The civil lawsuit alleges Ohno, Jao and two different defendants ran a $50 million crypto token rip-off.

Plaintiffs within the August thirteenth filed go well with are

- Brian Kang;

- Skyblock LLC;

- Mid-Wilshire Consulting;

- Prasad Hurra;

- David Kim;

- Blue Block Group;

- Artemio Verduzo;

- David Kwon; and

- Younger Jae Kwon

Named defendants are

- Hybrid Commerce Restricted;

- Asia Digital Asset Trade;

- Allysian Sciences;

- Apolo Ohno, a resident of California;

- Rod Jao, a resident of Vancouver, Canada;

- Eugenio Pugliese, a resident of California; and

- Henry Liu, a (former?) resident of California

As alleged by the Planitffs;

Between roughly January 2018 and June 6, 2018, Defendants supplied and offered digital tokens (the “Hybrid Token”), elevating roughly $50 million from traders based mostly world wide, together with inside america.

When you’ve by no means heard of Hybrid Token, you’re not alone.

BehindMLM reviewed Allysian Sciences in March 2015.

Discovering a seemingly overpriced complement and autoship recruitment scheme, for sure we weren’t impressed.

Quick-forward thee years and, simply after the 2017 bitcoin pump and dump, Apolo Ohno and his co-defendants, like so many crypto bros on the time, figured they’d have a crack at bEiNg ThE nExT bItCoIn!

Cue HybridToken’s ICO launch on or round January 2018.

As alleged within the lawsuit, the Hybrid group of firms had been made up of the next parts:

- BaseTrade – crypto buying and selling platform

- HybridExchange – crypto alternate

- HybridTerminal – API platform for BaseTrade and HybridTerminal (introduced however by no means launched)

- HybridWallet – ethereum based mostly crypto pockets

- HybridFX – shitcoin manufacturing unit platform

- HybridToken – ERC-20 token created by defendants by way of HybridBlock

These firms had been run by way of shell entities arrange in Hong Kong, Malta and Singapore.

Throughout the ICO part, Ohno and his co-defendants solicited round $50 million in funding.

Hybrid was pitched to traders on the premise the corporate had

former Olympic champions, funding bankers, Wall Road quants, and Whitehouse [sic] officers forming our core crew.

“We’re poised and able to carry our society into a brand new period of worldwide freedom.”

The White Paper 1.9.2 claimed to have “assembled a crew comprised of skilled buying and selling system professionals from each the cryptocurrency trade and non-crypto Wall Road markets.”

The corporate additionally claimed to have

longstanding relationships with a number of governments and trade regulators, together with the Philippines, Malaysia, Labuan, Singapore, Hong Kong, Korea, Taiwan, and provincial governments of huge cities in China.

Excluding Ohno being a former Olympic gold medalist, so far as I can inform the remainder of the claims had been baloney.

The Plaintiffs allege not one of the Hybrid firms had any financial institution accounts. Solicited funds had been thus saved in Allysian Sciences’ accounts.

On the entire nothing a lot occurred improvement smart all through the primary half of 2018.

Then, in July 2018, Hybex IO was launched.

A cursory overview of the code underpinning Hybex IO revealed that, opposite to Defendants’ representations that Hybrid was designing a brand new, novel, and groundbreaking platform, Hybex IO was as a substitute a so-called “white label alternate” bought from software program firm AlphaPoint.

AlphaPoint describes itself thusly: “AlphaPoint is a white-label software program firm powering crypto exchanges worldwide.”

In August 2018, 11,000 ETH, then value round $4.4 million, was purportedly stolen from one in all Hybrid’s wallets.

Defendants did nothing in response to the Breach.

Certainly, Defendants neither disclosed the breach to insiders or traders, nor took any affirmative motion to research the Breach or get well the roughly 11,000 ETH in cryptocurrency purportedly stolen within the Breach.

Hybrid’s traders solely discovered concerning the breach following a “what’s occurring?” enquiry from Brian Kang in September 2018.

After Mr. Kang made quite a few inquiries regarding Hybrid’s enterprise operations and plans, Pugliese knowledgeable Mr. Kang of the Breach.

Kang “insisted” Hybrid reply to the breach, prompting them to retain CipherBlade.

On its web site, CipherBlade claims to be a “blockchain investigation firm”.

On March 9, 2019, CipherBlade revealed a report entitled Blockchain Evaluation of HybridBlock Breached Funds.

The CipherBlade Report highlights Defendants’ refusal to help and makes an attempt to impede CipherBlade’s investigation of the Breach, together with by

(i) failing to offer sure backup units;

(ii) failing to offer full screenshots, chat logs, and login histories of suspect accounts; and

(iii) failing to well timed put together and supply an incident report for the Breach, and belatedly offering an incomplete and deceptive incident report for the Breach.

The CipherBlade Report additional defined that Defendants

(i) didn’t conduct acceptable Basic Information Safety Regulation (“GDPR”) actions in response to the Breach;

(ii) didn’t notify traders of the Breach; (and)

(iii) didn’t notify regulation enforcement of the Breach.

As well as, the CipherBlade Report famous that sure Hybrid staff knowledgeable CipherBlade that, in reckless disregard of correct safety protocols, and in direct contradiction of its illustration within the White Papers,

Hybrid saved roughly $20,000,000 of investor funds in TUSD, on a pockets on a pc.

Lastly, the CipherBlade reported famous that Hybrid had “little or no to indicate” for the roughly $50 million in investor funds raised.

From mid 2018 to Might 2019, once more nothing a lot on the event aspect occurred.

The Plaintiffs allege that in this time,

Hybrid transferred substantial parts of the $50 million to Allysian, purportedly for numerous disclosed and undisclosed services and products.

Upon data and perception, that cash was in the end funneled to Ohno, Jao, Pugliese, and Liu individually.

ADAX was a shell firm arrange in Cyprus.

As Defendants had deliberate all alongside, in or about Might 2019, ADAX … acquired Hybrid in full or partly.

Though they’d simply “bought” their very own firm from themselves, Ohno and Jao despatched Hybrid traders the next e mail;

“[W]e are extraordinarily excited to announce that parts of HybridBlock’s ecosystem have been acquired by Asia Digital Asset Trade (ADAX) – a completely licensed asset backed token issuance and alternate platform in Asia.

BaseTrade, our fiat to cryptocurrency platform, a number of the HybridBlock crew, and HybridBlock Token (HYB) will all be built-in into ADAX within the coming months.

[O]nce integration is full, HybridBlock will discontinue separate alternate providers,” and that “ADAX is the brand new dwelling for HybridBlock!

And naturally proper after that announcement was pushed out;

Defendants started to deactivate, disable, and in any other case take away from numerous web sites, boards, chat rooms, and social media accounts any and all proof of Defendants’ involvement in Hybrid and the supply and sale of Hybrid Tokens.

In the present day not one of the Hybrid firms or ADAX exist.

Defendants misled and duped their traders, in the end delivering on none of their commitments to traders.

“Thanks to your $50 mill. We’ll be going now, buh-bye!”

The Plaintiffs allege that after soliciting “roughly $50 million” of funding throughout HybridToken’s ICO, Ohno and his crypto bro co-defendants

squandered and/or misappropriated, and presupposed to lose by theft, all or almost the entire roughly $50 million raised by way of their supply and sale of Hybrid Tokens. Defendants’ supply and sale of Hybrid Tokens was, truly, a mere vessel for Defendants’ private enrichment.

What’s attention-grabbing is that Hybrid Commerce was soliciting funding from US residents.

Kang, a resident of California, invested $1.4 million into Ohno’s Hybrid Token ICO.

In a 2018 interview with Fox Enterprise, Ohno, cautious of regulation by the SEC, categorically acknowledged “we’re not accepting any U.S. cash into our ICO”.

To that finish neither Ohno, any of his co-defendants or Hybrid Commerce had been at any time registered with the SEC.

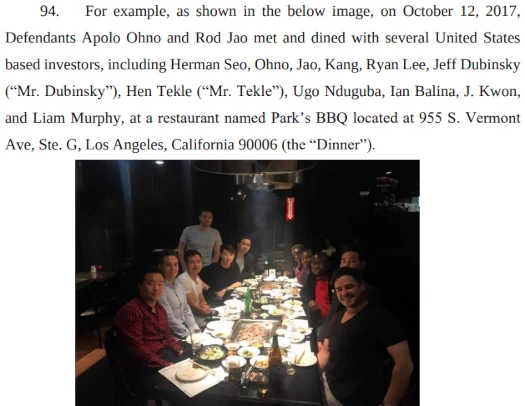

And such to the extent Ohno and his co-defendants would possibly deny knowingly pitching and soliciting funding from US residents, the lawsuit consists of documented proof on the contrary;

The remainder of the Plaintiffs had been all US residents on the time of solicitation.

- Prasad Hurra (Indian citizen residing within the US), invested and misplaced $100,000

- David Kim (US citizen and resident), invested and misplaced $70,000

- Artemio Verduzo (Mexican citizen residing within the US), invested and misplaced $53,020

- David Kwon (US citizen and resident), invested and misplaced $250,000

- Younger Jae Kwon (US citizen and resident), invested and misplaced $250,000

Of their criticism the Plaintiffs put forth that HybridToken was a safety they had been conned into investing in.

Plaintiffs invested cryptocurrency and fiat foreign money with the intention to obtain Hybrid Tokens, which they had been conditioned to anticipate can be value greater than their preliminary cryptocurrency investments.

Causes of motion raised towards the Defendants embrace:

- sale of unregistered securities;

- management individual legal responsibility;

- securities fraud;

- intentional misrepresentation;

- negligent misrepresentation;

- breach of contract;

- breach of implied covenant of fine religion & honest dealing;

- cash had and acquired;

- promissory fraud;

- unjust enrichment;

- fraudulent conveyance;

- unfair competitors; and

- accounting.

Plaintiffs search damages, pre and publish judgment curiosity and authorized prices.

Curious as to what the Plaintiffs had been as much as lately, I ran a fast search.

As beforehand acknowledged, not one of the Hybrid group firms or ADAX exist. They had been all shut down as a part of Hybrid’s “sorry to your loss” exit-scam.

Allysian Sciences continues to be working as an MLM firm.

Apolo Ohno resides it up on social media.

Credited as an “angel investor”, Ohno has invested in Brrrn.

(Ohno) invested in Brrrn, a New York Metropolis–based mostly chilly exercise program, to assist the model launch its first direct-to-consumer product and at-home exercise platform.

Whether or not the funds Ohno invested are investor funds stolen by way of the Hybrid firms is unclear.

Eugenio Pugliese (proper), convicted of drug trafficking in 2001, had a historical past of MLM previous to Allysian Sciences.

Pugliese nonetheless works as Allysian Sciences’ World Managing Director.

Henry Liu appears to have dicked off to the Cayman Islands:

He continues to run crypto schemes as co-founder of Frax Finance.

Frax is the world’s first fractional-algorithmic stablecoin.

The Frax Protocol launched the world to the idea of a cryptocurrency being partially backed by collateral and partially stabilized algorithmically.

That’s crypto bullshit for “we developed a buying and selling app”.

Though the Hybrid group of firms themselves weren’t an MLM providing, we’ve in curiosity within the case by way of Allysian Sciences.

Keep tuned for updates as I proceed to watch the case docket.

Replace 1st December 2021 – Apolo Ohno has filed a movement to dismiss. A listening to on the movement has been scheduled for January tenth.

Replace twenty second February 2022 – Apolo Ohno’s movement has prevailed, ensuing within the lawsuit being dismissed on February fifteenth.