something, will likely be left for class-action Plaintiffs.

Maasen can be being hounded by the SEC, in order that’s in all probability a dead-end too.

The second essential consideration is what this enchantment means for promoters of scams on YouTube – particularly of the Ponzi selection (pyramid schemes by themselves aren’t securities).

Right here we now have a US Courtroom of Appeals telling victims of a Ponzi scheme they’re free to sue anybody who promoted it.

Arcaro insists that legal responsibility follows solely when a vendor directs a solicitation to a specific potential purchaser.

Mass communications, in his view, are by no means sufficient.

That rule will surely go a good distance towards eliminating legal responsibility for the promoters right here, and for others who champion dicey investments by fashionable communication channels.

The issue for these promoters is that nothing within the Securities Act makes a distinction between individually focused gross sales efforts and broadly disseminated pitches.

The Securities Act prohibits an individual from utilizing “any means or devices of transportation or communication in interstate commerce” to promote an unregistered safety.

Nowhere in these definitions does Congress restrict solicitations to “private” or individualized ones because the district courtroom did right here.

In actual fact, the Act suggests the other.

For those who’re on the market selling Ponzi schemes on social media, together with YouTube, you’re liable in your victims losses, whether or not you straight recruited them into the Ponzi scheme or not.

Oh and, though it didn’t come up, I need to level out that “this isn’t monetary recommendation” is bullshit. The Securities and Trade Act equally doesn’t exempt promoters of unregistered securities in the event that they state that phrase (or the truth is any phrase).

If it have been that easy, strolling right into a financial institution and stating “this isn’t a theft”, earlier than continuing to rob the financial institution, could be defensible in courtroom.

It isn’t. Neither are foolish disclaimers on social media.

One secondary consideration associated to legal responsibility pertains to platforms reminiscent of YouTube themselves.

This isn’t one thing the Eleventh Circuit tackled so I’m branching off alone right here.

In essence, YouTube is the video model of text-based boards like MoneyMakerGroup.

MoneyMakerGroup abruptly shut down in 2017, on the heels of wire fraud accusations.

These accusations finally didn’t go anyplace however MoneyMakerGroup stayed down.

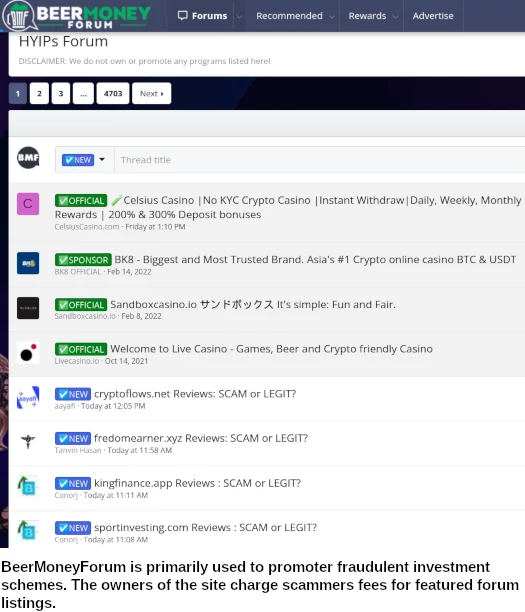

Non secular successors to MoneyMakerGroup exist, probably the most outstanding of which might be BeerMoneyForum.

BeerMoneyForum could or might not be equally abruptly shut down in some unspecified time in the future, who’s to say.

It’s been round lengthy sufficient to represent a sizeable honeypot. One that can solely enhance in worth to US authorities over time.

The place I believe YouTube and different social media platforms differ nonetheless is that they don’t completely exist to advertise fraud.

The place they’re weak nonetheless, is that if victims of Ponzi schemes can exhibit negligence on YouTube’s behalf.

That introduces a catch 22 nonetheless, whereby victims of a Ponzi scheme aren’t going to confess they’re victims till after the actual fact.

We see this on a regular basis right here on BehindMLM. It presents as “bUt I’m GeTtInG pAiD!”.

After the Ponzi collapses, these gullible traders naturally take a loss (getting paid in your backoffice != withdrawals), and disappear.

Individuals reporting fraud to YouTube are unlikely to observe up after a rip-off collapses, as a result of it doesn’t have an effect on them personally.

One actually can’t make the argument that YouTube didn’t do something if nothing was reported. And making an attempt to carry YouTube accountable after the actual fact whenever you didn’t do something previous to a Ponzi collapsing doubtless gained’t maintain up in courtroom.

In a super world platforms like YouTube would implement TOS violations pertaining to promotion of scams. Given the scale of the platforms, I don’t see that being tenable.

One doable answer could be for the US to begin issuing securities fraud notices, much like what we see in different nations. That’d require an adjustment to how the US approaches regulation of securities fraud nonetheless, as presently US authorities don’t verify or deny the existence of an investigation till motion is publicly taken.

Can’t see that altering anytime quickly, so I assume until somebody rolls the cube in courtroom with a compelling case, issues will keep the identical.

That completely doesn’t cease you from suing outstanding promoters of scams on YouTube as a civilian although.

As of at this time there have been no subsequent filings on the BitConnect class-action case docket. I’ll proceed to observe it for updates.