Trying into it additional nonetheless, it seems YEP are promoting digital shares legally.

The issue is the numbers don’t add up. So far as I can inform it’s a horrible deal.

YEP’s digital shares are being bought at 65 cents a chunk by means of NetCapital.

That is being performed by means of crowdfunding exemption 4(a)(6), which requires YEP to

- solicit not more than $1,070,000 over a twelve month interval;

- conduct the providing by means of an middleman (NetCapital);

- not be reporting to the SEC prior;

- be a US firm; and

- present potential traders with a marketing strategy.

So far as I can inform YEP have adhered to those guidelines, so we will rule out securities fraud. At the least primarily based on floor impressions.

As a part of the crowdfunding, YEP has to reveal ‘a dialogue of the issuer’s monetary situation and monetary statements.’

They do that by means of filed financials, which can be found to the general public.

YEP, an abbreviation of “Younger Entrepreneur Mission”, launched in mid 2019.

BehindMLM reviewed YEP as YEP Tribe in July 2021. We weren’t impressed with YEP’s journey subscriptions and $89 water bottles.

Seems customers haven’t been both. As I write this Alexa ranks YEP Tribe’s web site at 8.5 million – which for an MLM firm is lifeless.

In a FORM C filed with the SEC, we will see YEP misplaced $4.2 million in 2020.

Sadly we don’t have any quarterly information for 2021, as YEP isn’t required to file any.

In an try to show issues round, YEP has jumped on the CBD bandwagon.

This began off as an extension to their $89 Flux water bottles, however now seems to be a full-blown product providing underneath “Utopix” branding.

As per YEP’s NetCapital itemizing;

YEP, Inc. declares Utopix and CBDBrainIQ, a portfolio of plant primarily based CBD Well being and Wellness merchandise targeted on offering customers all over the world with Well being and Wellness CBD merchandise to compete and achieve market share within the U.S. and rising Asian markets.

YEP’s CBD Well being and Wellness client product classes:

-Plant primarily based CBD drinks

-Human and pet merchandise

-CBDBrainIQ, CBD nootropic merchandise for cognitive efficiency that includes clinically studied elements

That brings us to what YEP plan to do with their $1.079 million in crowdfunding funding;

YEP plans to develop UTOPIX that includes Micelle Nano expertise, CBDBrainIQ, and FLUX Drinkables into extremely coveted affiliate fashions by means of present places of work and companions.

Speed up buyer acquisition and safe extra, extremely coveted distribution clients domestically and in rising Asian markets.

We plan to strategically spend money on influencer advertising to scale the enterprise and types.

Advertising investments centered round driving efficiency primarily based gross sales, securing excessive revenue margins with a excessive degree of name publicity.

A major alternative for YEP lies in performance-focused paid media.

Platforms akin to Fb, Instagram, and Google advert networks can be workhorses for our progress.

Concurrently, we’ll use regular PR and media pitching to drive demand.

Lastly, we’ll create high-quality content material to gas the complete advertising ecosystem, and extra importantly, present actual worth to customers striving to enhance their well being and wellness.

Mainly it’s a advertising finances, though YEP’s “use of proceeds” downplays advertising to simply 20.6% of invested funds;

What’s actually curious right here is there’s completely no point out of YEP’s new Pushed buying and selling training providing.

When you’re questioning why, it’s as a result of YEP’s Pushed providing options an automatic buying and selling bot:

YEP not disclosing their buying and selling bot alternative to the SEC or potential crowdfunding traders is securities fraud (and we’ve come full-circle).

Regardless of soliciting as much as $1497 after which $147 a month in membership charges, YEP have up to now didn’t disclose something about their “automation commerce administration software program”.

That in itself is a possible violation of the FTC Act. What I’d be extra involved about nonetheless is the securities fraud angle.

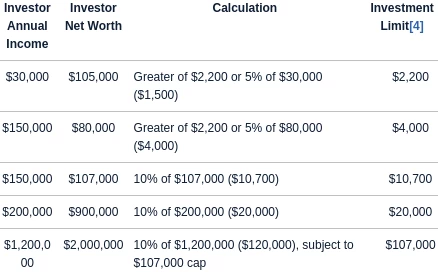

Registration exemption 4(a)(6) sees traders restricted by their annual earnings and internet value:

What I’m caught on is why?

YEP misplaced a ton of cash final 12 months, most likely misplaced a ton of cash this 12 months and… $1 million $220,000 in advertising goes to alter that?

Toss in potential securities fraud and… how is that this remotely a sexy funding alternative?

At time of publication YEP have up to now solicited $116,908 from most of the people. The providing closes on November twenty first.

Replace 4th April 2022 – YEP has ditched Pushed Buying and selling totally as per a February twenty fourth SEC submitting.

Replace thirtieth June 2022 – Nicely that didn’t go to plan, as per a Could eleventh submitting with the SEC;

Describe Progress Replace:

Finish of providing. Issuer closed its providing with estimated gross proceeds of $105,877.

$105,877 represents simply 9.8% of the $1.07 million YEP hoped to boost.

Unsure what occurs subsequent however I’ll proceed to control YEP’s SEC filings.