Mining Metropolis’s fastened returns are being marketed as “cost plans”.

As revealed by Mining Metropolis CEO Gregory Rogowski in a latest advertising and marketing video;

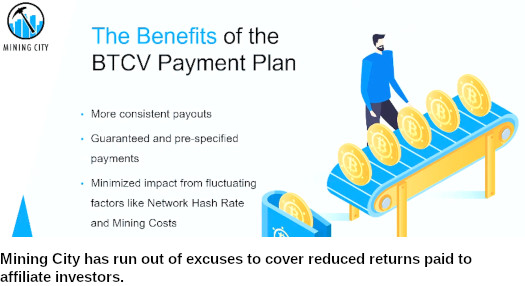

[3:46] These BTCV cost plan contracts are a brand new approach paying out rewards to particular person customers.

Right here, the pre-scheduled rewards are paid out day-after-day.

The most important benefit of the BTCV cost plan (is) your rewards are sure. You at all times know what you’re going to get.

Evidently developing with excuses for low variable ROI funds was an excessive amount of…

…and so Mining Metropolis has transformed from a variable ROI Ponzi scheme to a hard and fast returns Ponzi scheme.

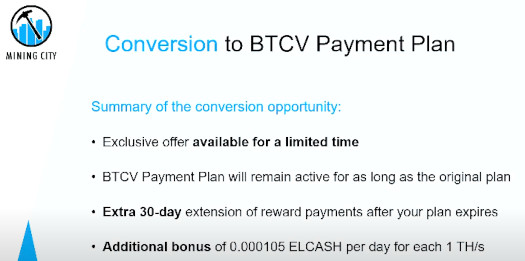

For causes unknown (advertising and marketing?), Mining Metropolis is pitching its transition to fastened returns as an “unique restricted time provide”.

If it hasn’t occurred already, presumably sooner or later new funding will solely be potential in fastened return plans.

Within the final level of the slide above you may see ELCASH being flogged as an incentive.

ELCASH, aka Electrical Money, was a Ponzi shit token Mining Metropolis launched final December.

The unique intention was to launch shitcoins to prop up BTCV’s buying and selling worth. After ELCASH did not have any influence although, these plans seem to have been placed on maintain.

Cue Mining Metropolis dumping ELCASH on associates as a advertising and marketing incentive.

Curiously, Rogowski doesn’t disclose the fastened return charges for the BCTV fastened return plans.

In any occasion, just like the introduction of Electrical Money, fastened returns is simply prolonging the inevitable.

Site visitors to Mining Metropolis’s web site is on the decline. BTCV’s public buying and selling worth has been stagnant for months.

Propping BCTV up when there’s no important new funding being made prices cash, additional draining what Mining Metropolis pays out.

Contributing to Mining Metropolis’s decline are regulatory warnings from the Philippines and Canada.

Mining Metropolis failed to handle participating in securities fraud with both regulator. The matter has been swept below the carpet, with Mining Metropolis persevering with to illegally solicit funding the world over.

Based mostly on Alexa visitors evaluation, Mining Metropolis’s largest sources of recent funding are Papua New Guinea and Japan.