On April 1st GSPartners spinoff Billionico introduced it had employed Alfredo Pino.

An accompanying press-release claimed Pino, who additionally goes by Alfie Pino, had been employed to “mentor elite training groups”.

Alfie Pino has in depth teaching expertise, specializing in all issues cryptocurrency.

He was educating, serving to college students navigate the ever-changing rapids of the blockchain business and has now launched Billionico to his crew, extending his distinctive mentoring methodology and enriching the platform’s holistic strategy to enterprise training.

Upon receiving the formal invitation to affix Billionico as a coach of its elite educators, Alfie Pino shifted his focus from educating people to mentoring a small group of choose elites and now has a singular alternative to make a worldwide influence.

Analysis into Pino reveals a scrubbed FaceBook profile and press-release spam. This piqued my curiosity so I dug a bit deeper.

Seems Pino, initially from Ontario, Canada, has fairly a little bit of regulatory baggage behind him.

Earlier than reinventing himself as a “blockchain know-how knowledgeable”, Pino labored as a mutual fund consultant for Buyers Group Monetary Companies Inc.

Buyers Group Monetary Companies, who now goes by IG Wealth Administration, is a personal wealth administration agency working out of Canada.

When Pino joined Buyers Group is unclear, however by 2011 he’d managed to draw the eye of the Ontario Securities Fee (OSC).

Following an inside investigation, OSC decided Pino switch $182,000 from Buyers Group consumer accounts on directions of an imposter.

Pino acted on directions obtained by electronic mail and by facsimile solely, with out taking applicable steps to establish the id of the people offering the directions.

OSC contended Pino’s actions constituted violations of of Canadian cash laundering and terrorist financing legal guidelines.

Because of these findings, OSC employees decided Pino “lacked the mandatory proficiency of a securities skilled.”

In an try to treatment this, in March 2011 OSC ordered Pino be topic to to supervision by a sponsoring agency for one 12 months. Pino was additionally ordered to undertake an “Funding Funds Course”.

A number of months after his supervision order expired, Pino solicited $280,000 from an Buyers Group consumer.

An investigation by the Mutual Fund Sellers Affiliation of Canada decided that “roughly $267,000” of the quantity was misappropriated.

As reported by Insurance coverage Portal in December 2016;

Pino repeatedly drove to the house of a recently-widowed consumer the place he would provide funding recommendation.

He would then drive her to the financial institution in his personal car and instruct her to acquire financial institution drafts whereas he waited within the automobile.

The MFDA says he gave the consumer false explanations in regards to the nature and function of the investments he really useful, and in reality deposited the financial institution drafts into a company account that he managed.

“The Respondent didn’t present consumer BC with any data, receipts or statements documenting the quantities of cash that she offered to the Respondent or how the cash could be invested.

The Respondent falsely represented to consumer BC that the cash was being invested in annuities that may pay consumer BC a charge of return of 6.5% per 12 months.”

Buyers Group have been unaware of Pino’s conduct.

Someday after MFDA started investigating. On or round February 2015, MDFA claims Pino started “failing to cooperate with and to mislead the MFDA in its investigation”.

The MFDA’s investigation continued nonetheless, leading to Pino being fined $400,000 and completely banned from working as a mutual fund rep in November 2018.

Reporting on the end result of MDFA’s investigation, Advisor wrote in February 2019;

In its penalty resolution, the panel characterizes Pino’s conduct as “egregious,” noting the sufferer was a widow. “The respondent took benefit of her. The details are stunning.”

A listening to panel of the Mutual Fund Sellers Affiliation of Canada (MFDA) completely banned Alfredo Pino, a former rep with Buyers Group Monetary Companies Inc. in Ottawa, and fined him $400,000. He was additionally ordered to pay prices of $25,000.

The penalties observe the panel’s discovering in November 2018 that Pino misappropriated roughly $267,000 from a widowed consumer to fund Trova Capital, an organization he set as much as spend money on U.S. actual property, and that he didn’t disclose the skin enterprise to his agency.

It additionally dominated that Pino “did not cooperate with and misled the MFDA throughout its investigation.” The truth is, it discovered that he was “uncooperative, misled employees, and manipulated the system.”

The panel notes that Pino “unreasonably sought” repeated adjournments within the case, and that “he was untruthful and manipulative in in search of a number of of the adjournments.”

Consequently, the panel dominated {that a} everlasting prohibition “is critical to guard the general public” and to forestall future hurt.

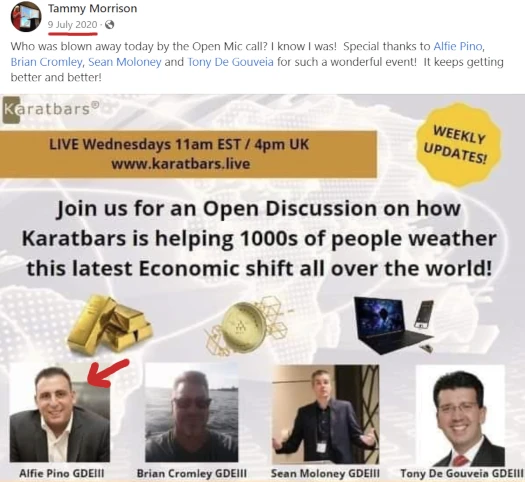

By the point MDFA had fined and banned Pino, the disgraced mutual fund rep had reinvented himself as a crypto bro by way of Karatbars Worldwide.

Initially a gold-themed pyramid scheme, Karatbars Worldwide transitioned to cryptocurrency fraud in 2018.

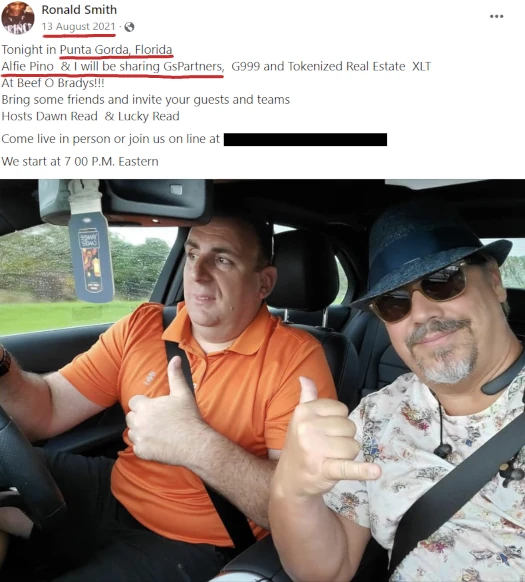

After becoming a member of Karatbars Worldwide, Pino relocated from Canada to Florida within the US.

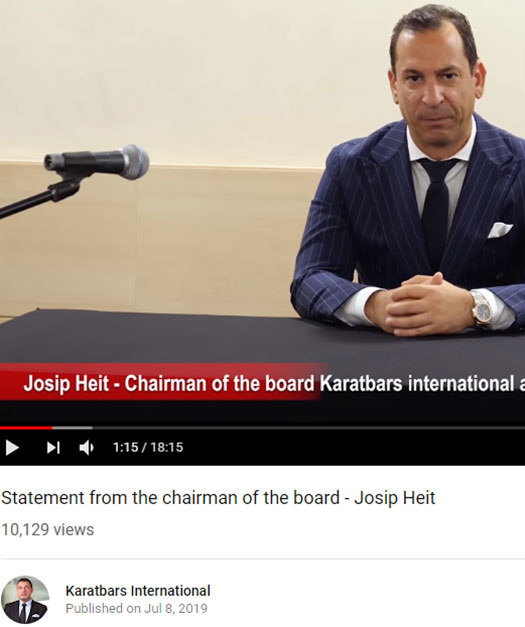

Karatbars Worldwide imploded in early 2018, leading to a cut up between proprietor Harald Seiz and Chairman of the Board Josip Heit.

Heit went on to launch GSPartners. Pino caught with Karatbars Worldwide after it collapsed however finally adopted.

GSPartners attracted the eye of Canadian regulators in early 2023. Later within the 12 months US regulators would go on to characterize GSPartners as a “fraudulent funding scheme”.

By December 2023, GSPartners and Heit had obtained fraud warnings from six Canadian provinces, eleven US states, South Africa and Australia.

In 2024 Georgia fined GSPartners and Josip Heit $500,000 for securities fraud. Massachusetts listed GSPartners as a “crypto rip-off”.

New Zealand and the UK additionally issued their very own GSPartners associated securities fraud warnings.

GSPartners collapsed in mid December 2023. A failed GSPro reboot adopted however failed to achieve any traction.

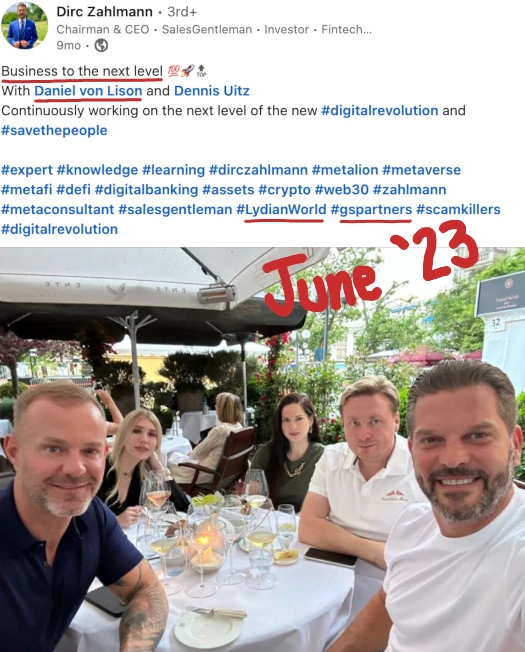

Earlier this 12 months GSPartners promoters started spruiking Billionico, a derivative firm registered to Josip Heit’s legal professionals in Germany.

Billionico is fronted by Daniel Lison, an affiliate of GSPartners government Dirk Zahlmann (who additionally came to visit from Karatbars).

Initially believed to be a backdoor for US GSPartners traders, that’s now up of their following affirmation from Josip Heit that mum or dad firm GSB Gold Normal Company is abandoning the US altogether.

what Billionico thus intends to launch on April nineteenth is unclear. What we do know is Billionico is hiring banned mutual fund reps discovered to have stolen consumer funds.

No matter Alfie Pino intends to show Billionico’s “choose elites”, it’s in all probability not well worth the ticket value.