Following an IRS investigation, the DOJ filed prices in opposition to McLane in June 2022.

As per a June twenty first “info” submitting, McLane made simply over one million {dollars} in 2019, which he did not pay $417,481 in taxes on.

Along with revenue from Mindset 24 International, McLane did not declare revenue from Secure ID Belief and Testculin (dba Stiff Advertising).

Each defunct, Secure ID Belief was an identification safety themed MLM firm. Testculin offered male enhancement merchandise.

On prime of promoting firm revenue, McLane additionally generated revenue by means of playing.

That revenue, likewise, ought to have been reported as taxable revenue on the Defendant’s particular person revenue tax returns, however was not.

The IRS’ investigation revealed that, as an alternative of paying his taxes, McLane used the cash

to pay a wide range of private bills, together with journey, housing, his kids’s faculty tuition, autos, retail purchases, and different residing bills.

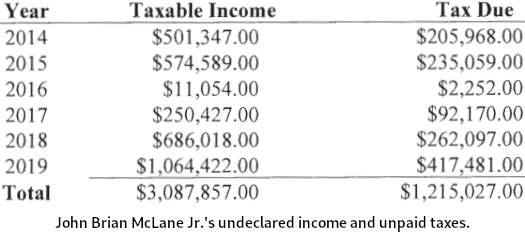

On July twenty second, McLane pled responsible to tax evasion. McLane’s plea settlement detailed extra unreported revenue, spanning 2014 to 2019:

On November thirtieth, McLane was sentenced to:

- 5 years probation;

- house detention for twelve months with digital monitoring;

- $1.2 million in restitution; and

- 100 hours group service

Along with tax fraud, McLane settled Mindset 24 International securities fraud prices with the SEC final month.

McLane can pay $135,200 in disgorgement, $17,770 in prejudgment curiosity and a $60,000 civil financial penalty ($212,970 whole).

The SEC filed go well with in opposition to Mindset 24 International and McLane in 2021. The regulator alleged McLane ran a Ponzi scheme topping one million {dollars}.