ORU Market, ORU Market, ORU Pay, ORU Chat, ORU Mail, ORU Social, ORU Quantum Widget, ORU Score, Infinity Reward, ORU Rewards, ORU Nicely being, ORU iOS App, ORU Android App, ORU Debit Card, ORU Card, Gizmoh.com are psychological properties owned by Azteya Ltd and its associates. Azteya Restricted is headquartered in George Metropolis Grand Cayman.

Azteya Restricted has a web page nevertheless there’s nothing on there other than a login form. As far as I can inform, Azteya Restricted is nothing better than a shell agency.

There isn’t a such factor as a good objective for an MLM agency to be built-in in an offshore tax haven.

Nick is a seasoned serial entrepreneur, know-how and financial suppliers innovator and navy veteran.

With over 38 years of experience in myriad options of know-how, science, finance and enterprise, he has been responsible for, and has contributed to flooring breaking utilized sciences throughout the communications, financial, banking, medical, {{hardware}}, software program program, security, social media and enterprise packages enterprise.

In his ORU Market firm vio, VandenBrekel is cited as “a native of the Netherlands”.

Firm data nonetheless suggest VandenBrekel depends out of the US state of Florida.

It follows thus that ORU Market could be seemingly being operated out of Florida.

Whatever the lofty claims made in VandenBrekel’s firm bio, I think about ORU Market is his first MLM enterprise as an govt.

Be taught on for a full overview of the ORU Market MLM different.

ORU Market Merchandise

ORU Market has no retailable companies or merchandise, with associates solely ready to market ORU Market affiliate membership itself.

ORU Market affiliate membership affords entry to a Visa pay as you go card, social group, journey low price portal, low price prescription service and an selling platform.

As per the ORU Market web page, the company’s

Visa Pay as you go Card is issued by MetaBank, 5501 S. Broadband Lane Sioux Falls, SD 57108, Member FDIC, pursuant to a license from Visa U.S.A. Inc.

The ORU Market Compensation Plan

ORU Market associates be a part of $30.94 after which pay $5.95 a month.

Commissions are paid after they recruit others who do the similar.

Recruitment Commissions

ORU Market associates are paid $10 per affiliate they personally recruit.

A residual $1 recruitment payment is paid on associates recruited by personally recruited associates (stage 2).

Residual Commissions

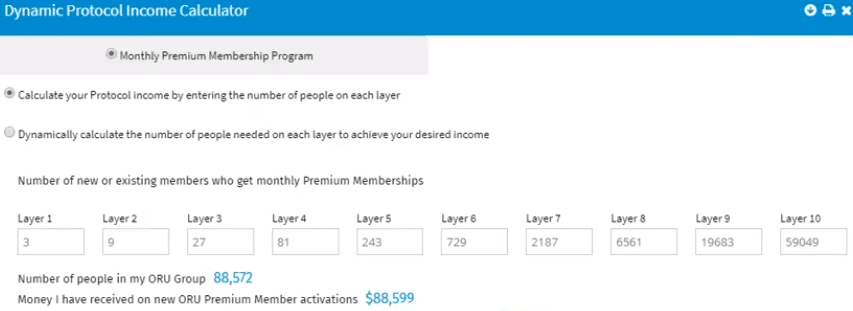

ORU Market pays residual commissions by means of a unilevel compensation development.

A unilevel compensation development places an affiliate on the excessive of a unilevel group, with every personally recruited affiliate positioned straight beneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the distinctive affiliate’s unilevel group.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite number of ranges.

ORU Market caps payable unilevel group ranges at ten.

Residual commissions are paid primarily based totally on month-to-month cost funds made by straight and never straight recruited unilevel group associates.

For each affiliate positioned into the unilevel group that continues to pay their month-to-month $5.95 affiliate cost, a 25 cent month-to-month residual payment is paid out.

Changing into a member of ORU Market

ORU Market affiliate membership is $30.94 after which $5.95 a month.

Conclusion

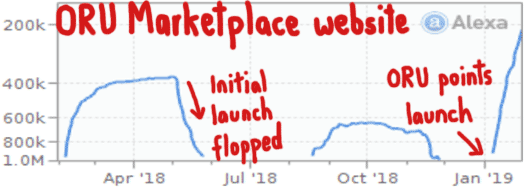

ORU Market initially launched on or spherical January 2017, if not earlier. The distinctive concept carefully pushed ORU Market’s social group.

That flopped and so now ORU appears to have rebooted itself with a not-so-publicized cope with unregistered securities.

Sooner than we get into that though, by paying out commissions on ten ranges ORU Market could also be very quite a bit an MLM agency.

However whatever the plain, ORU Market goes onerous on the “we’re not an MLM agency” denials.

Warning: Insane stage of pseudo-compliance waffle jargon ahead…

Is ORU an MLM agency?

The ORU Market is not going to be an MLM ( Multi Stage Promoting, additionally known as Direct Product sales or Group Promoting) Agency.

ORU Market is an Enterprise Software program program and Data Know-how agency that gives its software program program capabilities by subscription to its members on a non-exclusive license basis.

In a typical MLM agency the company distributes its private merchandise by way of a group of distributors who earn income from their very personal retail product sales of product and from the retail product sales made by the distributors direct and indirect recruiting of others.

A broader definition might be any promoting program throughout which the contributors pay money to the the proprietor or promoter of this technique in return for which the contributors have the most effective to:

(a) recruit additional contributors, or have additional contributors positioned by the promoter or another explicit particular person into this technique participant’s downline, tree, cooperative, income coronary heart, or completely different associated program grouping;

(b) promote gadgets or suppliers; and

(c) acquire compensation, in full or partly, based upon the product sales of those throughout the contributors downline, tree, cooperative, income coronary heart or associated program grouping. That is MLM outlined.

ORU Market does NOT:

– price a facilitation cost to its members

– receives a fee by its members for any rights to refer completely different members to the ORU Market

– pay compensation based upon product sales of members

– place members wherever proper right into a program

– receives a fee for recruitment of members

– acquire commissions primarily based totally on the participation of its members

ORU Market costs associates $34.94 to enroll after which $5.95 a month, so the above claims by the company are outright lies.

ORU Market’s compensation plan has nothing to do with retail product sales. 100% of commissions paid out are tied to affiliate recruitment and continued price of affiliate costs.

In MLM that is known as a pyramid scheme, subsequently ORU Market’s decided denials.

Decided denials don’t change the reality that ORU Market makes use of an MLM compensation plan and subsequently could also be very quite a bit an MLM agency though.

Behind ORU Market’s pyramid scheme front-end appears to be but yet another entry into the MLM cryptocurrency space of curiosity.

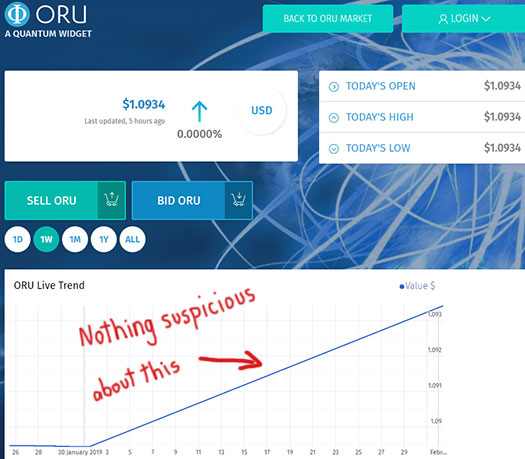

In case you occur to scroll down the ORU Market web page and click on on on “Deal with ORU Quantum”, you’re launched with the subsequent graph:

As per ORU Market’s web page, ORU Quantum is ‘the official neighborhood international cash of the ORU Market‘.

From the screenshot above, ORU Quantum seems like an inside change for ORU elements.

ORU is not going to be publicly tradeable and exists solely inside ORU Market itself. That is to say that if ORU Market collapsed or was shut down by regulators tomorrow, ORU elements would cease to exist.

On this sense ORU options additional as Ponzi elements, with ORU Market dictating the worth its associates can buy and promote elements at.

So why would regulators want to shut this down?

By offering elements associates can put cash into and later cash out at a greater price set by the company, ORU are offering associates an unregistered security.

ORU Market associates put cash into ORU elements, ORU Market will improve the inside price of the elements and associates who’ve invested can then cash out.

That’s solely passive on behalf of the affiliate, who relies on ORU Market to arbritrarily set the inside ORU price as they see match.

To have the ability to perform legally throughout the US ORU Market would wish to register their securities offering with the SEC.

As I write this neither ORU Market or Nick VandenBrekel are registered with the SEC.

Which implies no matter something, ORU Market is working illegally throughout the US.

Delving further into ORU elements, withdrawals are doable for as long as new associates are ready to take a place.

And with new funding really getting used to pay present affiliate returns, ORU Market thus options as a Ponzi scheme.

Every ORU Market’s pyramid membership cost commissions and ORU elements returns are relying on perpetual recruitment of newest ORU Market associates.

As quickly as recruitment dies, month-to-month costs stop getting paid and ORU Market associates gained’t be succesful to cash out their ORU stage balances.

As per the ORU elements chart screenshot equipped above, ORU Market appears to have launched their ORU elements scheme in just some weeks up to now.

This coincides with renewed promoting efforts, along with Alexa website guests estimates for the ORU Market web page:

Irrespective of whether or not or not the SEC goes after ORU Market, the arithmetic behind pyramid and Ponzi schemes ensures that the majority of contributors will lose money.