GetFit Mining’s web site area (“getfitmining.com”), was registered in March 2022. The non-public registration was final up to date on March twenty sixth, 2023.

A YouTube video embedded on GetFit Mining’s web site results in a YouTube channel titled “GetFit Exercise Mining”. There we discover GetFit Mining advertising and marketing movies hosted by “Lynette”.

On April sixteenth, Danny Dehek held a livestream protecting GetFit Mining on his “The Crypto Ponzi Scheme Avenger” YouTube channel.

At round [1:29:11] DeHek reveals he was contacted by Crawford in her capability as GetFit Mining’s proprietor. This tracks with Crawford that includes in GetFit Mining’s advertising and marketing movies.

DeHek calls Artin as a part of his livestream. She doesn’t reply however did name him again at [2:03:22].

Crawford, a US resident who additionally goes by “Lynette Artin”, is understood to BehindMLM as a net-winner within the Zeek Rewards Ponzi scheme.

How a lot Crawford stole by way of Zeek Rewards is unclear, however it was sufficient to see her focused by way of clawback litigation.

After Zeek Rewards was shut down by US authorities in 2012, Crawford’s identify popped up in affiliation with quite a few reload scams; GoFunRewards, OfferHubb, Uptown Affords, Fast Pay Group and CrowdFundFast.

As at all times, if an MLM firm shouldn’t be overtly upfront about who’s operating or owns it, suppose lengthy and exhausting about becoming a member of and/or handing over any cash.

GetFit Mining’s Merchandise

GetFit Mining has no retailable services or products.

Associates are solely capable of market GetFit Mining affiliate membership itself.

GetFit Mining’s Compensation Plan

GetFit Mining’s compensation plan combines a passive returns staking funding scheme with referral commissions.

Passive Returns (staking)

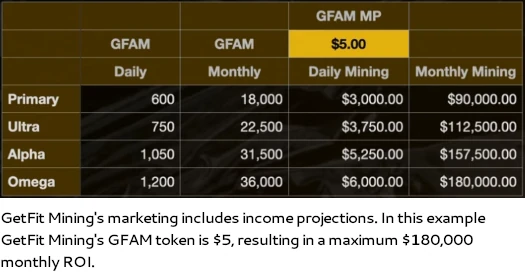

GetFit Mining associates make investments GFAM tokens on the promise of a passive ROI of as much as 25% per funding.

GetFit Mining associates can both buy GFAM tokens by way of the corporate, or generate them by way of a convoluted process course of.

Acquiring GFAM tokens by way of GetFit Mining requires buy by way of an inside change. GetFit Mining units the GFAM token worth they promote at.

GetFit Mining’s convoluted process course of sees associates generate GFAM by way of bodily exercise.

This begins with a GetFit Mining affiliate buying their token technology charge (observe the quantity spent additionally correlates to the staking ROI):

- Major – pay $99 for a 100% token technology charge

- Extremely – pay $199 for a 125% token technology charge

- Alpha – pay $499 for 175% token technology charge

- Omega – pay $899 for 300% token technology charge

GFAM token technology charges are tracked by way of NFT positions. Be aware that associates should purchase a number of positions to extend the quantity of GFAM tokens they’ll generate every day (and enhance their passive staking ROI).

GetFit Mining caps bodily exercise at 20,000 steps or 10 miles (16,000 km) per 24 hours. Additional restrictions embody as much as 2 hours of every day recorded exercise.

There may be additionally a tier system inside GetFit Mining, which provides a multiplier to generated tokens:

- Tier 1 – 5% bonus

- Tier 2 – 10% bonus

- Tier 3 – 20% bonus

- Tier 4 – 30% bonus

Be aware these tiers aren’t outlined inside GetFit Mining’s advertising and marketing materials.

The tiers nonetheless are named “depth tiers steps”, suggesting they could correlate to depth ranges tracked throughout bodily exercise.

There are extra undisclosed token technology bonuses based mostly on energy burned and tracked sleep time (as much as 8 hours a day).

No matter whether or not bought by way of GetFit Mining or obtained by way of the convoluted process based mostly scheme, token technology charge charges have to be paid to take part in GetFit Mining’s passive returns staking scheme.

It’s because returns throughout the staking funding scheme are decided by how a lot in charges have been paid.

GetFit Mining pays staking returns out in tether (USDT). The overall ROI per GFAM token funding made is calculated based mostly on the full token technology charge a GetFit Mining has paid for.

This begins at 1.39% for a 100% token technology charge (one Major NFT place), and will increase by 1.39% per 100% token technology charge as much as 1700%. 1700% to 1800% provides 1.37% to the every day ROI charge.

Maxxed out at 1800% (six Omega NFT positions @ $5394), GetFit Mining associates are capable of make investments GFAM tokens for a 25% ROI.

The return is paid out by way of what seems to be a every day variable charge over 90 days.

As soon as invested, GFAM tokens are unlocked if both

- if the full ROI charge is hit inside 90 days (1.39% to 25%);or

- the full ROI charge shouldn’t be hit at 90 days from the date of preliminary funding

Residual Commissions

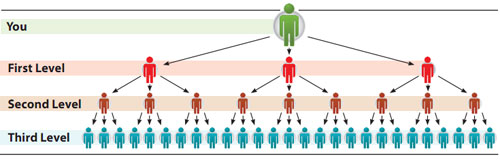

GetFit Mining associates pays referral commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel group, with each personally recruited affiliate positioned immediately underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel group.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

GetFit Mining caps payable unilevel group ranges at ten.

Referral commissions are paid as a proportion of token technology adjustment charges paid throughout these ten ranges as follows:

- stage 1 (personally recruited associates) – 25%

- stage 2 – 5%

- stage 3 – 4%

- ranges 4 and 5 – 3%

- ranges 6 and seven – 2%

- stage 8 – 3%

- ranges 9 and 10 – 5%

- stage 11 – 8%

Becoming a member of GetFit Mining

GetFit Mining affiliate membership is free.

Full participation within the hooked up earnings alternative requires cost of token technology charges:

- Major – pay $99 for a 100% token technology charge

- Extremely – pay $199 for a 125% token technology charge

- Alpha – pay $499 for 175% token technology charge

- Omega – pay $899 for 300% token technology charge

Be aware that with the intention to maximize passive returns and GetFit Mining’s compensation plan, a number of charge funds are vital.

GetFit Mining Conclusion

GetFit Mining is your traditional task-based Ponzi scheme. Right here the duty is bodily exercise however GetFit Mining might simply as simply have buyers rub their bellies or rely backwards from a thousand.

It’s because the duty assigned in task-based Ponzi schemes has nothing to do with income technology.

Don’t get me flawed, extra bodily exercise is nice however shouldn’t be construed as a blanket legitimacy for GetFit Mining as an entire.

That comes all the way down to regulatory compliance which GetFit Mining wholly fails at.

For starters GetFit Mining fails to supply customers with data that permits them to make an knowledgeable determination about becoming a member of the corporate. This consists of possession and compensation particulars on the corporate’s web site.

Then now we have the elephant within the room, GetFit Mining’s staking funding scheme.

Both by finishing a process or immediately buying them, GetFit Mining associates purchase GFAM tokens.

GFAM is a BSC-20 token. BSC-20 tokens will be created in a couple of minutes at little to no price.

As soon as acquired, GFAM tokens are then invested with GetFit Mining on the promise of a passive return.

To ascertain whether or not US securities regulation comes into play we have to set up the existence of an funding contract.

That is achieved by way of software of the Howey Check.

An funding contract exists if there’s an “funding of cash in a standard enterprise with an affordable expectation of income to be derived from the efforts of others.”

In GetFit Mining now we have associates investing GFAM tokens (whether or not they have been immediately bought or task-allocated is irrelevant).

This funding is finished into GetFit Mining by way of their staking funding scheme (a “widespread enterprise”), on the promise of a passive return decided by how a lot a GetFit Mining affiliate has paid in charges (“an affordable expectation of income’).

GetFit Mining associates purchase GFAM tokens and pay ROI charge charges however returns are generated completely passively (“from the efforts of others”).

GetFit Mining’s providing satisfies the Howey Check, which means its GFAM token “staking” funding scheme constitutes an funding contract.

Below US regulation this requires GetFit Mining and Shirley Crawford to register with the SEC.

A search of the SEC’s public Edgar database reveals neither GetFit Mining or Crawford are registered with the SEC.

This constitutes securities fraud, which the SEC asserts goes hand-in-hand with Ponzi schemes.

From a client due-diligence perspective, there isn’t any verifiable supply of exterior income coming into GetFit Mining.

The one acceptable and legally required type of verification could be audited monetary experiences filed with the SEC.

It must be famous that securities regulation globally is, for all intents and functions, just like that of the US. In a rustic the place monetary markets are regulated, registration of securities providing with monetary regulators in obligatory.

For reference, as of March 2024 SimilarWeb tracked high sources of visitors to GetFit Mining’s web site because the US (79%), Canada (8%), Mexico (8%) and Norway (5%).

Regardless of committing securities fraud and having no verifiable supply of exterior income to fund USDT ROI withdrawals, on her name with Danny Dehek Crawford asserted GetFit Mining is “not a Ponzi scheme and never a rip-off, 5 thousand %” [2:10:16].

Having been sued for clawback as a part of Zeek Reward’s securities fraud proceedings, not surprisingly GetFit Mining tries to brush off issues on its web site.

The GetFit tokens are usually not meant to represent, and shall not represent, securities in any jurisdiction.

- What GetFit tokens are meant or not meant to represent is irrelevant to what they’re; and

- the difficulty isn’t the tokens themselves being a securities providing, GetFit Mining’s “staking” funding scheme is a securities providing.

I’ll end up by noting GetFit Mining is fairly just like SmartSteps, one other health task-based Ponzi BehindMLM reviewed earlier this yr.

At time of publication SmartSteps’ web site is now not accessible. What it was reside although, SmartSteps ran the identical NFT funding place staking scheme by way of its BOLTYX BSC-20 tokens.

Taking a step again, task-based Ponzi schemes are nothing new. In Zeek Rewards, which launched in 2011, buyers needed to dump penny public sale bids to qualify for returns.

As a result of nature of compounding, the quantity of bids high buyers needed to dump every day shortly grew to become unmanageable. This resulted within the creation of 1000’s of dummy accounts to dump bids on to.

Not that it mattered, dumping bids had nothing to do with income technology. Like all task-based Ponzi schemes, the assigned process was simply busy-body work.

Once more placing apart well being advantages, with respect to income technology the identical is true of GetFit and its every day health duties.

The first verifiable income is fairly clearly GetFit Mining’s token technology NFT place charges – which is why they correlate to how a lot of a return is paid out through the staking scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding. GetFit Mining associates promoting GFAM tokens internally with out collaborating within the staking funding scheme can even dry withdrawable USDT up.

Both approach this may starve GetFit Mining of ROI income, leaving it unable to pay USDT ROI withdrawals.

Given the variable nature of the return charge, this may doubtless current itself in stated return dropping to near-zero earlier than collapsing altogether.

Math ensures that when a Ponzi scheme collapses, the vast majority of contributors lose cash.

In GetFit Mining, this may lead to associates bagholding GFAM, which outdoors of GetFit Mining’s staking funding scheme, is in any other case nugatory.