Moonberg offers no info on their web site about who owns or runs the enterprise.

Moonberg’s web site area (“moonberg.io”) was registered on January eleventh, 2019.

Bitdepositary Ltd. is listed because the proprietor, by means of an incomplete handle in Malta.

By itself web site Bitdepositary markets itself as a “decentralized crypto finance market”.

The corporate operates its providers by means of its personal BDT and BDT20 tokens.

Though its solely cited as a accomplice on Bitdepositary’s web site, Moonberg seems to be a derivative undertaking.

As at all times, if an MLM firm isn’t brazenly upfront about who’s operating or owns it, assume lengthy and arduous about becoming a member of and/or handing over any cash.

Moonberg’s Merchandise

Moonberg has no retailable services or products, with associates solely capable of market Moonberg affiliate membership itself.

Moonberg’s Compensation Plan

Moonberg associates make investments $25 or extra in MoonCoins.

As soon as obtained, MoonCoins are parked with Moonberg on the promise of marketed returns.

How a lot of a return is paid out is set by how lengthy a Moonberg affiliate opts to park their MoonCoins with the corporate.

- make investments for 30 days and obtain 40% of generated returns

- make investments for 120 days and obtain 50% of generated returns

- make investments for 180 days and obtain 60% of generated returns

- make investments for 240 days and obtain 70% of generated returns

- make investments for 360 days and obtain 80% of generated returns

Returns are paid in MoonCoins, which Moonberg associates can money out by means of an inner alternate.

Referral Commissions

Moonberg cost associates a 5% charge to park MoonCoins with the corporate.

Moonberg use this 5% to fund referral commissions, paid out by way of a unilevel compensation construction.

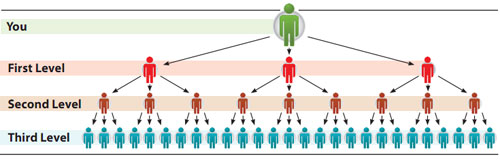

A unilevel compensation construction locations an affiliate on the prime of a unilevel workforce, with each personally recruited affiliate positioned immediately below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Moonberg cap payable unilevel workforce ranges at eight.

Referral commissions are paid out as a share of 5% charges collected throughout these eight ranges as follows:

- stage 1 (personally recruited associates) – 50%

- stage 2 – 20%

- stage 3 – 15%

- stage 4 – 5%

- stage 5 – 4%

- stage 6 – 3%

- stage 7 – 2%

- stage 8 – 1%

Becoming a member of Moonberg

Moonberg affiliate membership is free.

Participation within the hooked up funding alternative nevertheless requires a minimal $25 funding in MoonCoins.

A further 5% charge is charged on lively investments.

Conclusion

Moonberg is principally a reboot of the BitConnect lending Ponzi mannequin.

Moonberg associates enroll, purchase nugatory MoonCoins from the corporate after which “lend” these MoonCoins again in alternate for a return.

The return is paid again in MoonCoins, which Moonberg generates on demand.

The circulate of cash behind the scenes is actual cash paid to Moonberg for MoonCoins, which they pay out to associates who money out by means of the interior alternate.

Those that make investments longer obtain extra MoonCoins to money out with, and thus a return is realized when a Moonberg affiliate withdraws greater than they invested.

The usage of newly invested funds to pay returns makes Moonberg a Ponzi scheme.

Reasonably than acknowledge the recycling of invested funds, Moonberg claims to commerce by way of a “Moon Bot”.

That is in fact the identical ruse BitConnect and each different crypto lending Ponzi makes use of.

No proof of buying and selling is ever supplied, and Moonberg is not any exception.

I mustn’t right here that even when the same old social media advertising buying and selling movies floor, that’s nonetheless not proof of exterior income being truly used to pay associates.

As with all Ponzi schemes, as soon as affiliate recruitment dies down so too will new funding.

This may starve Moonberg of ROI income, finally leaving them unable to honor inner alternate withdrawal requests.

This precise situation noticed BitConnect affiliate traders lose over $2 billion when the corporate collapsed in early 2018.

Moonberg is unlikely to develop as huge, however nonetheless investor losses can be simply as actual when it too inevitably collapses.

Replace thirteenth March 2021 – Moonberg proprietor Tobias Graf reached out by way of e-mail on March fifth.

In his e-mail Graf put forth that Moonberg

was not operating very nicely on the finish based mostly on an not deliberate level however there was by no means fraud and by no means any Ponzi.

Graf claims “99.9% from all folks bought their cash + revenue again”.

Once I requested him for legally required audited monetary stories to substantiate this knowledge, Graf couldn’t present any.

This can be By no means out there as a result of it was simply an crypto undertaking Firm based mostly offshore so to do one thing like this could require large steps.

Passive funding schemes should not exempt from securities legislation in any jurisdiction.

Owing to Graf being unable to supply proof Moonberg defied the legal guidelines of arithmetic and paid out greater than was invested, I left it there.