Simply days after its fictional CEO vowed to resolve ongoing withdrawal points, Intelligence Prime Capital has unveiled a brand new crypto funding scheme.

Like all MLM Ponzi scheme inevitably does, Intelligence Prime Capital started having withdrawal points in mid February.

Preliminary signs had been blocking and draining of investor accounts. Performance was finally considerably restored however withdrawal issues persevered all through March.

Intelligence Prime Capitals admins put ongoing withdrawal issues right down to non-specific “glitches”.

Our technical crew is now fixing the problem on MetaTrader 4.

So let’s relaxation assured of this [sic], now we have realized the glitches which are occurring proper now.

Subsequently, we’ll resolve this problem as quickly as potential.

I perceive that some members had been going through withdrawal points which have negatively impacted their expertise with the IPCapital platform.

The withdrawal points had been easy a results of some technical difficulties, and now we have labored across the clock to resolve them in order that our members can proceed to take pleasure in the most effective that IP Capital has to supply.

Intelligence Prime Capital by no means bothered to rent an actor to play CEO. Its assumed this was one other communication from its admins.

In any occasion, lower than 48 hours after the CEO letter, Intelligence Prime Capital revealed a brand new crypto funding scheme.

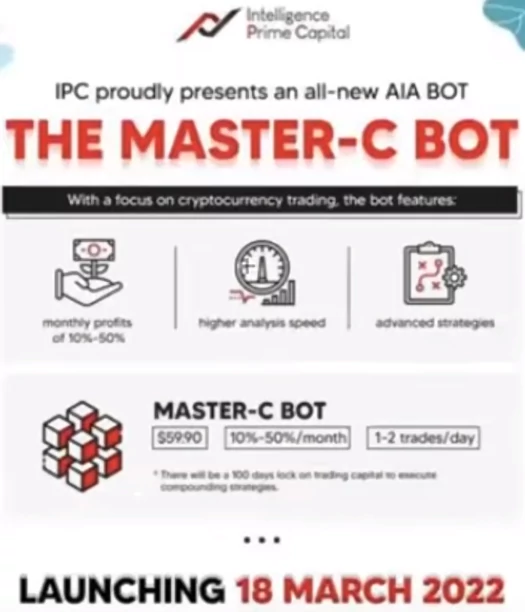

Dubbed “Grasp-C Bot”, Intelligence Prime Capital is promising month-to-month crypto returns of as much as 50%.

New Intelligence Prime Capital associates will probably be charged $59.90 for entry to Grasp-C Bot.

Current associates are being enticed to transition to crypto for free of charge. Word that Associates who decide to transition are locked out of Intelligence Prime Capital’s USD funding scheme.

Intelligence Prime Capital’s crypto buying and selling scheme is being supplied in tether (USDT).

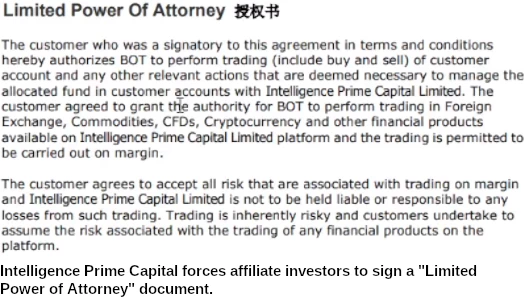

As a part of the signup/transition course of, associates are required to signal a “Restricted Energy of Legal professional” doc.

Versus an precise Energy of Legal professional, Intelligence Prime Capital are utilizing the ruse as extra of a “sorry on your loss” disclaimer.

The shopper who was a signatory to this settlement … hereby authorizes BOT to carry out buying and selling of buyer account and every other related actions which are deemed essential to handle the allotted fund in buyer accounts with Intelligence Prime Capital Restricted.

The shopper agrees to just accept all threat which are related to buying and selling on margin and Intelligence Prime Capital is to not be held liable or accountable to [sic] any losses from such buying and selling.

Clearly this doc has no authorized standing in any jurisdiction.

Oh and, maybe most significantly, at time of publication solely new funds could be invested into the tether buying and selling bot.

What we’re seeing right here is your traditional end-of-run money seize. Loads of Ponzi schemes have achieved it however a current instance is Futures Commerce.

The transition to cryptocurrency itself is price noting. MLM Ponzi schemes transition to cryptocurrency when regulators start cracking down.

Over the previous few months, Intelligence Prime Capital has acquired securities fraud warnings from Russia and Canada (British Columbia and Ontario).

As issues intensify, it turns into troublesome for MLM Ponzi schemes to keep up common banking channels. Moderately than ever admit this although, it’s packaged as a transition to crypto.

USI-Tech and Mirror Buying and selling Worldwide are two bigger MLM Ponzi schemes that did precisely this prior to now.

For now Intelligence Prime Capital is permitting affiliate buyers to proceed with USD (and withdrawal issues). That is more likely to change someday sooner or later.

Intelligence Prime Capital is believed to be run by a gaggle of scammers working out of Singapore.

Singapore has a poor monitor document on regulation of MLM securities fraud. Apart from a possible securities fraud discover from MAS, native authorities are unlikely to take motion.