BehindMLM reviewed Aluva the identical month it launched in June 2021.

In reviewing Aluva, I used to be form of impartial on the MLM alternative.

There’s nothing overtly offensive about Aluva’s MLM alternative.

Sadly there’s additionally nothing to actually hook you in.

Founder Gavin Dickson’s story about his father is a pleasant contact however the underlying message is principally “take care of your self earlier than it’s too late”.

And also you don’t essentially want an power drink, multivitamin drink or weight reduction complement to attain that.

Nearly two years into Aluva’s launch, SimilarWeb tracks negligible site visitors to its web site.

This isn’t definitive, nevertheless it’s a very good indication Aluva isn’t doing effectively.

Since launch, Aluva has marketed a spread of dietary dietary supplements.

Then, on or round January tenth, the corporate introduced it was pivoting to AUX.

Take part within the largest monetary shift of the century and get your time again, extra freedom, and funds on observe utilizing AUX.

This unimaginable platform launched 1/15!

AUX stands for Aluva College & Trade; and you may in all probability guess the place that is going…

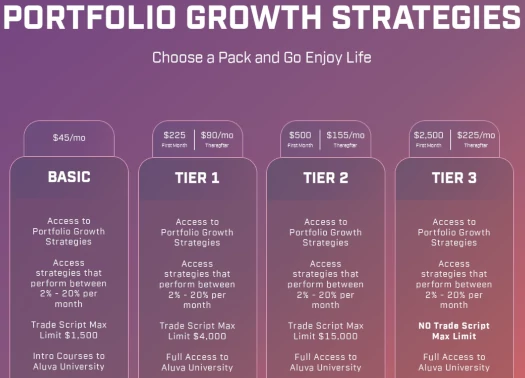

By AUX, Aluva pitches a 2% to twenty% passive month-to-month ROI:

It’s your typical buying and selling bot providing, with costs beginning at $45 a month.

- Primary – $45 a month and in a position to make investments as much as $1500

- Tier 1 – $225 after which $90 a month, in a position to make investments as much as $4000

- Tier 2 – $500 after which $155 a month, in a position to make investments as much as $15,000

- Tier 3 – $2500 after which $225 a month, no funding restrict

Funds invested are purportedly traded on investor’s behalf by Aluva’s “commerce script”.

Take part in state-of-the-art buying and selling techniques with Aluva’s hands-free API integration.

We’ll deal with the technicalities – your simply make investments, commerce and earn.

Aluva advertising suggests charges and funding are solicited in bitcoin and ether.

Hooked up to Aluva’s “buying and selling script” funding scheme is AUX College.

You recognize the drill, crypto buzzwords and an training platform no person cares about.

AUX is $240 a month standalone or bundled with Tier 1 and better funding plans.

The Primary tier supplies entry to “intro programs to Aluva College”.

To be clear, there’s nothing inherently unlawful about Aluva’s passive funding buying and selling alternative.

Being a US-based firm nevertheless, the legitimacy Aluva’s “buying and selling script” scheme hinges on registration with the SEC.

A search of the SEC’s Edgar database reveals neither Aluva or founder and CEO Gavin Dickson are registered.

Because of this at a minimal Aluva is committing securities fraud.

On high of that, Aluva fails to reveal particulars of its “buying and selling script” to shoppers. This can be a potential violation of the FTC Act (disclosures).

Failing regulatory intervention, MLM buying and selling bot schemes usually finish in considered one of two methods;

- the bot blows up; or

- a rigged trades exit-scam.

No matter how Aluva’s “buying and selling script” funding scheme ends, the one individuals who will earn cash with it are Gavin Dickson, early traders and/or high recruiters.