Hyperverse has added dogecoin swimming pools as a part of ongoing efforts to cut back withdrawal legal responsibility.

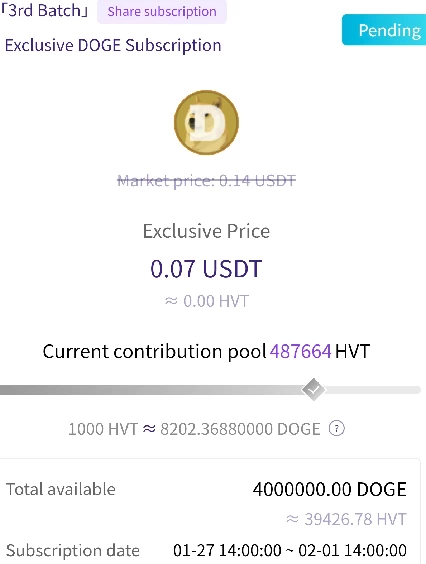

Hyperverse’s first dogecoin pool was added on January twenty seventh. The pool permits Hyperverse buyers to trade HVT for a share in 4 million DOGE.

As of yesterday the pool held 487,664 HVT. DOGE is at present buying and selling at 14.2 cents.

This ends in every HVT share paying $1.17 every.

HVT is at present publicly buying and selling at $6.88. The result’s Hyperverse slashing its HVT withdrawal legal responsibility by 82.9%.

On account of ongoing withdrawal restrictions since HyperFund’s collapse final December, Hyperverse buyers are keen to take no matter they’ll get for his or her HVT.

Hyperverse has exploited this desperation by providing comparable withdrawal legal responsibility reductions in BTC, punishing buyers who don’t recruit with non withdrawable GNX tokens, or just blocking withdrawals altogether.

Expensive Person,

Threat notification of the account.

Your account asset consists of abnormality! HyperVerse has stopped your fee of bonus earnings and restricted quickly the switch and withdrawal, with a danger of quantity theft there could also be.

Please end the id authentication as quickly as attainable to renew your regular capital transaction and assure fund safety.

This stops each withdrawals and every day monopoly cash ROI accrual within the backoffice.

Hyperverse homeowners Ryan Xu and Sam Lee fled to Dubai final yr. They’re on the run from liquidators in Australia and haven’t been seen in months.