The NewU Financial website identifies Jeff Prolonged and George Wilson as co-founders of the company.

Jeff Prolonged first appeared on BehindMLM’s radar as a result of the founding father of AutoXTen, a recruitment scheme launched in 2011.

AutoXTen collapsed only a few months after launch, with Prolonged going to launch SMS Dailies. It too didn’t remaining prolonged.

Prolonged resurfaced in late 2015 with Get Paid Social, a Fb spam pyramid scheme.

Get Paid Social went into decline all by means of 2016, prompting Prolonged to launch 1 On-line Enterprise in mid 2017.

1 On-line Enterprise combined a cycler Ponzi enterprise model with social media spam. Alexa web site guests estimates for the 1 On-line Enterprise current a fast hype interval adopted by a collapse fundamental into 2018.

Prolonged launched and began promoting Luvv, a pyramid scheme, spherical April, 2018.

Luvv is believed to have collapsed only a few months after its launch.

George Wilson appears to be a earlier participant of Prolonged’s schemes, as evidenced by Wilson’s promotion of 1 On-line Enterprise in September 2017.

Going once more extra, Wilson moreover promoted the Infinity2Global Ponzi scheme and Empower Group gifting scheme.

Study on for a full overview of the NewU Financial MLM various.

NewU Financial Merchandise

NewU Financial has no retailable providers or merchandise, with associates solely able to market NewU Financial affiliate membership itself.

The NewU Financial Compensation Plan

NewU Financial’s compensation plan isn’t typical for an MLM agency, nonetheless nonetheless operates inside a downline/upline development.

Funds are made by downline associates, with referral commissions and a 200% ROI paid upline.

The referral price is single-level and by no means MLM. 200% ROI funds nonetheless could also be collected extra upline (over plenty of ranges).

This requires the utilization of a unilevel compensation development to hint funds, so I’m classifying NewU Financial as an MLM agency.

That talked about NewU Financial’s enterprise model isn’t typical of an MLM agency, so this a part of isn’t in our regular overview format.

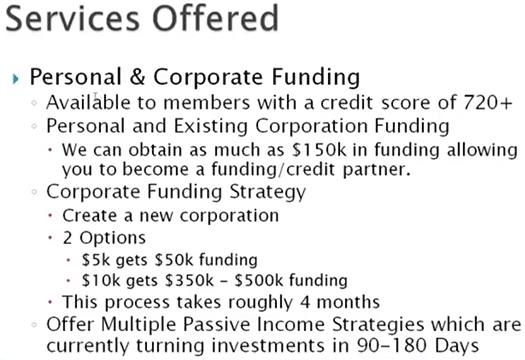

On the front-end of the plan NewU Financial is pitched to potential associates with a credit score rating score of decrease than 720.

NewU Financial ensures to revive credit score rating scores of latest associates to 720 or higher.

That’s achieved by current NewU Financial affiliate(s) gifting “roughly $2500” to “restore” the credit score rating score.

The phrases of this contract see the model new affiliate conform to pay 200% of the amount it costs to restore their credit score rating score, to the affiliate(s) who cowl the worth of fixing their credit score rating score.

So the place does anyone with a crappy credit score rating score get 200% of funds gifted to them to pay once more?

Proper right here’s the place points get murky…

Upon the restoration of credit score rating, the affiliate who’s credit score rating was mounted is required to create a model new firm and take out a mortgage of as a lot as $150,000.

Upon getting a $150,000 mortgage, which is supposedly by the use of NewU Financial’s “financial confederate”, the first amount paid once more is the 200% promised to the gifting affiliate(s).

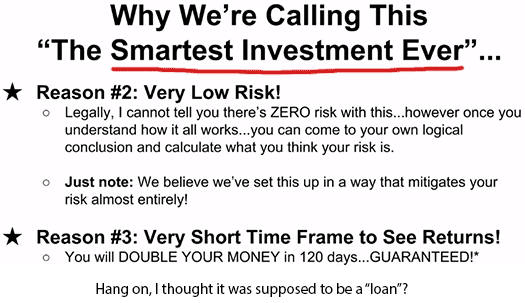

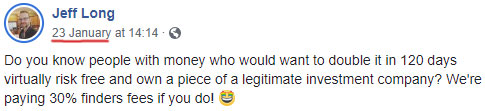

That’s the concept of NewU Financial and Jeff Prolonged selling a assured 200% ROI in 120 days.

What’s left of the mortgage is predicted to be rolled once more into NewU Financial, as gifting funds to new associates eager to restore their credit score rating score.

The loaned money is introduced to these associates on the promise of a 200% ROI.

That’s primarily the stream of money inside NewU Financial.

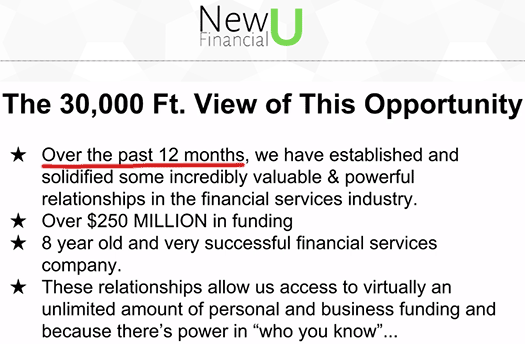

On excessive of that’s what NewU Financial calls “firm funding”.

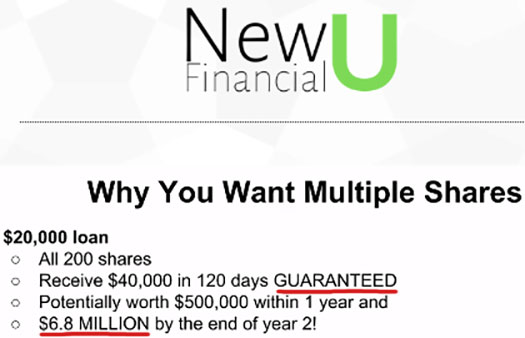

$20,000 is paid by NewU Financial to rearrange a company, by the use of which a mortgage of $350,000 to $500,000 is obtained.

Some promoting supplies I cited moreover quoted $5000 to get a $50,000 mortgage and $10,000 for a $350,000 to $500,000 mortgage.

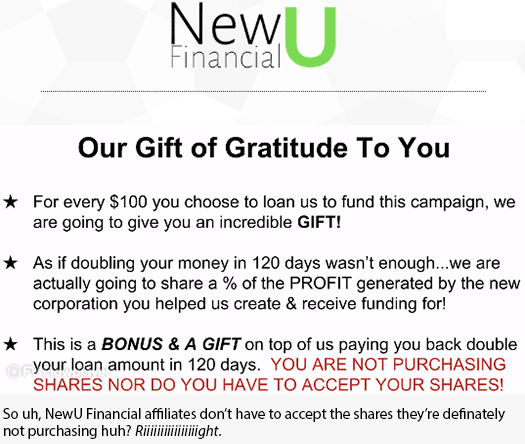

Associates can purchase into the $20,000 firms that NewU Financial items up, by the use of $100 funding positions.

Each $100 funding by NewU Financial is made on the promise of a assured 200% ROI in 120 days.

As above, NewU Financial are efficiently promoting $100 positions throughout the firms they prepare as shares.

For each $100 a personally recruited NewU Financial affiliate invests, the affiliate who recruited them receives a $30 referral price.

The 200% ROI is paid out of the $350,000 to $500,000 firm mortgage obtained by the use of the newly prepare agency.

$150,000 is paid to NewU Financial’s “financial companions” as an additional “consulting worth”.

With what’s left NewU Financial pays a 0.2% dividend per share on annual income generated by the company.

NewU Financial declare each firm they prepare will “produce a minimal of $1 million yearly”, by reinvesting the corporate mortgage (sans 200% ROI payouts) once more into their credit score rating restore scheme.

Principally versus an affiliate getting a mortgage and individually gifting funds, NewU Financial are doing it on an even bigger communal scale by the use of firms they prepare.

NewU Financial moreover declare that among the many firm mortgage money will generate earnings by the use of completely different means, nonetheless fail to produce specifics:

Sooner than we go any extra, let me reiterate the place we’re at with NewU Financial’s firm funding scheme.

NewU Financial associates put cash into $100 shares offered out of a $20,000 sum.

As quickly as $20,000 is reached, NewU Financial take the money and through undisclosed “financial companions”, prepare a shell firm.

As quickly as prepare, the shell firm applies for an organization mortgage of as a lot as $500,000.

Associates who invested in $100 shares are paid a 200% ROI on funds invested, from the acquired firm mortgage.

$150,000 is paid to people unknown, with the general loaned amount supposedly paid once more by the use of the credit score rating restoration scheme, “precise property duties”, “completely different firms” and “completely different passive funding autos”.

Together with paying the corporate mortgage off, NewU Financial reckons they’ll have the power to make over $1 million per prepare firm yearly.

Whatever the agency makes, is promised to associates skilled rata based on the amount of $100 shares invested in:

If none of that set off your alarm bells, brace your self on account of we’re however to go over NewU Financial’s “firm stacking system”.

Certain, it’s as harmful as a result of it sounds.

To utilize NewU Financial’s private occasion, $20,000 of the corporate mortgage funds obtained by “Firm A”, will seemingly be used to rearrange “Firm B”.

Firm B will even make upwards of $1 million a yr by the use of one factor one factor.

Digital $100+ shareholders in Firm will acquire the similar skilled rata share of earnings they get from Firm B as they do from Firm A.

The occasion equipped in NewU Financial’s promoting supplies extends three firms deep.

The complete number of situations NewU Financial plans on doing this with one firm nonetheless is unclear (one occasion states seven situations inside a two-year interval).

Changing into a member of NewU Financial

NewU Financial affiliate membership is free. Free associates nonetheless can solely earn 30% referral commissions on $100 investments made by recruited associates.

Full participation in NewU Financial’s MLM various requires a minimal $100 funding.

Conclusion

Even when the MLM nature of NewU Financial’s enterprise model is debatable, the underlying enterprise model raises some important regulatory purple flags.

First let’s go over the credit score rating restoration aspect of the enterprise.

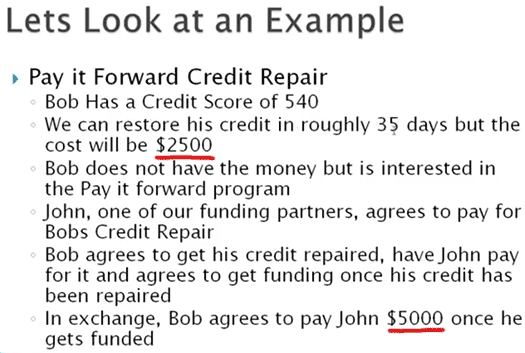

Let’s create Bob, a hypothetical particular person with a credit score rating score of decrease than 720.

Bob indicators up and accepts credit score rating restoration from an current NewU Financial affiliate (or perhaps even the company itself), on the promise of paying once more 200% of irrespective of it costs to revive Bob’s credit score rating score.

Funds are gifted on Bob’s behalf and over 120 days Bob’s credit score rating score is repaired to 720 or further.

Bob is happy alongside together with his repaired credit score rating score and does a runner. No establishing of a shell firm, no mortgage and so no 200% ROI.

What now?

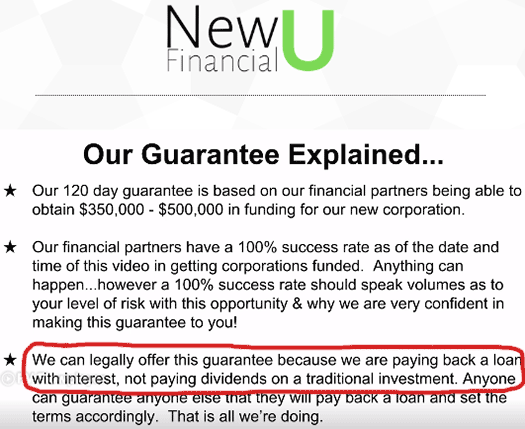

On the regulatory aspect of points, NewU Financial is signing up associates on the promise of a assured 200% ROI. That’s a security and with a function to be licensed throughout the US, requires NewU Financial to be registered with the SEC.

As I write this nonetheless, neither NewU Financial, Jeff Prolonged or George Wilson are registered to produce securities throughout the US.

And so they seem like aware about this, on account of NewU Financial’s laughable strive at evading securities regulation has them claiming investments are “loans”:

NewU Financial’s enterprise model being a securities offering is important on account of it means the company is legally required to produce disclosures to positive consumers.

Off the best of my head the two obvious ones are who NewU Financial’s companions are, exactly what they’re doing with invested funds and their observe file.

By all means this can be saved a secret if a company was working for itself, nonetheless when you’re soliciting funding from most people this knowledge should be made on the market every to the SEC and most of the people.

Secondary concerns related to NewU Financial’s 200% ROI credit score rating restoration service embrace:

- potential fraud in using a newly prepare shell firm to build up a mortgage by the use of (notably the mentioned objective of the mortgage);

- failure to repay an acquired mortgage;

- a NewU Financial affiliate shopping for a mortgage after which doing a runner with the money; and/or

- not enough people be part of the credit score rating restoration service.

A number of of those concern the affiliate getting their credit score rating restored, the affiliate investing $x on the promise of a assured 200% ROI or NewU Financial as a company itself.

Regardless and considering the portions of money involved, there’s some pretty big risks being taken proper right here (principally by the unnamed lender, who themselves are sure to financial authorized pointers regarding lending).

Shifting onto the “firm stacking”, think about it or not mortgage stacking as a result of it’s acknowledged simply is not illegal in and of itself.

Misstating the purpose of a mortgage and/or buying one by the use of deception can lead to every kind of financial points, most of which can be far increased than merely having a really spotty credit score.

With respect to creating a company, buying an organization mortgage, using a couple of of that money to create one different firm, shopping for one different firm mortgage, using a couple of of that money to create a model new firm and so forth. and so forth., what happens if these corporations fail to pay once more their acquired loans?

I’m pretty sure if I approached a lender about shopping for $350,000 to $500,000 so I can prepare new firms to mortgage way more money, with the promise I’ll pay the whole thing once more by the use of a credit score rating restoration unregistered securities offering, I’d be laughed out of their office.

However proper right here we’ve got now Jeff Prolonged and George Wilson supposedly doing merely that.

Securities regulation violations exist in NewU Financial’s firm stacking model, by way of $100 digital shares being offered on the promise of a 200% ROI and ongoing dividend value.

Similar to the “investments are loans” pseudo-compliance, NewU Financial refers to annual dividends as “a gift”.

Organising shell corporations stacked on excessive of each other and paying returns and dividends on invested funds isn’t merely one factor it’s possible you’ll prepare and, when the SEC come knocking, make clear it away by claiming invested funds in shares are “loans” and paid out dividends are “gadgets”.

I suggest you might probably, nonetheless do you really suppose the SEC are going to buy it?

And look, proper right here’s what I really don’t understand.

As above, NewU Financial is selling a passive second yr $6.8 million return off an preliminary $20,000 funding.

And apparently Prolonged and Wilson have been at this now for over 12 months:

If the $6.8 million return was attainable in two years by the use of fully licensed means, why haven’t Jeff Prolonged and George Wilson obtained $20,000 and prepare a bunch of shell firms by themselves?

Promote the credit score rating restoration enterprise as a stand-alone (which could allow you to keep up the methodology secret), and in flip keep 100% of the generated income.

Why share infinity money derived from an limitless chain of firms with randoms over the online?

Nearly both sides of NewU Financial’s enterprise model is a house of taking part in playing cards, resting on a relentless stream of people eager to restore their credit score rating, create a company, purchase a mortgage after which themselves participate in securities fraud to pay it once more.

If that’s as flimsy as a result of it sounds, it’s on account of it is.

Over to you Jeff.