Titan Capital Market’s web site area (“titancapitalmarkets.com”), was privately registered on March thirty first, 2022.

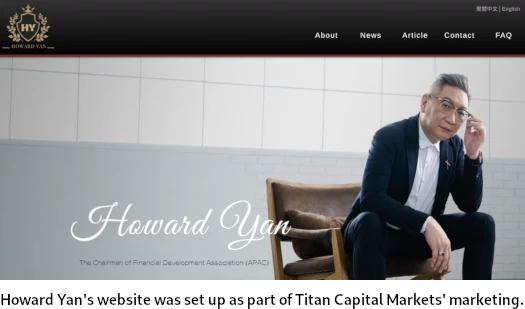

An official advertising and marketing presentation names “Howard Yan” as CEO of Titan Capital Markets.

Yan doesn’t exist outdoors of Titan Capital Markets’ advertising and marketing. That stated, some effort has gone into making a bogus digital profile.

The area “yanfxeducation.com” was registered on June eighth, 2022.

The web site presents a photograph of Yan with fictional backstory and foreign currency trading filler fluff.

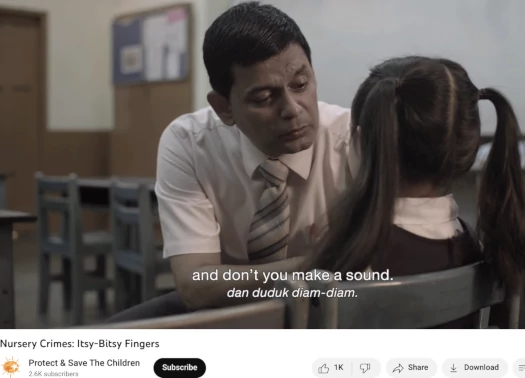

In one Titan Capital Markets promo video we’re launched to “Klaus Huber”.

Huber is an actor who, again in 2016, portrayed a pedophile in an consciousness marketing campaign for a Malaysian charity.

The marketing campaign was put collectively by Naga DDB Tribal, a Malaysian advertising and marketing firm.

I need to make clear that work is figure and I’m not insinuating something from the actor’s position. The takeaway is that “Klaus Huber” is being performed by a Malaysian actor and doesn’t truly exist.

Neither does Howard Yan however, apart from him presumably being from Taiwan, was unable to search out something additional.

A few of Titan Capital Markets’ movies are unusual, like this Fulham Soccer membership sponsorship promo.

Early Titan Capital Markets movies recommend preliminary promotion in south-east Asia. Since then recruitment wherever outdoors of India seems to have collapsed.

Immediately SimilarWeb tracks 100% of Titan Capital Markets’ web site visitors as originating from India.

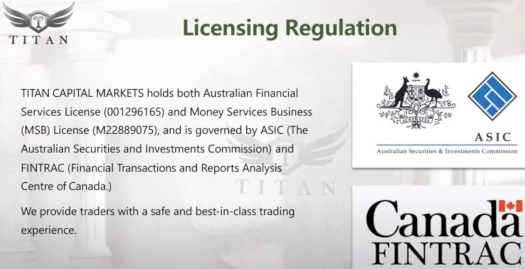

In an try to look respectable, Titan Capital Markets presents itself as an Australian shell firm:

From the above analysis, we conclude that whoever is working Titan Capital Markets is probably going primarily based out south-east Asia.

As at all times, if an MLM firm just isn’t overtly upfront about who’s working or owns it, suppose lengthy and arduous about becoming a member of and/or handing over any cash.

Titan Capital Markets’ Merchandise

Titan Capital Markets has no retailable services or products.

Associates are solely in a position to market Titan Capital Markets affiliate membership itself.

Titan Capital Markets affiliate membership gives entry to “monetary programs”.

Titan Capital Markets’ Compensation Plan

Titan Capital Markets associates pay a charge. How a lot is paid in charges determines how a lot is ready to be invested in Titan Capital Markets’ passive funding alternative:

- Fundamental Stage – $30 charge lets you make investments $10 to $45

- Normal Stage – $100 charge lets you make investments $10 to $200

- Superior Stage – $300 charge lets you make investments $10 to $900 (bonus 0.15% a day)

- Professional Stage – $1000 charge lets you make investments $10 to $5000 (bonus 0.2% a day)

Returns for the Fundamental Stage aren’t supplied, however Normal and better tier associates spend money on a “Sensible Wings” plan.

The Sensible Wings Plan pays a 7% to eight.8% ROI over 15 days.

Word that Titan Capital Markets costs a 5% withdrawal charge.

The MLM aspect of Titan Capital Markets pays on recruitment of affiliate buyers.

Titan Capital Markets Affiliate Ranks

There are 5 affiliate ranks inside Titan Capital Markets’ compensation plan.

Together with their respective qualification standards, they’re as follows:

- JNR Accomplice – earn $500

- SNR Accomplice – earn $3000

- Government Accomplice – earn $10,000

- JNR Government Accomplice – earn $30,000

- SNR Government Accomplice – earn $100,000

Recruitment Commissions

Titan Capital Markets associates earn a fee per affiliate they recruit.

Recruitment fee charges are decided by how a lot an affiliate themselves spent on membership:

- Fundamental tier associates earn a ten% recruitment fee fee

- Normal and better tier associates earn a 15% recruitment fee fee

Residual Commissions

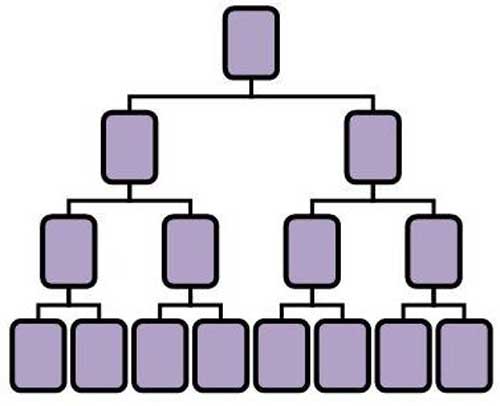

Titan Capital Markets pays residual commissions through a binary compensation construction.

A binary compensation construction locations an affiliate on the prime of a binary group, cut up into two sides (left and proper):

The primary stage of the binary group homes two positions. The second stage of the binary group is generated by splitting these first two positions into one other two positions every (4 positions).

Subsequent ranges of the binary group are generated as required, with every new stage housing twice as many positions because the earlier stage.

Positions within the binary group are stuffed through direct and oblique recruitment of associates. Word there is no such thing as a restrict to how deep a binary group can develop.

On the finish of every day Titan Capital Markets tallies up new charge quantity on each side of the binary group.

Associates are paid 12% of charge quantity generated on their weaker binary group aspect.

As soon as paid out on, charge quantity is matched towards the stronger binary group aspect and flushed.

Any leftover quantity on the stronger binary group aspect carries over.

Residual Commissions Match

Titan Capital Markets pays a residual fee match down three ranges of recruitment (unilevel):

- stage 1 (personally recruited associates) – 10%

- stage 2 (should recruit three associates to qualify) – 5%

- stage 3 (should recruit 5 associates to qualify) – 5%

Word that the Residual Commissions Match is each day capped at how a lot an affiliate has spent in charges.

Titan Accomplice Rewards

Titan Accomplice Rewards are a bonus proportion paid on charges paid by personally recruited associates.

- JNR Companions earn a 2% bonus

- SNR Companions earn a 4% bonus

- Government Companions earn a 6% bonus

- JNR Government Companions earn an 8% bonus

- SNR Government Companions earn a ten% bonus

ROI Match

Titan Capital Markets pays a match on returns earned by downline associates.

The ROI Match is paid utilizing the identical unilevel group the Residual Commissions Match is paid with (see above), this time capped at eight ranges:

- Fundamental Stage tier associates earn a 5% ROI match on ranges 1 to three

- Normal Stage tier associates earn a 5% match on ranges 1 to five

- Superior and Professional Stage tier associates earn a 5% match on ranges 1 to eight

Tremendous Management Dividends

Titan Capital Markets matches 20% of returns paid out firm broad. This match is positioned into Tremendous Management Dividend swimming pools.

- Hermes (will need to have one SNR Government in your downline) – qualify a 5% Tremendous Management Dividends Pool

- Athena (will need to have two SNR Executives in your downline) – qualify for a ten% Tremendous Management Dividends Pool

- Poseidon (will need to have three SNR Executives in your downline) – qualify for a 15% Tremendous Management Dividends Pool

- Zeus (will need to have 4 SNR Executives in your downline) – qualify for the total 20% Tremendous Management Dividends Pool

Word that recruited SNR Executives should be in separate unilevel group legs.

Becoming a member of Titan Capital Markets

Titan Capital Markets affiliate membership prices between $30 and $1000:

- Fundamental Stage – $30

- Normal Stage – $100

- Superior Stage – $300

- Professional Stage – $1000

The extra a Titan Capital Markets affiliate spends on charges the upper their revenue potential.

Titan Capital Markets Conclusion

Titan Capital Markets represents it generates exterior ROI income through a “3-way arbitrage system”. That is the everyday buying and selling bot Ponzi ruse.

Titan Capital Markets fails to offer proof it generates exterior ROI income, through a buying and selling bot or every other means.

Being a passive funding alternative, Titan Capital Markets is required to register with monetary regulators and supply audited monetary studies.

The one monetary regulator Titan Capital Markets seems to have registered with is the Australian Securities and Investments Fee (ASIC).

Given Titan Capital Markets seems to be operated from south-east Asia, and 100% of its web site visitors originates from India, ASIC registration is meaningless.

However ASIC’s atrocious historical past in terms of regulating MLM associated securities fraud.

Because it stands, the one verifiable income getting into Titan Capital Markets is new funding. Utilizing new funding to pay returns makes Titan Capital Markets a Ponzi scheme.

That is in step with Titan Capital Markets utilizing actors to play fictional executives.

Moreover with nothing marketed or bought to retail prospects, Titan Capital Markets’ MLM alternative is a pyramid scheme.

As with all MLM Ponzi schemes, as soon as affiliate recruitment dries up so too will new funding.

This can starve Titan Capital Markets of ROI income, finally prompting a collapse.

Math ensures the vast majority of contributors in Ponzi schemes lose cash.