Hedgefinity offers no info on their web site about who owns or runs the corporate.

The Hedgefinity web site area (“hedgefinity.com”) was privately registered on July twentieth, 2018.

As all the time, if an MLM firm just isn’t overtly upfront about who’s operating or owns it, assume lengthy and onerous about becoming a member of and/or handing over any cash.

Hedgefinity Merchandise

Hedgefinity has no retailable services or products, with associates solely capable of market Hedgefinity affiliate membership itself.

The Hedgefinity Compensation Plan

Hedgefinity associates buy positions in an 2×8 matrix cycler.

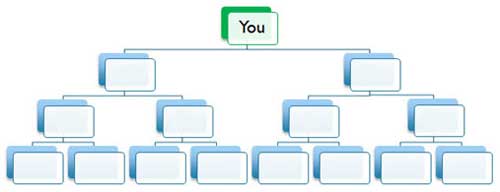

A 2×8 matrix locations an affiliate on the high of a matrix, with two positions immediately underneath them.

These two positions kind the primary degree of the matrix. The second degree of the matrix is generated by splitting these first two positions into one other two positions every (4 positions).

Ranges three to eight of the matrix are generated in the identical method, with every new degree housing twice as many positions because the earlier degree.

Every matrix degree in a Hedgefinity 2×8 matrix capabilities as a cycler tier.

Positions in every tier are stuffed by way of subsequent place purchases, made by present and newly recruited Hedgefinity associates.

As soon as all positions in a matrix degree tier are stuffed, a “cycle” fee is generated and the following degree is unlocked.

Fee funds throughout Hedgefinity’s 2×8 matrix cycler are as follows:

- degree 1 (positions value $11, 2 positions to fill) – $10 cycle fee and unlocks degree 2

- degree 2 (4 positions to fill) – $20 cycle fee and unlocks degree 3

- degree 3 (8 positions to fill) – $80 cycle fee and unlocks degree 4

- degree 4 (16 positions to fill) – $640 cycle fee and unlocks degree 5

- degree 5 (32 positions to fill) – $10,240 cycle fee and unlocks degree 6

- degree 6 (64 positions to fill) – $327,680 cycle fee and unlocks degree 7

- degree 7 (128 positions to fill) – $41,943,040 cycle fee

Notice that the Hedgefinity web site mentions an both divine degree tier however offers no additional info.

Additionally observe that Hedgefinity pays an extra $5 fee is paid per affiliate personally recruited.

Becoming a member of Hedgefinity

Hedgefinity affiliate membership is free, nonetheless no less than one $11 matrix place buy is required to take part within the connected MLM alternative.

All funds in Hedgefinity are made in bitcoin (each paid and obtained).

Conclusion

As evidenced by web site article titles akin to “What Are Bitcoins? & How Do Bitcoins Work?”, Hedgefinity is pitched at individuals who don’t know what cryptocurrency is.

Why?

In all probability as a result of Hedgefinity pitches their scheme as a approach to see “how $11 will get changed into $42 Million”.

To place that into perspective, at a naked minimal you’d want 3.8 million $11 funds to fulfill only one $42 million fee payout.

And that’s not factoring within the referral fee, which eats nearly half of deposited funds (so that you’re taking a look at nearer to eight million funds).

In actuality no one goes to get anyplace close to marking $42 million in Hedgefinity.

So why go to the hassle of even attempting to pitch ridiculous numbers at gullible idiots?

Nicely, for Hedgefinity’s nameless admin and early adopters, they make their cash being on the high of the company-wide matrix.

This ensures nearly all of deposited funds are funneled as much as them.

The Hedgefinity admin additionally retains $1 of each $11 deposit. In addition they maintain funds trapped in matrix ranges that haven’t stuffed but when Hedgefinity inevitably collapses.

Regardless of billing itself as a “social enterprise enterprise funding platform”, Hedgefinity is nothing greater than an $11 buy-in Ponzi scheme.

Hedgefinity associates make investments $11 on the promise of a $42 million ROI.

That ROI is paid out of subsequently invested funds, making Hedgefinity a Ponzi scheme.

As with all MLM Ponzi schemes, when affiliate recruitment dries up so too will newly invested funds.

Being a matrix-based scheme this can see affiliate’s caught in stalled matrices.

As soon as sufficient matrices stall company-wide, an irreversible collapse is triggered.

The mathematics behind a Ponzi scheme ensures that when it collapses nearly all of individuals lose cash.