I ran a search throughout BehindMLM and positive sufficient in 2017 I’d talked about it as an replace to our KulaBrands assessment.

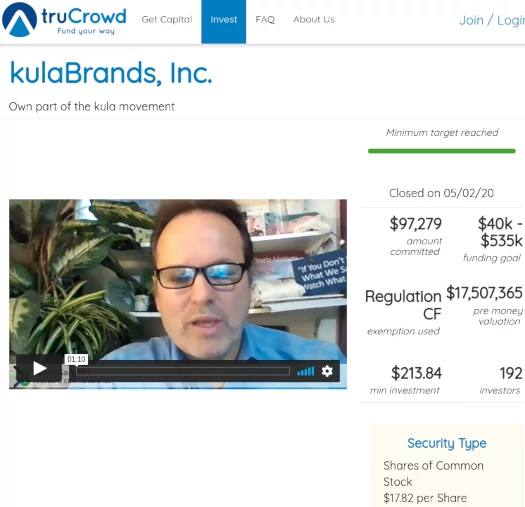

On the time, KulaBrands was utilizing TruCrowd to flog digital shares at $17.82 every.

To entice buyers, KulaBrands touted a “pre cash valuation” of $17.5 million.

As of Might 2nd, 2020 KulaBrands’ share providing closed, netting $97,279 from 192 buyers.

Prompted by TruCrowd’s SEC settlement, which for the file has nothing to do with KulaBrands, I assumed we’d revisit KulaBrands providing and see the place it’s at.

KulaBrands is actually a crowdfunding platform, manipulated by way of an MLM enterprise alternative (associates vote on what to crowdfund after which do the funding).

This manipulation differentiates typical crowdfunding, by means of backers having a vested monetary curiosity.

As to the ethics of the KulaBrands idea, official crowdfunding sees tasks succeed or fail based mostly on public curiosity. The final idea is crappy concepts don’t get funded.

By way of KulaBrands, it’s fully doable {that a} crappy thought will get funded, based mostly on projected ROIs moderately than the deserves of the services or products itself.

Anyway, getting again to KulaBrands’ digital share providing; in September 2017 the corporate introduced it hoped to launch a $40,000 IPO.

As of January 2022, that hasn’t materialized. KulaBrands by no means went public.

In early 2019 KulaBrands launched HealX Vitamin, a standalone MLM CBD providing.

HealX Vitamin’s web site is presently down and the corporate is “not processing orders”.

As famous by BehindMLM, in 2016 KulaBrands generated $33,981 in losses.

KulaBrands’ newest Annual report, filed April 2020 for the 12 months 2019, the corporate generated $330,746 in losses.

That’s up from $51,374 in losses in 2018. And KulaBrands additionally has a further half one million in “long run debt”.

Lengthy story quick, KulaBrands has remained unprofitable and continues to generate losses.

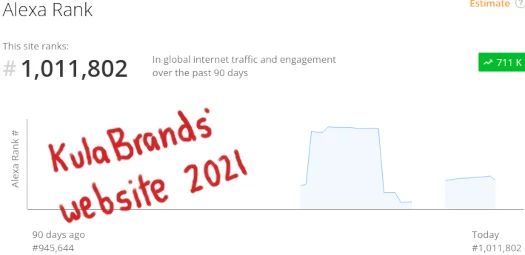

Alexa site visitors estimates reveal that, all through most of 2021, KulaBrands’ web site site visitors was non-existent:

KulaBrands final official Fb submit was a Christmas profile image change on December ninth. The submit previous to that’s dated April twenty sixth, 2021.

Anybody gullible sufficient to put money into KulaBrands again in 2017 need to weigh in? Or is that $97,279, together with no matter else folks threw into KulaBrands, quietly misplaced?