Sadly Nguyen missed the mark. She additionally doubled down on her husband’s crypto securities fraud.

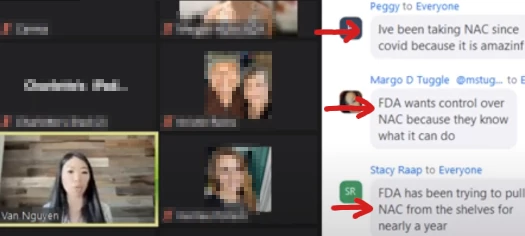

Talking on behalf of Elomir company, together with firm proprietor Terry LaCore, Nguyen revealed Elomir is presently working as a pyramid scheme.

In the course of the pre-enrollment section of July, solely distributors have been allowed to enter in at $250.

And one field can be shipped someday within the month of July. And naturally the remainder of the (ordered) product can be totally fulfilled, beginning August fifteenth.

Nguyen blames product delivery delays on damaged equipment. That’s positive, issues occur and so are delivery delays consequently.

With respect to regulatory compliance, why not simply delay the launch altogether? In the event you’re an MLM firm solely letting distributors join $250 a pop – and also you’re paying commissions on these charges – you’re working a pyramid scheme.

We have now 6500 Model Companions registered within the tree. Over 5000 profitable transactions went via.

The moral factor to do right here upon realizing you’re not going to have the ability to fulfill orders, is cease taking cash from folks.

Whenever you’ve fastened up no matter equipment wants fixing, then reopen – each to distributors and retail clients.

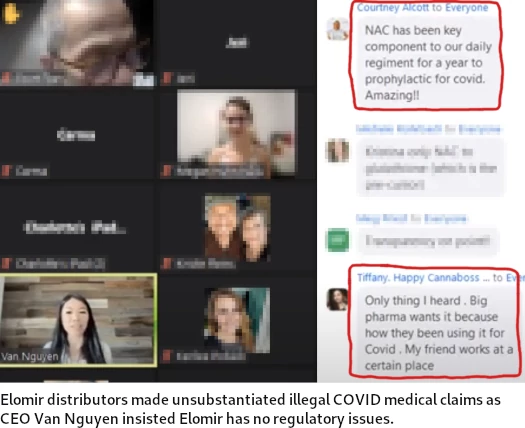

Nguyen goes on to scale back regulatory compliance as “rumors”, particularly how the FTC regulates the MLM business.

I do know that over the weekend it was type of mentally exhausting for a few of you guys, listening to concerning the FTC, the FDA. That I’m working illegally as a result of I’m not permitting clients to return in, and NAC is an unlawful drug.

Guys, belief me once I say, we’ve a authorized crew that’s backed by a billion greenback model.

The FTC would solely shut me down if I used to be illegally working a enterprise, that wasn’t totally disclosed about what was taking place.

After we went public on July fifth, there was a dialogue had, with the present management that was enrolled within the tree earlier than it went dwell, and everybody understood that if we have been going to enter this pre-enrolment section, meaning it was really solely open and restricted to the three-box order for Model Companions.

Thereafter, as soon as we caught up on stock, we’d enable clients into the system. As a result of us because the house owners, didn’t really feel assured in taking cash out of your shoppers and your clients.

And guys, that was totally disclosed and publicly introduced within the ATM web page known as “Dwell Your Finest Life”.

So will the FTC supposedly attempt to come after me and the corporate?

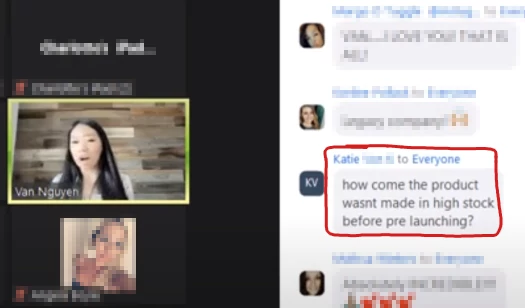

Guys, the one purpose why the FTC pursues corporations… for a number of causes; one, are you doing medical claims within the discipline?

The second factor that the FTC appears for is are we screwing over Model Companions and clients. And what I imply by that’s are we not refunding them, or addressing the issues that they’ve concerning the product or our alternative.

That’s the one means the FTC will actually concentrate, if our personal clients or personal distributors are reporting theft or fraud.

Are disclosure violations and “screwing” over distributors and clients on refunds potential FTC violations? Completely.

Nevertheless it’s patently false to say these are the one two causes the FTC “pursues” MLM corporations.

By and huge, pyramid fraud is the first purpose we see regulatory enforcement initiated by the FTC in opposition to MLM corporations.

That’s to say, when an MLM firm’s distributor order income outstrips retail order income. There are further caveats to that, which may alter the magnitude of alleged fraud (promoting, “screwing over” distributors and clients and so forth.), however at its core not having vital retail gross sales quantity is an issue.

The FTC has been fairly clear about this up to now.

With respect to Elomir, 100% of gross sales income generated is attributable to associates. This implies in flip that 100% of any commissions paid out are defacto tied to recruitment.

With not a single retail buyer, Elomir is presently working as a pyramid scheme in violation of the FTC Act.

Is the FTC going to return in weapons blazing and shut down Elomir?

Most likely not simply but. Like I stated, equipment breaking down is an affordable trigger for delay and, whereas not probably the most accountable determination, soliciting Model Companions isn’t essentially a problem – but.

Elomir have primarily backed themselves right into a nook. If this drags on (for no matter purpose), and retail nonetheless isn’t a factor months from now – that mess might set off an FTC investigation.

One factor that may additionally curiosity the FTC is the motivation behind Elomir Model Partnership.

In a legit MLM firm, distributors signal as much as run a enterprise promoting merchandise to retail clients.

Right here with Elomir there aren’t any retail clients. 1000’s of Model Companions signing up for $250 with out with the ability to really promote something to retail clients. All they’ll do is recruit.

“However I signed up for the product!” can also be a really tough argument to make, when product delivery is backed up for a month and you may’t join the product with out shopping for into Elomir’s enterprise alternative.

Of their Vemma and Herbalife litigation, the FTC made it explicitly clear that distributors aren’t retail clients. This was challenged in court docket in each situations and the FTC prevailed.

The selection to not droop enterprise operations until product success points are sorted out casts doubt on the motivation of Elomir distributors signing up.

Given Elomir is in “pre-enrollment” (what does that even imply with 6500+ Model Companions enrolled), it’s a shaky basis to construct an MLM firm on.

Considerably disturbingly, Nguyen goes on to discredit and dismiss client complaints to the FTC.

There’s so many anti-MLM’er on the market reporting each firm. Calling them a pyramid scheme and doing all these items.

You suppose the FTC has the time to take a look at these complaints?

In researching Elomir, BehindMLM didn’t cite any pyramid scheme issues. We additionally weren’t conscious Elomir had signed up 6500+ distributors and not using a single retail buyer both.

Elomir must both refund Model Companions and droop enrolment, or get this problem sorted and begin taking retail buyer orders instantly.

Shifting on to the N-acetylcysteine (NAC) being a product in Axis Klarity, one thing we did touch upon, Nguyen mischaracterizes present FDA regulatory steerage.

Our authorized crew is totally conscious that the FDA is taking a look at NAC and presumably shifting it to prescribed drug standing.

No they’re not. NAC is presently an accredited drug that requires a prescription. Placing it in dietary dietary supplements is presently unlawful.

As of April 2022 the FDA is taking a look at permitting NAC in dietary dietary supplements – however as of but no determination has been made.

Like working an MLM firm with no retail clients, I think about promoting a product with an unlawful ingredient a nasty enterprise determination.

As an alternative of acknowledging that, after mischaracterizing NAC’s present authorized standing in dietary dietary supplements, Nguyen trots out a “large pharma” conspiracy principle.

I don’t know why they’re doing what they’re doing, however large pharma is making an attempt to take NAC off the marketplace for dietary supplements.

I’m working intently with our authorized crew. They did replace me in January and stated, “Van, as of proper no longer a full determination has been made. You don’t must be involved about it but when one thing does occur in a ruling, then we must tackle the ingredient.”

I don’t know what LaCore Enterprises’ legal professionals are taking a look at however right here’s the present NAC standing and proposal from the FDA (April 2022);

If an article has been accredited as a brand new drug underneath part 505 of the FD&C Act (21 U.S.C. 355), merchandise containing that article are outdoors the definition of a dietary complement except both of two exceptions applies.

First, there’s an exception if the article was marketed as a dietary complement or as a meals earlier than such approval.

Second, there’s an exception if FDA (underneath authority delegated by the Secretary of Well being and Human Companies) points a regulation, after discover and remark, discovering that the article can be lawful underneath the FD&C Act.

FDA has decided that NAC is excluded from the dietary complement definition underneath part 201(ff)(3)(B)(i) of the FD&C Act as a result of NAC was accredited as a brand new drug earlier than it was marketed as a dietary complement or as a meals.

Particularly, NAC (i.e., acetylcysteine) was accredited as a brand new drug underneath part 505 of the FD&C Act on September 14, 1963 (see 28 FR

13509 (Dec. 13, 1963) (saying the approval)).FDA is just not conscious of any proof that NAC was marketed as a dietary complement or as a meals previous to September 14, 1963. As mentioned

beneath in Part III, FDA lately confirmed NAC’s exclusion from the dietary complement definition in response to 2 citizen petitions.Nevertheless, we’re contemplating initiating rulemaking underneath part 201(ff)(3)(B) of the FD&C Act to allow using NAC in or as a dietary complement (i.e., to offer by regulation that NAC is just not excluded from the definition of dietary complement), and, if, amongst different issues, FDA doesn’t determine safety-related issues as we proceed our evaluate of the out there information and data, we’re prone to suggest a rule offering that NAC is just not excluded from the definition of dietary complement.

However why let details get in the way in which of “large pharma” conspiracy theories.

So we’re going to depart (NAC) in there, so long as potential, and I pray and hope that it doesn’t develop into a prescribed drug.

It already is, and has been for fifty-nine years.

If the FDA modifications the classification of NAC, nice. Axis Klarity is within the clear. However that hasn’t occurred.

As an alternative Elomir seems to have rolled the cube and preempted the FDA’s plan of action, selecting to supply an unlawful ingredient in its flagship product and roll the cube on regulatory penalties.

We’re totally monitoring it from a authorized standpoint. So simply know, I’m not neglecting or simply throwing stuff collectively and praying to God it’s going to work and hoping they don’t catch us. That’s not our mentality.

As defined above, it kinda is. It’s precisely Elomir’s mentality.

Like having no retail clients, promoting merchandise with unlawful elements is just not an incredible basis to construct an MLM firm on prime of.

At this level BehindMLM will get a point out, with Nguyen begging Elomir distributors to not go to our website

In the event you run into somebody that claims, “Are you aware concerning the BehindMLM article, please don’t go Google search and click on on it, cuz then it simply rises up guys.

An MLM firm not wanting your distributors to tell themselves isn’t a very good look.

By all means if one thing printed on BehindMLM isn’t factually correct, let me know and I’ll tackle it. However that hasn’t occurred.

As an alternative we’ve the CEO of Elomir ignoring the first purpose the FTC goes after MLM corporations, and mischaracterizing the present authorized standing of NAC as an accredited drug.

Subsequent we get into Nguyen’s husband, Toan, peddling crypto Ponzi schemes whereas role-plays being the co-CEO of Elomir.

I used to be anticipating a BehindMLM article about me. I knew they have been going to say my husband does Ponzi schemes, as a result of we do put money into crypto.

Clearly investing in Ponzi schemes and, extra importantly, selling them, is an indefensible place. And so we’ve Nguyen scale back her husband’s Ponzi scamming to “investing in crypto”.

With respect to BehindMLM, I don’t have an issue with “investing in crypto”. I couldn’t care much less if Van and Toan Nguyen are crypto buyers working Elomir.

What I’ve an issue with, and what’s essential for anybody doing their due-diligence into Elomir to acknowledge, is that Toan Nguyen is selling crypto Ponzi schemes. And has been for a while.

In the event you put money into a Ponzi scheme and revenue, you’re a scammer.

In the event you promote Ponzi schemes, you might be a good greater scammer.

Toan Nguyen does each of these items, and I’ve offered documented proof to again up these claims.

Decreasing Toan Nguyen selling Ponzi schemes and scamming folks via them to “investing in crypto”, is the peak of disingenuousness.

Guys, we totally disclosed all the things to everybody and you may ask the O.G. crew.

Once they came visiting to our home, I instructed them at my eating desk, “Hey guys, when BehindMLM comes out be aware they’re in all probability going to say Toan does Ponzi schemes.” Proper? As a result of he does do crypto.

No. Toan Nguyen “does Ponzi schemes” as a result of “Toan does Ponzi schemes.” Whether or not wire and securities fraud is dedicated by way of crypto or another automobile is irrelevant.

Van continues to defend her husband’s Ponzi scamming by piling on much more disingenuousness;

When it does come about, please be trustworthy to folks and allow them to know that sure, my husband does do crypto.

Crypto may be very controversial in the US however he doesn’t knowingly take cash and rip-off folks. He has a YouTube channel that evaluations crypto tasks, NFTs, all these issues and so I would like you guys to be utterly clear to the folks you discuss to.

That might entail disclosing Toan Nguyen recruits folks into the crypto Ponzi schemes he “evaluations”.

I need to take a step again for a second and clarify why, from a due-diligence perspective, Toan’s crypto Ponzi scamming was such an enormous deal in BehindMLM’s Elomir evaluate.

Passive funding alternatives are securities choices. If that sentence is senseless to you, go and browse up on the Howey Check and the way it’s used to ascertain the existence of an funding contract.

Securities within the US are regulated by the SEC. Each corporations providing securities and promoters of securities must be registered with the SEC.

Providing and selling unregistered securities is prohibited within the US (and anyplace on the planet with monetary regulation).

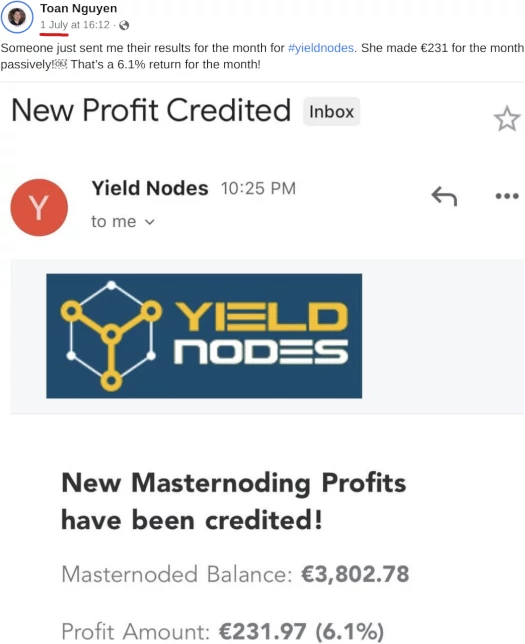

Toan Nguyen’s newest rip-off is Yield Nodes:

Yield Nodes is a crypto Ponzi pitching a passive 213% annual ROI.

Toan Nguyen actively promotes Yield Nodes on YouTube and social media, actively recruiting buyers right into a Ponzi scheme.

Neither Yield Nodes or Toan Nguyen are registered with the SEC. You may confirm this your self with a search of the SEC’s Edgar database.

Once more, providing and selling unregistered securities is prohibited within the US.

This isn’t about “investing in crypto”, Toan Nguyen is committing securities fraud.

I do know I’m not mendacity. I do know my husband’s not mendacity. And for us, why would we disclose this publicly if we all know we’re doing one thing illegally.

As demonstrated by her personal phrases, neither Tan or her husband Toan have really disclosed Toan’s funding and promotion of crypto Ponzi schemes.

To BehindMLM’s Elomir evaluate, I identified that having an government overtly committing securities fraud by selling Ponzi schemes isn’t a very good look.

I wholeheartedly stand by that.

To be clear: I’m not suggesting or insinuating Terry LaCore or LaCore Enterprises has something to do with Toan Nguyen scamming folks via Ponzi schemes. It’s price noting although that Terry LaCore himself has a historical past of securities fraud.

With that in thoughts I’m notably shocked it is a subject I’ve needed to tackle once more. Possibly LaCore, Van and Toan want to take a seat down and discuss this one out.

This isn’t “investing in crypto”. That is full-blown monetary fraud by way of serial funding and promotion of Ponzi schemes.

Or maybe LaCore doesn’t give a crap certainly one of his executives is scamming folks via Ponzi schemes. I’m not right here to make that judgment name, I’m simply stating details as a part of due-diligence into Elomir.

Poor enterprise selections and misrepresentation of regulatory compliance appears to be a recurring theme right here.

My due to Mombie #Anti-MLM for drawing my consideration to Van Nguyen’s misinformation webinar.