On January thirty first Alan Friedland’s CompCoin fraud trial kicked off.

After three days of the CFTC presenting its proof towards Friedland, which included calling up 5 witnesses, Friedland settled the costs.

Friedland’s CFTC settlement has but to be finalized and accredited by the courtroom.

Regardless of that Friedland is already sweeping his settlement beneath the rug.

With BuilderDefi’s launch and Friedland’s CFTC settlement taking place concurrently, there are buyers asking uncomfortable questions.

Upon listening to Friedland clarify BLDR’s coin worth will fluctuate and losses are attainable, one potential BuilderDefi investor remarked;

Pay attention I’m sorry, I’m not making an attempt to be disrespectful in any approach, form or type. I used to be simply allowed into this room so I’m not going to try to be…

However from that assertion that was simply made, coming from any person who simply mentioned twenty, perhaps fifteen minutes in the past, that he had simply handled the CFTC or some courtroom case, after which he’s like, “Hey man, don’t threat something that you just would possibly lose, this would possibly fluctuate.”

After which, “Oh however we’re completely, y’know, assured that that is gonna work”. That scares the residing fuck out of me as an investor.

Whereas Friedland was rambling on about BuilderDefi, webinar contributors raised questions on his CFTC settlement.

There’s some chatter about my latest settlement for a case that was introduced towards my agency after which myself, with regard to a really promising blockchain challenge that began in 2014, that I based.

I’m an entrepreneur. I’ve been within the monetary business. We bumped into some very, very unfair regulation as a result of, y’know I used to be a proponent of cryptocurrency.

We filed, we met many occasions with the regulators. Sadly they made it inconceivable for us to function and so, as a part of it, I agreed, for enterprise resolution [sic], to settle.

For the file, the CFTC went after Friedland for soliciting $1.6 million in funding into CompCoin.

The CFTC didn’t invent any new legal guidelines to cost Friedland beneath. The Commodities Change Act has been round since 1936.

Friedland represented to CompCoin buyers that income can be generated by way of ART, an AI buying and selling platform.

Friedland started soliciting funding into CompCoin primarily based on ART’s “success”, failing nonetheless to reveal that ART had solely been examined in a hypothetical surroundings.

The CFTC sought to have Friedland return the $1.6 million stolen from buyers, plus curiosity and a civil penalty.

The case had nothing to do with Friedland being an entrepreneur or early crypto adopter.

When NRGY launched Duane Noble, one in all Friedland’s enterprise companions, was touting TradeGenie.

[21:20] Our first app is popping out, it’s an algorithm that connects to individuals’s TD Ameritrade account and it trades shares routinely.

[22:14] It’s gonna be referred to as TradeGenie.

TradeGenie is believed to be the rebranding of ART.

TradeGenie nonetheless by no means materialized. If it’s nonetheless a part of NRGY and/or if it’s being relaunched by means of BuilderDefi, particulars are beneath wraps.

Friedland revisited his but to be accredited CFTC settlement later within the two hour plus webinar;

It was very unfair. Very, very unfair.

Regulators are referred to as regulators for a purpose. They’re making an attempt to manage, they’re making an attempt to cease the change and folks like me are innovating and creating the change.

And I’m not the primary individual to be attacked, proper… as a result of they’re making an attempt to make change on this world.

On the similar time, um, it’s completed. I simply settled it.

I had sufficient time preventing with the federal government. They received loads sensible attorneys. That they had 9 attorneys, with the employees.

They know find out how to roll individuals. They know find out how to bulldoze individuals. Okay?

And I fought with them, and I… y’know, ultimately I feel I earned their respect.

In the course of the trial they mentioned, “Hey, do you need to settle?”

And I used to be similar to, y’realize it’s simply what’s finest. It was a enterprise resolution.

I must spend my time and spend my efforts and my energies that I’ve in my life creating issues, constructing issues – not preventing with the federal government.

That’s simply not price it. Not over cash.

There’s a bit to unpack there.

Let’s begin with investor losses not being some revolutionary “change” as Friedland places it.

Illegally soliciting $1.6 million on the pretend illustration of theoretically generated returns that you just did not open up to your buyers, doesn’t make you some entrepreneurial maverick.

It makes you a scammer in violation of the Commodity Change Act.

The CFTC submitting a lawsuit towards Friedland wasn’t “attacking” him, it was holding him accountable for breaking the legislation.

As for preventing the federal government. The CFTC filed go well with towards Friedland in April 2020 – nearly two years in the past.

Friedland very a lot fought the federal government each step of the way in which. Having then ready for trial and spending the cash on attorneys who ready a protection for the jury, Friedland pulled the plug.

Previous to the trial Friedland acknowledged US regulators had “botched this up very, very badly.”

All that modified after that was the CFTC had three days to put their case out in entrance of a jury.

Friedland had already fought the federal government. All he needed to do was sit again and let his attorneys current his protection.

As an alternative, after listening to the proof towards him over three days, Friedland jumped on the first alternative to settle.

If you happen to’d been preventing a case for 2 years that had lastly progressed to trial, would you pull the plug in the event you felt assured?

The fact of Friedland’s CFTC settlement is in stark distinction to the advertising bravado he’s pitching to potential BuilderDefi buyers.

I get why Friedland’s doing it, evidently simply admitting you broke the legislation and copping on the chin is an excessive amount of for some individuals, however why placed on this present when the whole lot is publicly verifiable?

The one factor I’ve left to hypothesis above is why precisely Friedland settled on the eleventh hour – actually on the eve of his protection presenting his case to the jury.

Every thing else is pulled from publicly obtainable courtroom filings.

Personally I believe TradeGenie has been quietly dropped (or quickly shelved), to throw off the CFTC.

Friedland stays unregistered with the CFTC, that means there’d be nothing stopping the regulator from submitting an equivalent lawsuit over the identical conduct (Artwork to CompCoin is what TradeGenie can be to NRGY/BuilderDefi).

BuilderDefi providing a passive 5% per week ROI alternative nonetheless, brings it beneath the SEC’s jurisdiction.

BuilderDefi and Friedland aren’t registered with the SEC and, primarily based on representations of his companions, doesn’t plan to.

As an alternative they’re going to deploy pseudo-compliance:

Assembly with the lawyer, I simply need to let you already know this proper, as a result of earlier than I’d say a complete lot of issues, proper?

An entire lot of issues, earlier than we created this complete challenge, and we met with the lawyer and the authorized crew there, they usually mentioned, “Hey, you higher watch out what you say. You may’t use the phrase funding.”

And I assume as a result of the SEC have bought that phrase and have possession to that phrase for some purpose, so we will’t say it. However you possibly can say, “You should purchase some cash”.

You may’t assure any return. And that’s the rationale why, though Alan and his crew have created a program that may probably earn greater than 5% per week – however guess what?

We are able to’t say (that), we have now to say, “Goal 5 p.c.” Proper?

So there’s a whole lot of issues that we have now to vary and that very same verbiage needs to be utilized by your complete group.

Simply to ensure that we will hold the Securities and Change Fee, the SEC, on the opposite aspect of the wall and they’re by no means going to return into our yard.

With respect to regulation, whereas what you name a passive funding alternative can add further prices, it’s the act of providing unregistered securities itself that could be a violation of the Securities and Change Act.

BuilderDefi’s 5% per week passive returns MLM alternative is a securities providing, no matter the way it’s phrased, whether or not it’s by means of cryptocurrency or the way it’s marketed.

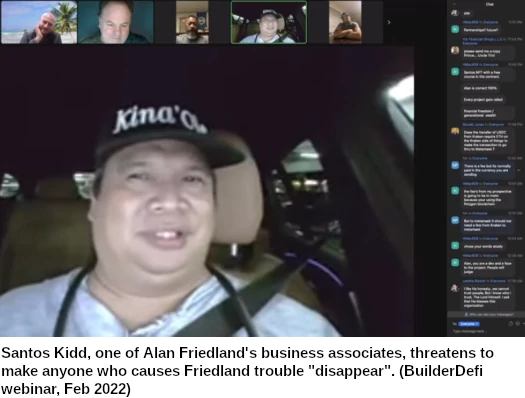

Friedland’s enterprise associate Santos Kidd ended the webinar by evaluating Friedland’s CFTC case to Jesus Christ’s crucifiction.

Whoever makes bother to you I could make them disappear. I do know individuals in (indecipherable).

BuilderDefi begins soliciting funding from the general public on February tenth.

Replace seventh April 2022 – Alan Friedland’s CompCoin fraud settlement has been accredited.