Crowd1 supplies no info on their web site about who owns or runs the enterprise.

Crowd1’s web site area (“crowd1.com”) was first registered again in 2007. The area registration was final up to date in October 2018.

Stelios Piskopianos of Crowd1 Community Europe Ltd is listed because the proprietor, by way of an handle in Cyprus.

Cyprus is a scam-friendly jurisdiction with little to no MLM regulation.

In response to his LinkedIn profile, Stelios Piskopianos has a monetary providers background.

A commercially conscious, hands-on Senior Finance Skilled with appreciable expertise of economic and enterprise management throughout a broad spectrum together with robust IT expertise and in depth information of computerised info techniques.

Curiously, Crowd1 doesn’t seem on Piskopianos’ LinkedIn profile.

Whether or not Piskopianos is working alone or with others to run Crowd1 is unclear.

Replace twenty third March 2020 – Stelios Piskopianos seems to be a fall man. Crowd1’s Spanish shell firm data reveal Jonas Erik Werner is working the corporate from Sweden. /finish replace

Learn on for a full assessment of the Crowd1 MLM alternative.

Crowd1’s Merchandise

Crowd1 has no retailable services or products, with associates solely capable of market Crowd1 affiliate membership itself.

Crowd1’s Compensation Plan

Crowd1 associates make investments funds on the promise of marketed returns.

Crowd1 tracks and pays out returns by way of “proprietor rights” shares.

- White – make investments €99 EUR and obtain €100 EUR price of proprietor rights shares

- Black – make investments €299 EUR and obtain €300 EUR price of proprietor rights shares

- Gold – make investments €799 EUR and obtain €1000 EUR price of proprietor rights shares

- Titanium – make investments €2499 EUR and obtain €3500 EUR price of proprietor rights shares

Residual Commissions

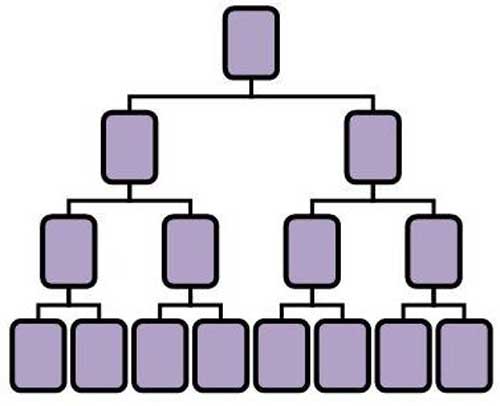

Crowd1 pays residual commissions through a binary compensation construction.

A binary compensation construction locations an affiliate on the high of a binary crew, break up into two sides (left and proper):

The primary degree of the binary crew homes two positions. The second degree of the binary crew is generated by splitting these first two positions into one other two positions every (4 positions).

Subsequent ranges of the binary crew are generated as required, with every new degree housing twice as many positions because the earlier degree.

Positions within the binary crew are crammed through direct and oblique recruitment of associates. Observe there isn’t a restrict to how deep a binary crew can develop.

Residual commissions are paid based mostly on funding quantity generated on either side of the binary crew.

Funding quantity is tracked through factors, which correspond with Crowd1’s funding tiers as follows:

- White – 90 factors

- Black – 270 factors

- Gold – 720 factors

- Titanium – 2250 factors

Crowd1 calculates residual fee utilizing what they name a “1/3 stability” ratio.

A 1/3 stability ratio sees residual commissions paid out on funding quantity generated on the weaker facet of the binary crew.

This quantity is matched in triple towards the stronger binary crew facet (assuming matching quantity is on the market).

As soon as payable quantity is tallied up, associates obtain 10% of the entire quantity quantity.

E.g. a recruited affiliate indicators up on the White tier and is positioned in your weaker binary crew facet.

This generates 90 factors on the weaker binary crew facet, which is matched with 270 factors from the stronger binary crew facet.

This calculates to 360 factors in whole.

A ten% residual is calculates on this level whole, coming to €36 EUR.

Observe that if 270 factors doesn’t exist on the stronger binary crew facet, the system will attempt to match both double or an equal quantity of factors from the stronger binary crew facet.

If there isn’t sufficient to match the weaker binary crew facet, solely 10% on the weaker binary crew facet factors is paid out.

Matching Bonus

Crowd1 pays a Matching Bonus on residual commissions earned by downline associates.

The Matching Bonus is paid out through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel crew, with each personally recruited affiliate positioned straight below them (degree 1):

If any degree 1 associates recruit new associates, they’re positioned on degree 2 of the unique affiliate’s unilevel crew.

If any degree 2 associates recruit new associates, they’re positioned on degree 3 and so forth and so forth down a theoretical infinite variety of ranges.

Crowd1 caps payable Matching Bonus unilevel crew ranges at 5.

What number of ranges a Crowd1 affiliate earns the Matching Bonus on is set by an affiliate’s private recruitment efforts:

- make investments on the White tier and recruit 4 buyers = a ten% match on degree 1 (personally recruited associates)

- make investments on the Black tier and recruit eight buyers = a ten% match on ranges 1 and a couple of

- recruit twelve buyers = a ten% match on ranges 1 to three

- make investments on the Gold tier and recruit sixteen buyers = a ten% match on ranges 1 to 4

- make investments on the Titanium tier and recruit twenty buyers = a ten% match on ranges 1 to five

Streamline Bonus

The Streamline Bonus seems to be a technique to enhance proprietor rights share returns.

Crowd1 tracks the Streamline Bonus through company-wide recruitment. You join and everybody who joins after you falls in your Streamline Bonus.

There are “streamline ranges” that correspond with how a lot a Crowd1 affiliate has invested:

- White tier associates obtain three Streamline ranges

- Black tier associates obtain eight Streamline ranges

- Gold tier associates obtain twelve Streamline ranges

- Titanium tier associates obtain fifteen Streamline ranges

Aside from stating “all Streamline Bonus is payed out in unique restricted Proprietor rights”, Crowd1 fails to elucidate how precisely the Streamline Bonus is paid out.

Worry of Loss Bonus

The Worry of Loss Bonus is a recruitment bonus, lively throughout a newly recruited Crowd1 affiliate’s first fourteen days with the corporate.

Throughout the Worry of Loss Bonus interval, a Crowd1 affiliate earns

- €125 EUR per 4 White funding tier associates recruited

- €375 EUR per 4 Black funding tier associates recruited

- €1000 EUR per 4 Gold funding tier associates recruited

- €3000 EUR per 4 Titanium funding tier associates recruited

Playing Residual

By convincing others to speculate, Crowd1 associates can enhance their share of company-wide playing income.

The Playing residual begins at 5% on the Group Chief rank (generate 500 factors in weaker binary crew quantity), and will increase to 10% for the Director (generate 500,000 factors in weaker binary crew quantity) and better ranks.

Becoming a member of Crowd1

Crowd1 affiliate membership is tied to a €99 to €2499 EUR funding.

- White – €99 EUR

- Black – €299 EUR

- Gold – €799 EUR

- Titanium – €2499 EUR

Conclusion

Crowd1 presents an open-ended funding MLM alternative (no formal ROI construction), with pyramid recruitment to drive new funding.

Supposedly, Crowd1 generates income by way of on-line playing.

At present probably the most worthwhile trade is the gaming trade.

Crowd1 shall introduce our buyer base to this trade in a

means that may create substantial recurring income for Crowd1

members with out being a gaming firm and with out

arranging any funds to a gaming firm.

Though it claims to generate exterior income by way of playing actions, Crowd1 maintains it ‘should not be mistaken for a gaming or playing firm.‘

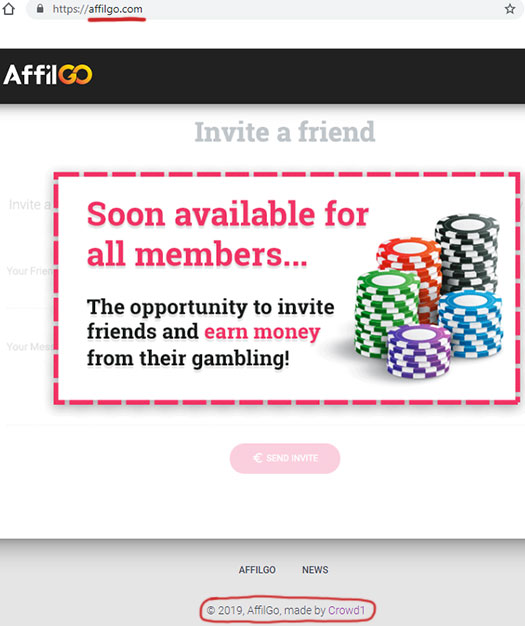

The playing income is purportedly generated by way of third-party suppliers, which Crowd1 solicits by way of their Affilgo platform.

The Crowd1 buyer base is then launched to exterior companions by way of Affilgo, within the type of licensed gaming firms, the place agreements are made for revenue sharing.

As above, Crowd1 == Affilgo.

Naturally no details about any of the supposed gaming companions Crowd1 has is offered.

But regardless of that, the corporate concurrently touts accrued returns of 450%.

If we pull Crowd1’s enterprise mannequin aside, it rapidly turns into obvious its a regulatory minefield on a number of fronts.

Gaming is strictly regulated the world over. Therefore Crowd1 being shady about who their suppliers are, and clarification that they themselves don’t supply playing providers.

This can be a regulatory concern in and of itself. With respect to the Crowd1’s MLM alternative, the extra urgent concern is the passive funding alternative supplied by way of “proprietor rights” shares.

The sooner you be a part of throughout prelaunch, the extra useful the Proprietor Rights program will likely be for you, because the Proprietor Rights will steadily enhance in worth.

All pioneers and members will be capable to get an excellent return on their Proprietor Rights for the reason that consumer base will enhance massively.

Crowd1’s proprietor rights funding alternative is a securities providing, which requires registration with monetary regulators.

Crowd1 supplies no proof it has registered with any monetary regulator – specifically in South Africa, the Netherlands and Colombia, which Alexa presently pegs as high sources of visitors to Crowd1’s web site.

Having not registered with monetary regulators, Crowd1 is thus working illegally in each nation it solicits funding in.

The one purpose an MLM firm would choose to function illegally, is that if it isn’t doing what it says it’s.

Within the case of Crowd1, that will be utilizing exterior gaming income to pay out proprietor rights shares returns.

Because it stands the one verifiable income coming into Crowd1 is new funding.

Supporting the truth that Crowd1 has in reality no exterior income, is the 450% return declare weighed towards the truth that Affilgo hasn’t even opened but.

Utilizing new funding to pay proprietor rights share returns to present associates would make Crowd1 a Ponzi scheme.

On high of that you’ve got recruitment commissions, including a pyramid layer to the scheme (once more unlawful the world over).

As with all MLM Ponzi schemes, as soon as affiliate recruitment slows down so too will new funding.

This may starve Crowd1 of return income, ultimately prompting a collapse.

The maths behind Ponzi schemes ensures that once they collapse, the vast majority of individuals lose cash.