Evidently absolutely conscious of this, Cloud Token has begun to embrace pseudo-compliance.

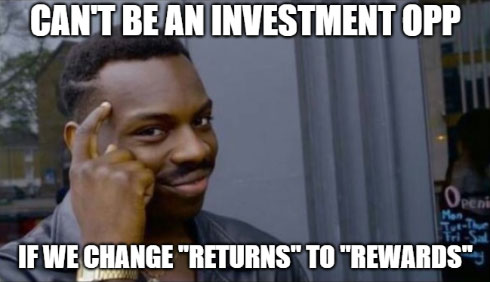

In it’s newest app replace, Cloud Token advises it has eliminated any references to returns.

As a substitute, Cloud Token now refers to returns associates obtain as “rewards”.

From a regulatory perspective, Cloud Token can name its returns no matter it chooses.

The mechanics of fee inside Cloud Token sees associates make investments $x in CTO factors.

CTO factors are parked with the corporate inside their app, offering associates with extra CTO factors.

Over time Cloud Token arbitrarily will increase the interior CTO worth, thus permitting associates to withdraw greater than they’ve invested.

Reward, return… it’s what it’s – securities fraud.

This isn’t the primary time Cloud Token has tried to distance itself from its fraudulent enterprise mannequin.

Beforehand Cloud Token admin Ronald Ai and US promoter Religion Sloan claimed that as a result of the corporate was investing funds invested into by associates, that associates themselves weren’t investing.

This convoluted logic fell aside upon consideration that associates had been paid returns (a safety exists when a return is derived through the efforts of a third-party).

At current Cloud Token is operated between Malaysia and Singapore. The corporate additionally has a notable presence within the US, headed up by a lot of serial scammers.

As of but the Financial institution of Malaysia, Financial Authority of Singapore or the US SEC has taken any motion in opposition to the scheme.

Given Cloud Token is now adopting Zeek Rewards’ and TelexFree’s best hits, regulatory motion most likely isn’t too far behind.