Cloud Token has no bodily enterprise operations in Australia. Neither is Australia a major supply of funding income for the corporate (Alexa).

Reasonably Cloud Token is run by scammers in Singapore, who’re at present soliciting funding primarily from Japan, the US and Brazil.

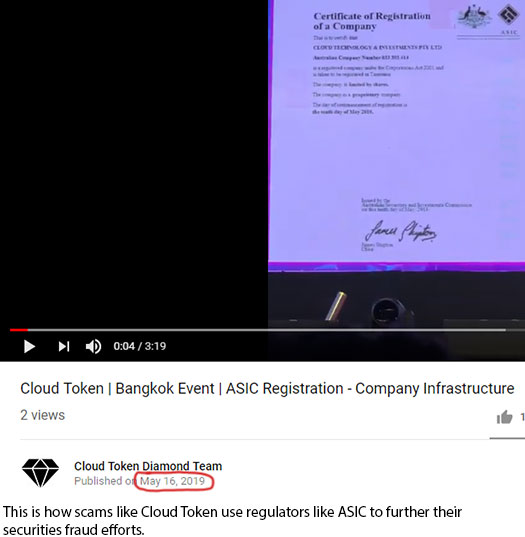

So why register with ASIC?

ASIC aren’t identified for well timed regulation of securities fraud. By the point they cotton on Cloud Token’s homeowners and prime affiliate buyers will likely be lengthy gone with invested funds.

Within the meantime Cloud Token can parade their Could tenth “Cloud Expertise & Investments” ASIC registration round, successfully making it a securities fraud advertising instrument.

To be clear, the extent of Cloud Token’s registration with ASIC is at this stage nothing greater than a three-page software for registration as a proprietary firm.

That is in any other case generally known as a Kind 201.

All that’s required in a Kind 201 submitting are common particulars in regards to the firm.

These may be made up or organized by way of a shell incorporation and native brokers.

Once more, by the point ASIC initiates a fraud investigation and tries to confirm it’ll be far too late for Cloud Token buyers.

As of but Cloud Token has not filed any audited accounting experiences with ASIC, so there stays no verifiable proof the corporate is utilizing exterior funds to pay affiliate investor returns.

However let’s minimize to the chase. Even when we take the ASIC registration at face worth, it means completely bugger all exterior of Australia.

Cloud Token remains to be an unlawful funding alternative in each different jurisdiction it solicits funding in. Specifically the US and Japan.

Moreover it’s a must to surprise why Cloud Token hasn’t registered itself with monetary regulators in Singapore itself.

Properly, why is definitely fairly apparent:

Cloud Token is one other app-based MLM crypto Ponzi scheme.

Whereas I’d like to say this time ASIC received’t drop the ball and as a substitute be fast to behave on Cloud Token’s bogus registration, historical past has repeatedly proven us in any other case.

A current instance I may give you is the AWS Mining Ponzi scheme.

AWS Mining pulled the identical “look we’re registered in Australia” bullshit as Cloud Token.

Regardless of receiving a securities fraud discover in Texas after which collapsing final month, AWS Mining remains to be registered with ASIC.

Worse nonetheless, they’ve been registered since 2017. And through all of that point, not as soon as did AWS Mining file any audited accounting experiences.

So uh yeah, take Cloud Token’s ASIC registration for what it’s price. Lower than used rest room paper.

And should you’re dedicated to precisedue-diligence, ask why Cloud Token hasn’t registered with the Monetary Companies Company (Japan), the Securities & Change Fee (US) or the Financial Authority of Singapore.