In doing so, she’s additionally confirmed repeated violation of her 2019 TelexFree closing judgment.

Sloan admitted CashFX Group is an funding alternative in an October ninth Fb stay occasion.

[10:04] CashFX is a platform the place many individuals have made some cash.

It’s not everybody. Y’know while you discuss in regards to the buyers which might be on the market, I had a tough time getting quote unquote buyers in. It was simpler for networkers however for some, not really easy.

The networkers they didn’t like giving up 30%. Let’s say they wish to are available for $100,000; they weren’t pleased with 30% of that, or $30,000 going into the product, which to at the present time isn’t there but.

[10:38] After which one other 20% taken out on the withdrawal. When in essence that 200% (return) finally ends up being about 160%. In order that’s about 60% in ten months, proper.

So lots of buyers didn’t like that.

At [59:35] Sloan refers to CashFX Group as an “funding deal”.

That CashFX Group is committing securities fraud shouldn’t be a revelation. BehindMLM identified securities fraud in our July 2019 CashFX Group evaluation.

What makes Sloan’s admission of curiosity is her 2019 TelexFree closing judgment.

As a promoter of the TelexFree Ponzi scheme, Sloan was sued by the SEC for fraud in 2014.

The case performed out for 5 years, concluding final yr in a $778,455 closing judgment.

As a part of the judgment Sloan was prohibited from violating Part 5 of the Securities Act.

Below Part 5 of the Securities Act of 1933, all presents and gross sales of securities have to be registered with the SEC or qualify for some exemption from the registration necessities.

As a common rule, MLM corporations working passive funding schemes don’t qualify for registration exemption.

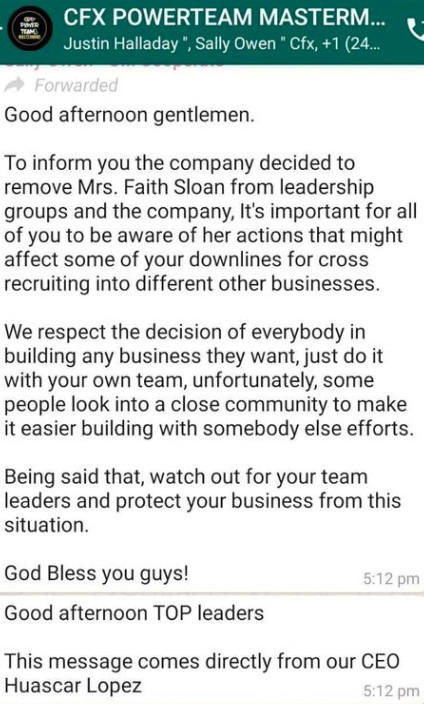

For those who’re questioning what prompted Sloan to verify CashFX Group’s securities fraud, it seems two days she was terminated for cross-recruitment. Accounts arrange for Sloan’s mom and daughter have additionally been terminated.

Sloan claims she wasn’t straight knowledgeable of the account terminations.

As a substitute she discovered when a message, purportedly circulated in a CashFX Group WhatsApp group a number of days in the past, was shared together with her by CashFX associates.

Just a few weeks again Sloan started selling QubitTech, one other passive funding MLM alternative.

As with CashFX Group, neither QubitTech or CEO Greg Limon are registered with the SEC.

Since Sloan’s TelexFree closing judgment was handed, she has and continues to make a mockery of it.

BehindMLM first documented Sloan persevering with to commit securities fraud by means of Cloud Token, two months after the judgment order was made.

By October 2019 Cloud Token associates started experiencing withdrawal issues.

These, like Sloan, on the high of the Cloud Token Ponzi rapidly deserted ship. It wasn’t nevertheless till Could 2020 that Cloud Token formally collapsed.

After Cloud Token Sloan centered on CashFX Group. Now that’s over it’s QubitTech.

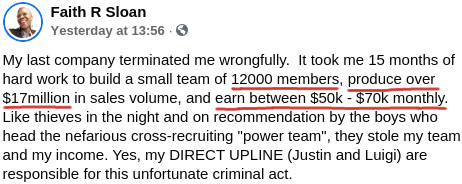

Sloan’s Cloud Token earnings are unknown. In her CashFX Group Fb stay video, Sloan discloses she had a downline of 11,000 affiliate buyers.

[18:18] I get about $50,000 to $70,000 a month in CashFX.

As claimed by Sloan, the 11,000 buyers in her CashFX Group downline collectively invested over $17 million {dollars}.

Sloan states she’s now “doing nicely” through “one other deal” with QubitTech.

[44:20] With QubitTech, in 5 and a half weeks, I’ve made $90,000.

To this point the SEC has didn’t comply with up on Sloan’s ongoing TelexFree judgment violations.