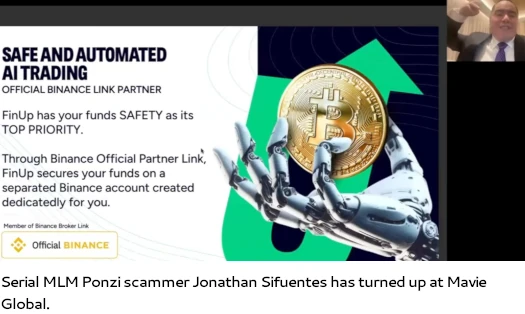

Via FinUp, Mavie World has jumped on the launched an “ai crypto buying and selling” fraud bandwagon.

FinUp sees Mavie World pitch buyers on passive returns, purportedly derived by way of AI crypto buying and selling.

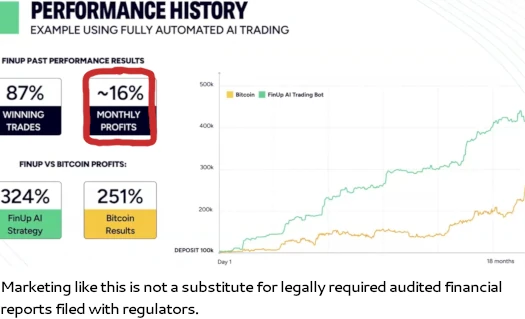

Via its AI buying and selling providing, Mavie World claims FinUp can generate month-to-month returns of round 16% for buyers.

On the cash aspect of issues, Mavie World associates buy FinUp licenses costing between 100 and 30,000 tether (USDT).

The extra a Mavie World affiliate spends, the extra they will make investments and payment quantities are decreased.

Commissions on charges paid to entry FinUp are paid out by way of Mavie World’s MLM alternative.

FinUp’s “protected and automatic AI buying and selling” purportedly takes place by way of Binance.

Binance is a cryptocurrency trade in decline with an unsure future.

Binance was sued by the SEC in June 2023. In its grievance, the SEC cited Binance as “the biggest crypto asset buying and selling platform on the planet” and alleged its

crypto asset buying and selling platform, Binance.US; and their founder, Changpeng Zhao, [have committed] a wide range of securities legislation violations.

Changpeng Zhao, aka CZ, was criminally charged with cash laundering in November 2023.

Zhao pled responsible in November 2023 and agreed to give up $4 billion in ill-gotten positive aspects.

Binance’s founder and chief govt officer (CEO), Changpeng Zhao, a Canadian nationwide, additionally pleaded responsible to failing to take care of an efficient anti-money laundering (AML) program, in violation of the BSA and has resigned as CEO of Binance.

Binance grew to become the world’s largest cryptocurrency trade partially due to the crimes it dedicated – now it’s paying one of many largest company penalties in U.S. historical past,” mentioned Legal professional Basic Merrick B. Garland.

Zhao was sentenced to 4 years in jail earlier this month. The sunshine sentence prompted hypothesis Zhao supplied US authorities with helpful intelligence on accomplices.

Heading up FinUp is Jay Hao, former CEO of the OKX cryptocurrency trade.

OKX is ready up as a shell firm within the Bahamas. To keep away from prosecution for fraud within the US, OKX purportedly doesn’t enable US residents to enroll to its trade.

Nonetheless as of February 2024, South Korean authorities are investigating OKX for securities fraud.

As to FinUp’s regulatory failings, the supply of passive returns derived by way of automated buying and selling constitutes a securities providing. Automated buying and selling additionally requires FinUp to stick to commodities laws.

Each FinUp and Mavie World are usually not registered to supply securities or act as a commodities dealer in any jurisdiction.

Outdoors of FinUp’s securities and commodities fraud now we have “professional schooling” and “market insights”.

These seem like shallow makes an attempt at pseudo-compliance. Bundling extra services doesn’t legitimize a primarily fraudulent funding providing.

FinUp operates from the web site area “finup.ai”. A go to to FinUp’s web site reveals the scheme is ready to launch on June 18th.

One final be aware is that serial fraudster Jonathan Yelemian Sifuentes Saucedo has emerged as a FinUp promoter:

Sifuentes is greatest recognized within the MLM business for defrauding buyers by way of his Xifra Life-style and Decentra Ponzi schemes.

Sifuentes fled to Dubai as Xifra Life-style was collapsing in 2022. Whereas he hasn’t been held personally accountable for Xifra Life-style and Decentra, Sifuentes did face the music over his involvement in My Dealer Coin.

Like FinUp, Mavie World, Xifra Life-style and Decentra, My Dealer Coin was an MLM crypto Ponzi scheme.

In 2020 the Arizona Company Fee sued Sifuentes for being a My Dealer Coin promoter. Sifuentes settled the ACC’s expenses for $85,000 in September 2022.

It appears while nonetheless hiding out in Dubai, Sifuentes has now hitched his wagon to Mavie World and FinUp.

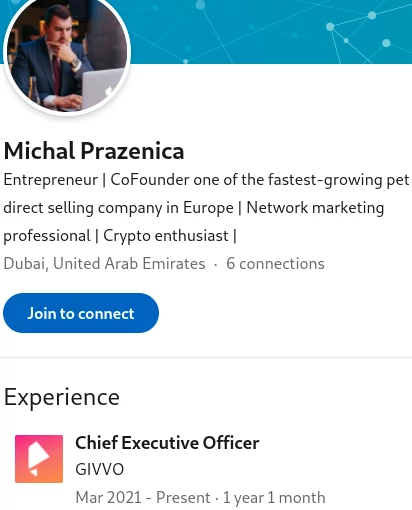

Mavie World can also be primarily based out of Dubai. The fraudulent funding scheme is headed up by former Givvo Ponzi scammer Michal Prazenica.

As famous within the title of this text, FinUp is Mavie World’s fourth spinoff. The unique Ponzi was constructed round ULX and stalled a while in the past.

Since then Mavie World has spun off

- Lottoday (NFT grift Ponzi) – launched mid 2023 with ~16,000 month-to-month web site visits as of April 2024 (SimilarWeb)

- 369X (VIBRA and 369T token Ponzi) – launched late 2023 with web site site visitors too low for SimilarWeb to trace and

- FlipMe (NFT grift Ponzi) – launched early 2024 with ~30,800 month-to-month web site visits as of April 2024 (SimilarWeb)

Via the fixed launch of spinoff scams, Mavie World did handle to reverse a 2023 decline in web site site visitors. SimilarWeb tracked ~212,000 month-to-month visits to Mavie World’s web site for April 2024, up from ~110,400 in February 2024.

It stays to be seen what number of spinoffs Mavie World launches in an try and preserve its dying ULX token Ponzi scheme afloat.