AtmosO2 gives no information on their web page about who owns or runs the enterprise.

In actuality as I write this, the AtmosO2 web page is nothing larger than an affiliate login kind.

The AtmosO2 web page space (“atmost02.com”) was privately registered on October 18th, 2018.

In response to Contreras’ LinkedIn profile, he co-founded Ocular Compliance Tech.

In response to Ocular Compliance Tech’s web page,

Ocular is an Anti- Money Laundering (AML) compliance platform that provides quick verification of a purchaser`s background (KYC).

The platform leverages cryptographic security mechanisms employed in distributed ledger utilized sciences to ensure that data cannot be tampered with, whereas allowing clients full administration over how their data is saved and shared.

Contreras’ LinkedIn profile suggests Ocular Compliance Tech launched in early 2017.

The current Alexa web site guests score of 11.7 million for the company’s web page suggests Ocular Compliance Tech flopped.

Nonetheless Ocular Compliance Tech ties Contreras to the cryptocurrency commerce. I wasn’t able to find any prior MLM involvement.

Contreras LinkedIn profile cites his location as California throughout the US. That’s presumably the place AtmosO2 may be being operated from.

Be taught on for a full analysis of the AtmosO2 MLM different.

AtmosO2 Merchandise

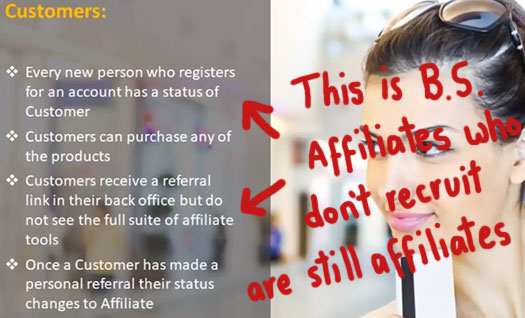

AtmosO2 has no retailable companies or merchandise, with associates solely able to market AtmosO2 affiliate membership itself.

The Atmos2 Compensation Plan

AtmosO2 associates make investments funds on the promise of an marketed annual ROI:

- Requirements Pack – make investments €125 EUR and acquire an annual ROI of as a lot as €1500 EUR

- Premium Pack – make investments €250 EUR and acquire an annual ROI of as a lot as €3500 EUR

- VIP Pack – make investments €750 EUR and acquire an annual ROI of as a lot as €10,000 EUR

- Elite Pack – make investments €5000 EUR and acquire an annual ROI of as a lot as €25,000 EUR

ROI funds are based on offered debit card utilization, which is calculated weekly.

For each €100 spent by an AtmosO2 affiliate on their card each week, they’re eligible to acquire a ROI of as a lot as €3200.

After 12 months an AtmosO2 affiliate ought to reinvest within the occasion that they need to proceed receiving ROI funds.

The exception to that’s the Elite Pack tier, which is on a three-year recurring basis.

Referral Commissions

AtmosO2 associates are paid 20% of funds invested by personally recruited associates.

Residual Commissions

AtmosO2 pays residual commissions by means of a unilevel compensation building.

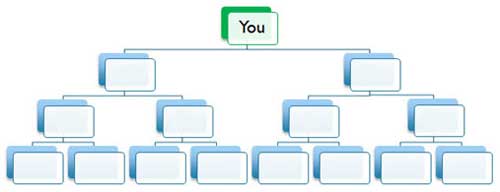

A unilevel compensation building areas an affiliate on the prime of a unilevel employees, with every personally recruited affiliate positioned instantly beneath them (diploma 1):

If any diploma 1 associates recruit new associates, they’re positioned on diploma 2 of the distinctive affiliate’s unilevel employees.

If any diploma 2 associates recruit new associates, they’re positioned on diploma 3 and so forth and so forth down a theoretical infinite number of ranges.

AtmosO2 caps payable unilevel employees ranges at fifteen.

Residual commissions are paid out as a proportion of funds invested as follows:

- generate €125 PV a month and acquire 20% on diploma 1 (personally recruited associates

- generate €250 PV a month and two or further recruited downline investments and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 and 5

- generate €750 PV a month and two or further recruited downline investments and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to 9

- generate €750 PV a month, two or further recruited downline investments and €5000 GV a month and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to 10

- generate €750 PV a month, two or further recruited downline investments and €10,000 GV a month and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to 11

- generate €750 PV a month, two or further recruited downline investments and €25,000 GV a month and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to 12

- generate €750 PV a month, two or further recruited downline investments and €50,000 GV a month and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to 13

- generate €750 PV a month, two or further recruited downline investments and €100,000 GV a month and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to 14

- generate €750 PV a month, two or further recruited downline investments and €200,000 GV a month and acquire 20% on diploma 1, 3% on ranges 2 and three and a few% on ranges 4 to fifteen

PV stands for “Personal Amount” and is a mixture of non-public funding and funding by personally recruited associates.

GV stands for “Group Amount” and is the sum full of PV generated by your downline (instantly and never immediately recruited associates).

Discover that as a lot as 50% of required GV each month can come from anyone unilevel employees leg.

Card Spend Commissions

Each AtmosO2 affiliate is equipped with a debit card. These taking part in playing cards are supposedly hooked as much as a equipped “worldwide checking account”.

The Ocular Tech web page states the taking part in playing cards are equipped by the use of a partnership between OlePay and Jack Chang.

AtmosO2 pays a price on the amount downline associates spend with their offered taking part in playing cards.

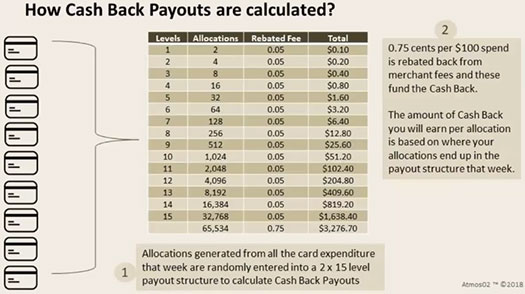

These commissions are paid out by means of a 2×15 matrix.

A 2×15 matrix areas an AtmosO2 affiliate on the prime of a matrix, with fifteen positions instantly beneath them:

These two positions kind the first diploma of the matrix. The second diploma of the matrix is generated by splitting these two positions into one different two positions each (4 positions).

Ranges three to fifteen of the matrix are generated within the similar technique, with each new diploma of the matrix housing twice as many positions as a result of the sooner diploma.

Card spend commissions are paid out based on portions spent by associates positioned into the matrix.

How loads of a price is paid on each spend is ready by what diploma of the matrix an affiliate is positioned on:

- funds spent on diploma 1 generate a 20% price

- funds spent on ranges 2 and three generate a 3% price

- funds spent on ranges 4 to fifteen generate a 2% price

Ocular Tokens

AtmosO2 associates who make investments on the Elite Pack tier receive €200 EUR worth of Ocular Tokens.

Ocular Tokens is not going to be publicly tradeable and appear to exist solely inside AtmosO2.

AtmosO2 does not publicly disclose the current inside price of Ocular Tokens to potential merchants.

Turning into a member of AtmosO2

AtmosO2 affiliate membership is tied to funding at thought-about one in all three equipped tiers:

- Requirements Pack – €125 EUR

- Premium Pack – €250 EUR

- VIP Pack – €750 EUR

- Elite Pack – €5000 EUR

Discover that excluding the Elite Pack tier, the above affiliate cost portions are yearly recurring.

Elite Pack fees are due every three years.

The primary distinction between the funding tiers is elevated income potential by means of the AtmosO2 compensation plan.

Conclusion

To position it merely, the maths behind AtmosO2 doesn’t add up.

As per the above official AtmosO2 promoting presentation slide, for each €100 spent 75 cents is put proper right into a cashback pool.

AtmosO2 associates who spend €100 or further receive supposedly randomized positions in a 2×15 matrix, by the use of which €3276.70 worth of collected 75 cent service supplier cost funds are distributed.

Via this method, AtmosO2 associates can receive annual returns of as a lot as €25,000 EUR.

Merely to put that into perspective, that’s 33,333 seventy-five cent transaction fees.

And consider, AtmosO2 don’t allocate the whole 75 cents to anyone affiliate, it’s break up over a most 65,534 associates.

Yeah I’m not even going to goal the potential math on that one, suffice to say you’re 1000’s and 1000’s of €100 price service supplier fees for just one potential €25,000 annual ROI.

Each AtmosO2 are grossly overstating potential annual returns or there’s some humorous buggers occurring – further on that in a bit.

My second stage of rivalry is AtmosO2’s inaccurate use of the time interval “cashback”.

Respectable cashback sees clients returned a proportion of the cash they paid for a companies or merchandise.

If a consumer receives larger than the cash they paid, as is the case in AtmosO2, it’s not cashback nonetheless a return.

AtmosO2 are intentionally mischaracterizing the returns they pay to associates.

Why? On account of within the occasion that that they had been honest they’d should admit they’re offering a security.

And this brings us to the aforementioned humorous buggers.

If AtmosO2 affiliate ROIs are funded solely by service supplier fees, I’m at a loss as to why associates are charged as a lot as €5000 EUR to participate.

Aside from Ocular Tokens on the Elite Pack funding tier, there doesn’t seem like any notable distinction between the other tiers – aside from the annual ROI amount.

Seeing as ROIs are purportedly generated by means of service supplier fees, why are annual ROI portions tied to how quite a bit an affiliate invests?

Chances are you’ll almost definitely see the place this going…

At 75 cents for every €100 spent break up between a whole bunch of associates, I imagine it’s pretty obvious returns of as a lot as €25,000 aren’t sensible with out an extra revenue.

As a result of it stands the one totally different revenue entering into AtmosO2 is producing outside of service supplier fees, is the portions associates make investments as soon as they enroll.

The problem is AtmosO2 recycling any invested funds to fulfill marketed annual ROI portions would make it a Ponzi scheme.

The good news is passive funding options identical to the one AtmosO2 are offering are securities and require registration with a securities regulator. Inside the US, that may be the SEC.

AtmosO2 registering their passive funding different with the SEC would require them to disclose the exact nature of their annual ROIs- from provide funds to how they’re paid out to associates.

The unhealthy info is neither AtmosO2, Ocular Tech, Ocular Compliance Tech or Dager Contreras are registered with the SEC.

Due to this AtmosO2 is working illegally throughout the US, and positively in any jurisdiction throughout which securities are regulated (nearly every nation on the planet).

Two further compliance red-flags are commissions tied to affiliate recruitment (there is no retail in AtmosO2), and the Ocular Tokens.

In response to a circulated “roadmap”, Ocular Pay tokens had been presupposed to be equipped in the marketplace in Q1 2018.

Whether or not or not that occurred or not is unclear. What we do know nonetheless is Ocular Token is little larger than an Ethereum ERC-20 shitcoin.

Ocular Coin serves no goal outside of Ocular Tech and is not publicly tradeable.

So why is it being dumped on AtmosO2 associates?

Ocular Coin costs Ocular Tech and AtmosO2 little to nothing to generate. It’s easy ROI fodder.

“We offer you Ocular Tokens at the moment, lambo rapidly!” and that form of rubbish. If you’ve been spherical anyone involved in speculative cryptocurrency prolonged ample, you already know what I’m talking about.

After ample people have invested on the Elite Pack tier, I take into consideration there’ll be a push to get Ocular Token listed on some dodgy exchanges.

Trouble is being tied to AtmosO2 funding, Ocular Token is usually a securities offering.

That’s so by means of AtmosO2 associates being led to think about the Ocular Tokens they’re given (in commerce for €5000 EUR), will go up in price.

Public itemizing of Ocular Token might even has the potential to supply AtmosO2 with ROI revenue, counting on how that pans out.

Given how Ocular Tech appears to have flopped and the current state of cryptocurrency normally though, I wouldn’t be holding my breath.

In summary, there may very well be some parts of AtmosO2 that, when isolated, carry out legitimately.

When considered a complete nonetheless, there’s no getting throughout the illegal unregistered securities offering and pyramid commissions.

As an AtmosO2 affiliate investor you’re each going to

- have your money tied up if the SEC strikes in and shuts it down;

- lose your money when AtmosO2 affiliate recruitment collapses; or

- lose your money if OlePay pulls the plug on AtmosO2’s taking part in playing cards.

If an MLM agency isn’t ready to operate legally, don’t give them your money.

Exchange twentieth December 2018 – Inside 24 hours of this analysis going dwell, AtmosO2 launched it is shutting down.