Securities are strictly regulated the world over and for good purpose.

It’s one factor to say you’re doing one thing and supply social media proof. Registering your securities providing (legally required) and offering documented proof to authorities is one other.

Naturally, MLM Ponzi schemes give you all kinds of causes as to why they haven’t registered their securities providing.

As we speak, courtesy of Cloud Token, Ronaly Aai and Religion Sloan, we study one of the vital blatantly deceptive excuses for securities fraud I’ve ever seen.

For these unfamiliar with the corporate, Cloud Token sees associates put money into CTO factors.

CTO factors are usually not publicly tradeable and maintain no worth outdoors of Cloud Token itself.

Over time Cloud Token will increase the inner worth of CTO factors, permitting associates to money out.

When an affiliate places in a withdrawal request, Cloud Token pays them on the present CTO fee with subsequently invested funds.

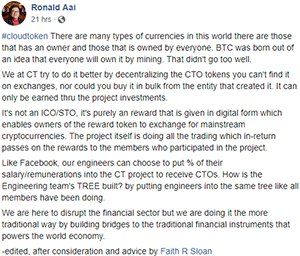

Though he’s formally credited as Cloud Token’s CTO, Ronald Aai seems to be working the corporate.

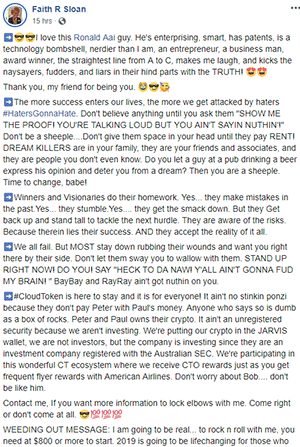

With considerations of potential regulatory motion mounting, yesterday Aai enlisted the assistance of Religion Sloan to handle securities fraud.

Aai primarily communicates to Cloud Token associates over Fb.

It’s not an ICO/STO, it’s purely an reward that’s given in digital kind which allows homeowners of the reward token to change for mainstream cryptocurrencies.

The challenge itself is doing all of the buying and selling which in-return passes on the rewards to the members who participated within the challenge.

On the conclusion of the submit Ai thanked Sloan for serving to him edit it.

CloudToken is right here to remain and it’s for everybody!

It ain’t no stinkin ponzi as a result of they don’t pay Peter with Paul’s cash.

Anybody who says so is dumb as a field of rocks.

Peter and Paul owns their crypto.

It ain’t an unregistered safety as a result of we aren’t investing.

We’re placing our crypto within the JARVIS pockets, we aren’t traders, however the firm is investing since they’re an funding firm registered with the Australian SEC.

We’re taking part on this fantastic CT ecosystem the place we obtain CTO rewards simply as you get frequent flyer rewards with American Airways.

I do know, I do know… anybody who’s aware of securities regulation needs to leap proper in. However let’s break this down step-by-step.

First off whereas Cloud Token has registered itself with the Australian Funding and Securities Fee;

- that’s an especially low bar (pay a charge, present some particulars); and

- it solely pertains to the solicitation of funding in Australia.

As I write this Australia isn’t a major supply of site visitors to Cloud Token’s web site. Which means funding exercise there may be little to none.

Alexa at the moment pegs the US as the biggest supply of site visitors to Cloud Token’s web site (20%).

So as to verify whether or not Cloud Token’s revenue alternative constitutes a safety, the existence of an funding contract should be established.

With respect to MLM corporations, that is executed by way of the Howey Check.

As per the Howey Check, an funding contract is outlined as

a contract, transaction or scheme whereby an individual invests his cash in a typical enterprise and is led to count on income solely from the efforts of the promoter or a 3rd occasion.

The Howey Check has been round since 1946. It’s been cited in numerous instances by the SEC to ascertain the existence of an funding contract.

To wit the Howey Check is non-negotiable and there aren’t any exceptions.

By their separate personal admissions, each Ronald Aai and Religion Sloan overtly acknowledge Cloud Token is providing an funding contract.

Ronald Aai;

The challenge itself is doing all of the buying and selling which in-return passes on the rewards to the members who participated within the challenge.

Religion Sloan;

We’re placing our crypto within the JARVIS pockets, we aren’t traders, however the firm is investing.

And right here’s Cloud Token themselves (taken from official advertising and marketing materials);

Cloud Token Pockets provides its customers the choice of deploying algorithms and AI programs to commerce cryptos and probably earn a passive revenue.

JARVIS arbitrage bot delivers engaging month-to-month returns of 6%-12%, that are paid day by day to Cloud Token Pockets customers.

(HAL) delivers engaging month-to-month returns of 18%-30%, that are paid day by day to Cloud Token Pockets customers.

Simply so that you’re crystal clear:

- a contract, transaction or scheme whereby an individual invests his cash in a typical enterprise (Cloud Token associates dumping cash into the corporate by way of the app)

- and is led to count on income solely from the efforts of the promoter or a 3rd occasion (Cloud Token represents it does AI buying and selling, the returns of that are used to pay associates who money out their Cloud Token factors)

Cloud Token is offering associates with an funding contract. Which in flip makes it a securities providing.

So as to function legally, Cloud Token must register itself with monetary regulators in each jurisdiction it solicits funding in.

Specifically the US and Malaysia.

Religion Sloan resides within the US and as evidenced by site visitors to Cloud Token’s web site, the US is at the moment Cloud Token’s largest supply of funding.

Ronald Aai not too long ago fled to Malaysia after he was booted out of Singapore.

Along with securities fraud by way of an unregistered securities providing, Cloud Token additionally fails to offer traders with particulars of its supposed Jarvis and Hal AI buying and selling bots.

This lends itself to wire fraud, which is the place the Ponzi side of the enterprise kicks in.

Paying Peter with Paul’s cash as Sloan put it.

Even when Cloud Token was registered with the SEC and Financial institution of Malaysia, they’d want to offer traders with full disclosure concerning their Jarvis and Hal buying and selling bots.

This contains who created the bot, their experience, who owns the bot and verifiable buying and selling outcomes.

The outcomes would have to be audited by a third-party, such that returns paid to Cloud Token associates could be correlate with buying and selling income generated by the Jarvis and Hal bots.

Cloud Token offers none of this on there web site. Nor has something been filed with ASIC.

Only a fast word on that time, ASIC are a considerably of a joke relating to securities regulation. Don’t count on them to chase after Cloud Token for required filings any time quickly.

There may be one and just one purpose an MLM firm providing securities fails to register itself with monetary regulators:

It isn’t doing what it represents it’s.

On this case, utilizing income generated by an AI buying and selling bot to pay associates a return by way of an inner factors (token) system.

The one verifiable income getting into Cloud Token is new funding.

Cloud Token might have put aside a token quantity of funds to feed a bot. Probably simply sufficient to create movies to defraud traders with on social media.

Any income generated by way of token buying and selling nevertheless is actually nowhere close to sufficient to offer returns calculated utilizing the ever-increasing inner CTO level worth.

If each single Cloud Token affiliate opted to withdraw each single CTO of their app pockets, in true Ponzi style the scheme would collapse.

What makes Ronald Aai taking securities recommendation from Sloan significantly egregious, is that not even per week in the past Sloan was slapped with a $778,455 securities fraud judgment.

Though she would possibly play the function of a assured “queen” on social media, when caught by authorities Sloan’s MO sees her play dumb and roll over.

With Sloan now “advising” Ronald Aai on the way to mislead current and potential traders with respect to securities regulation, any authorized protection on their half will probably be a tough case to make.

The self-incriminating proof is on the market on social media for anybody to doc.

The one factor left is for the SEC, DOJ or Financial institution of Malaysia to gather it and make a transfer.

Alternatively, Cloud Token collapses every time recruitment runs dry and Ronald Aai, Religion Sloan and their co-conspirators make off like bandits.

Everybody else loses out and we report yet one more “sorry in your collective losses” entry within the MLM crypto area of interest.