On June third a $778,455 closing judgment was entered towards Religion Sloan.

Sloan’s judgment was a part of the SEC’s case towards TelexFree scammers, who collectively stole over $3 billion from their victims.

As a part of the judgment, Sloan is “completely restrained and enjoined” from committing securities fraud.

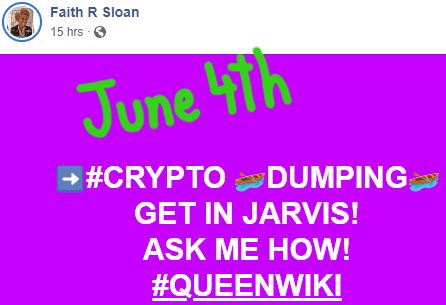

Bother is that whereas her legal professional was participating the SEC, Sloan was and continues to brazenly commit securities fraud.

- $650,334 in disgorgement (returning the cash she stole from TelexFree victims);

- $120,621 in prejudgment curiosity; and

- a $7500 civil tremendous

A part of what Sloan owes will probably be instantly settled by her legal professional surrendering $30,000 held in escrow.

A Financial institution of America account in Sloan’s identify holding $1058 may even be emptied out.

Sloan has fourteen days from June third to fulfill the remaining $747,397 judgment.

In mild of Sloan’s closing judgment the scheduled trial, which might have given Sloan the chance to clear her identify and show she isn’t a Ponzi scammer, has been cancelled.

With respect to what Sloan can and may’t do, the order stipulates Sloan is “completely restrained and enjoined” from “violating Part 5 of the Securities Act”.

That’s to say Sloan is prohibited from providing or promoting unregistered securities in any capability.

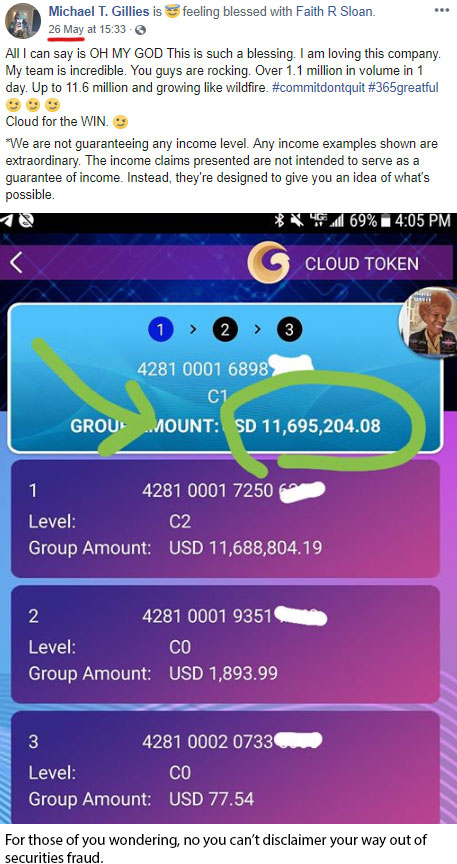

Amongst different suspect schemes, earlier than, throughout and now after her closing judgment, Sloan has been selling Cloud Token.

As per Cloud Token’s enterprise mannequin, associates make investments with the corporate and obtain CTO. Funding is made on the the expectation of a passive return.

This return is achieved by Cloud Token arbitrarily rising the interior worth of CTO tokens, permitting associates, like Sloan, to money out.

Cloud Token isn’t registered to supply securities in any jurisdiction it operates in. As a promoter of Clout Token, Religion Sloan isn’t registered to supply securities with the SEC both.

Cloud Token represents it generates exterior income by means of buying and selling, supposedly by means of their “Jarvis AI” bot.

To this point nevertheless Cloud Token has not registered itself with a monetary regulator in any jurisdiction it solicits funding in.

Nor have Cloud Token affiliate buyers been supplied with proof of exterior income truly getting used to pay associates (filed audited accounting).

Upon receiving withdrawal requests from affiliate buyers, Cloud Token merely pays them with subsequently invested funds.

Thus along with providing unregistered securities, Cloud Token additionally operates as a Ponzi scheme (wire fraud).

By selling Cloud Token Sloan is in violation of her TelexFree closing judgment order.

Whether or not the SEC takes any additional motion towards Sloan and/or Cloud Token stays to be seen.

Actually the extra urgent of the 2 potential defendants would look like Sloan.

Getting into into closing judgement with securities fraud perpetrators, who proceed to brazenly commit securities fraud earlier than, throughout and after judgment proceedings, isn’t a very good search for a regulator.