Earlier than we get into that although, some historical past.

AiYellow launched in 2005. Though they’ve added bits and items to it over time, the core enterprise mannequin has remained comparatively unchanged.

AiYellow is centered round a ineffective enterprise director (as a result of y’know, the web itself isn’t sufficiently big itself).

The cash aspect of issues sees AiYellow associates enroll and pay charges for service provider licenses.

These codes might be offered to retailers (or extra probably given away as a result of no person is paying for them).

Commissions are tied to affiliate recruitment, by means of preliminary signup charges and compelled month-to-month spends.

Lengthy story quick, what have is an organization stuffed with associates shopping for service provider codes every month. That’s the primary income spinner and what drives the compensation plan.

For probably the most half AiYellow had been limping alongside, till the corporate introduced its YellowTradingCoin ICO final 12 months.

YellowTradingCoin is an ERC-20 shit token. It serves no objective apart from AiYellow’s house owners to suck much more cash out of their affiliate base.

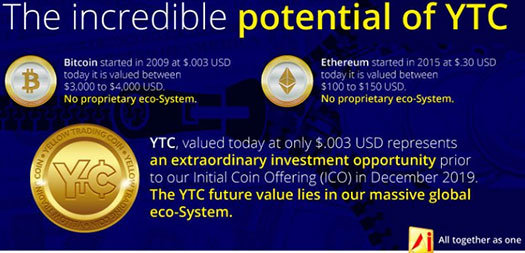

Funding in YTC is solicited on the same old comparisons to bitcoin and bullshit guarantees of lambo riches:

AiYellow themselves actually concede YTC is only a crypto money seize;

The YTC Token is using on the huge wave of Momentum created by the Blockchain revolution.

In actuality AiYellow was a ineffective listing and no person used. Including a crypto shit token isn’t going to vary something.

But regardless of that, AiYellow maintains it’s an present use case and is bound to drive up YTC’s worth… when it publicly launches in March 2020.

Sure, you learn that proper. AiYellow is ICO’ing its YTC shit token for one complete 12 months.

YTC was flogged to what’s left of the AiYellow affiliate-base for two cents a token. By March 2020 the corporate plans to go public at 15 cents a token.

No specific purpose, it’s simply an arbitrary worth AiYellow has plucked out of skinny air.

Till then associates can spend money on YTC, nonetheless I consider they’re not allowed to promote for 75 days.

The cited purpose for that is to “deter hypothesis as the worth will increase” (AiYellow arbitrarily units the inner worth of YTC as they see match).

By now try to be intimately accustomed to the MLM crypto rip-off mannequin. However for many who aren’t;

After extracting as a lot as it may out of its associates, on or round March 2020 AiYellow will get listed on some dodgy public alternate.

Initially there’ll be a pump, throughout which AiYellow administration will dump as a lot YTC as they’ll (AiYellow administration generate YTC at little to no price).

AiYellow associates will likely be instructed YTC is “going to the moon” and inspired to take a position extra.

When that’s over the worth dumps, leaving YTC bagholders to look at their cash dump to $0.

The very fact of the matter is a enterprise listing no person makes use of isn’t going to prop YTC up. Even with out the crypto nonsense AiYellow’s enterprise listing is an outdated idea (even so in 2012, after we first reviewed the corporate).

Need proof?

When was the final time you used something apart from a search engine to search out data on an organization or product? Hell, when was the final time you went to a web site to make use of their enterprise listing?

Again in 2012 AiYellow was headed up by co-founders Martin Naka and Rick Cabo.

Not likely certain how one can CEO of an ERC-20 token however alrighty then.

As per the “company staff” part of AiYellow’s web site, Martin Naka and Rick Cabo are nonetheless working the present.

Naka is cited as residing in Thailand and Cabo within the US (Los Angeles).

I don’t know if Varon is definitely based mostly out of the rip-off pleasant jurisdiction Saint Marteen, nevertheless it needs to be apparent AiYellow has no bodily presence there.

On the time of publication Alexa pegs Colombia (29%), Greece (18%), Thailand (10%), Venezuela (8%) and Brazil (8%) as the highest sources of site visitors to the AiYellow web site.

Regardless of fairly clearly advertising and marketing a passive funding alternative, AiYellow supplies no indication it has registered its securities providing in any jurisdiction.

That signifies that along with pyramid fraud, AiYellow, its company stafff and affiliate promoters are additionally committing securities fraud.

Merely put; If regulators don’t step in between now and March 2020, the overwhelming majority of AiYellow YTC buyers will lose cash in one more MLM altcoin exit-scam.