Crowd1’s digital shares scheme has come full-circle, with the Ponzi scheme now spruiking digital shares in a UK shell firm.

Crowd1 launched in mid 2019. The authentic Ponzi idea was associates investing in “proprietor rights” for digital shares.

Since then Crowd1 has launched one ruse after one other, in an try and persuade associates their digital shares had been price one thing.

Crowd1’s proprietor rights have constantly paid peanuts. Clearly a lot of the cash pumped into the scheme has been retained by its homeowners.

This culminated in former Crowd1 CEO Johan Stael von Holstein cashing out and doing a runner in December 2020.

Previous to disappearing, Holstein spent 2020 pitching a ‘3 to 5-year plan to deliver Crowd1 into the NASDAQ and grow to be a publicly-traded firm.’

For many of 2021 Crowd1 has been drifting alongside. Not one of the firm’s beforehand launched ruses have generated any vital revenue.

Crowd1’s newest ruse was an try and money in on the short-lived NFT fad.

Planet IX was introduced again in April. It went nowhere and has been rapidly forgotten about.

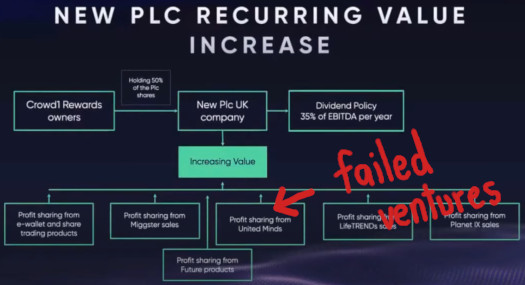

Now Crowd1 is pitching “shares in a UK PLC for future worth creation”.

PLC stands for “public restricted firm”. As of but Crowd1 hasn’t revealed the corporate identify.

UK as the chosen shell firm jurisdiction shouldn’t come as a shock. Corporations Home has been synonymous with company fraud for years.

So the pitch goes, in some unspecified time in the future Crowd1 associates will be capable to nugatory “possession shares”, for equally nugatory digital firm shares.

As per the advertising and marketing, the “share swap (is) deliberate for June/July 2021”. Apparently, Crowd1 can also be pitching their new ruse as a tax loophole.

The first cause Crowd1 wouldn’t need associates to report taxable earnings is as a result of it’s a Ponzi scheme.

Believing a digital shares scheme “keep away from(s) any tax points” is a danger Crowd1’s associates take with none authorized assist from the corporate.

What’s amusing about Crowd1’s new share alternative is that, on paper, it’s no completely different to failed digital possession scheme.

As above, you’ve received the identical failed ruses being touted as offering “rising worth”.

EBITDA stands for “earnings earlier than curiosity, taxes, depreciation, and amortization”. 35% of EBITDA will probably be put aside to pay Crowd1 associates who’ve invested in digital shares.

The kicker is we already know these ventures aren’t producing revenue, as a result of traditionally Crowd1’s possession shares have paid peanuts.

This is similar failed funding scheme, repackaged to pitch to new buyers.

Soliciting new funding is Crowd1’s solely vital income – and has been since day one.

Trying additional down the observe, Crowd1 is pitching its personal inventory buying and selling platform as “Multiwallet”.

Presumably this will probably be run by the but to be launched UK shell firm. Or it might simply be run illegally, with Crowd1 who is aware of.

What we do know is none of this will probably be launched with Crowd1’s personal firm identify.

Thus far Crowd1 has attracted regulatory consideration in at least 13 international locations; Peru, New Zealand, Mauritius, South Africa, the Philippines, Norway, Namibia, Paraguay, Gabon, Vietnam, Cote d’Ivoire, Slovakia, Hungary and the Czech Republic.

On its web site Crowd1 represents it’s primarily based out of a PO Field in Dubai.

With no lively regulation and virtually no extradition treaties, over the previous few years Dubai has emerged because the MLM rip-off capital of the world.

The final time an MLM Ponzi scheme used a UK shell firm to commit monetary fraud, it took the FCA eight months to close it down.

How lengthy Crowd1’s UK shell firm survives stays to be seen.

Replace thirteenth October 2021 – Crowd1 has unveiled the identify of their UK shell firm as Digital Companions Community.