The transcript in question is that of Mark Scott’s bond look on September thirteenth, 2018.

Although the listening to was a months prior to now, the transcript has solely these days been made public.

Representing US regulators on the listening to had been a DOJ authorized skilled for the Southern District of New York, two federal prosecutors and an FBI agent.

When requested for particulars regarding the case early into the listening to, certainly one of many federal prosecutors described OneCoin as “a fraudulent cryptocurrency”.

This fraud scheme was worldwide in scope and launched in roughly $4 billion worldwide from victims.

To which the Select replied;

Can I merely ask a question about that.

Is that cryptocurrency fraud scheme inside the nature of a pump and dump or Ponzi, or have you ever learnt?

The reply to the courtroom’s question confirmed what has been acknowledged about OneCoin for some time.

It is (a) hybrid Ponzi pyramid scheme.

It is a fraudulent cryptocurrency that does not have, as far as the investigation has determined, an actual blockchain, and most patrons have not been able to recoup or take their money out of the scheme as quickly as they spend cash on these money.

There could also be some extent of Ponzi scheme proper right here simply because there are commissions paid to promoters and recruiters with a view to convey in extra victims.

OneCoin’s blockchain controversy began in early 2017, following a report the company was using a SQL database to hint affiliate funding.

OneCoin has denied the claims, going so far as to claim investigations in Germany licensed the company has a blockchain.

Thus far no proof or reference to any specific investigation has surfaced. However that hasn’t stopped OneCoin’s patrons from incessantly parroting OneCoin’s claims.

Whereas the above occasion from OneCoin investor Igor Krnic is significantly dated, the most recent event I can current you is barely 24 hours earlier.

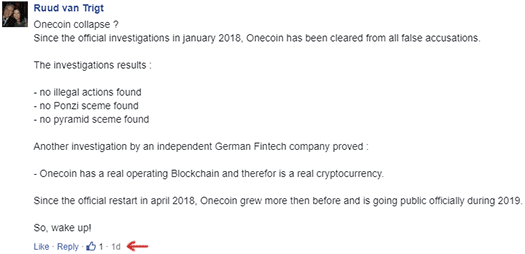

In a comment posted on an January twentieth BusinessForHome article lambasting BehindMLM’s reporting on scams like OneCoin, Ruud van Trigt claimed

One different investigation by an neutral German Fintech agency proved:

– Onecoin has an precise working Blockchain and therefor is an precise cryptocurrency.

The author of the article Ted Nuyten, CEO and proprietor of BusinessForHome, is believed to have acquired undisclosed sums of money in alternate for favorable OneCoin safety.

Nuyten has moreover personally appeared in OneCoin promotional supplies.

The investigation the US federal prosecutor is referring to is believed to be an ongoing joint worldwide effort.

Getting once more to Mark Scott, as alleged by US federal prosecutors, his

place on this scheme was he’s a licensed authorized skilled, and he joined the co-conspirators and formed hedge funds, worldwide hedge funds, with accounts inside the Cayman Islands along with Ireland.

And through these hedge funds, he laundered the proceeds of the cryptocurrency fraud scheme.

As a means to do that, he lied to banks, he lied to fund administrators, and he misrepresented the place the funds had been coming from.

As a technique to secure OneCoin banking channels, Mark Scott represented that stolen investor funds

had been coming into the hedge funds … from a select group of European households and entities that had been investing who (Scott) had acknowledged for a couple of years.

US federal prosecutors allege their investigation

revealed that the money that was coming into the hedge funds that (Scott) formed had been solely the proceeds of this fraud scheme.

In alternate for aiding Ruja Ignatova with hiding stolen OneCoin investor funds, Scott was allegedly rewarded with

$15.5 million in fees … used … to buy beachfront property, luxurious autos, luxurious watches.

When queried on the proof the DOJ wanted to once more up its claims, the federal prosecutor knowledgeable the courtroom US authorities had

voluminous discovery provides, which embrace every exhausting copies and voluminous digital proof.

These courses are broadly outlined as monetary establishment and financial data, emails, fund administration data, pen register data, phone data, WhatsApp and e mail account data, GPS data, the cryptocurrency promotional provides, and the cryptocurrency account provides.

We have precise property data, firm entity group data.

We have pictures of a phone of his and data on that phone.

We have FBARs that (Scott) filed with the IRS this earlier summer season.

We have a listing of accounts that had been seized or restrained.

We opened an undercover account inside the cryptocurrency scheme, and so now we’ve got provides from that.

That’s proof that was seized as part of Scott’s arrest warrant.

Sadly analysis of that proof has been delayed, on account of Scott representing to not lower than one co-conspirators that he was performing as their authorized skilled.

This has resulted in potential shopper authorized skilled privilege, requiring the utilization of a privilege evaluation employees.

For that goal, the investigative employees does not have your complete provides that in the mean time are inside the possession of the privilege evaluation employees.

As quickly because the priviledge evaluation employees has accomplished sifting by way of it, US regulators might have entry to Scott’s OneCoin data on ‘not lower than 17 telephones, six laptops, two iPads and three memory taking part in playing cards and 5 flash drives‘.

Needless to say this was as of October 2018. Since then there have been no public updates regarding the continued OneCoin investigation.

Ruja Ignatova’s second in command, Sebastian Greenwood, was arrested in Thailand and extradited to the US sometime all through the 2018 4th quarter.

Other than affirmation of the arrest by way of Thai authorities, US authorities have however to launch one thing public regarding Greenwood’s current standing or whereabouts.

Ruja Ignatova’s whereabouts weren’t talked about on the listening to, however this paragraph may current a clue as Ignatova’s disappearance since mid 2017.

The investigation has revealed that certainly one of many co-conspirators most definitely has fled to a jurisdiction the place there is not a extradition treaty with america.

As for Mark Scott, US authorities have revealed he has German twin citizenship.

Owing to Scott’s “necessary abroad ties”, they see him as a flight risk.

If Scott managed to flee the US whereas on bail, federal prosecutors asserted

no combination of bail conditions will assure his return and look in courtroom.

Nonetheless Scott was launched on a $2.5 million bond later that month.

BehindMLM continues to hint Scott’s case nevertheless, as of January twenty third, 2019, there are usually not any extra updates on Scott’s case docket.