As per a filed June 1st report from the Receiver;

Although his investigation is in its very preliminary stages, the Receiver has not yet identified an account of EminiFX that contains revenue from an underlying business operation (or any legitimate business activity that requires the ongoing use of the business premises or employees once the data is fully secured).

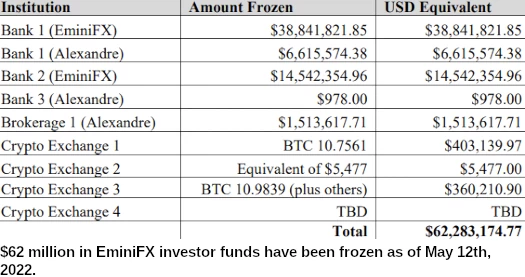

With respect to assets seized, as of May 12th they current sit at $62 million.

The most pressing issue for the Temporary Receiver is crypto, held in an Estonian exchange in EminiFX owner Eddy Alexandre’s name.

The Receiver has yet been unable to obtain records from Crypto Exchange 4, a company headquartered in Estonia, at which the Receiver is advised Defendant Alexandre had an account in his own name.

The Receiver has been informed that millions of dollars in cryptocurrency were deposited in users’ EminiFX accounts, and disbursed to user’s EminiFX accounts, through Alexandre’s account at Crypto Exchange 4, consistent with the CFTC’s allegation that Alexandre

was running EminiFX “in the manner of a Ponzi scheme.”The Receiver has not been provided with any information that would indicate that the Crypto Exchange 4 account was used for trading activity from which revenue was derived.

Records from “Exchange 4” will likely further confirm EminiFX operated as a Ponzi scheme – the primary reason Eddy Alexandre has refused to provide authorities and the Receiver with requested financial records.

The good news for EminiFX investors is that Exchange 4 has “voluntarily frozen” funds held in Alexandre’s account.

As opposed to engaging in legitimate business activity and, in addition to helping himself to $14.7 million of investor funds, Alexandre appears to have been building himself a real-estate empire.

The Receiver has located 46 residential real estate properties in Suffolk County where EminiFX is in contract to purchase such properties out of foreclosure, having paid over $2 million in deposits.

The Receiver has also discovered two properties in Nassau County.

The first, in contract to purchase by EminiFX for over $1.5 million, appears after an initial investigation by the Receiver to be worth less than the additional cost of marketing and resale even if the contract were to close, and as such the Receiver has accepted the seller’s offer to rescind the contract and return the deposit and enter into mutual releases.

The second, in contract to purchase by Defendant Alexandre for over $5 million, appears to have its 10% deposit funded with money from customer funds, and as such the Receiver has informed the escrow agent and the bank holding the deposit of that fact and the SRO.

Based on forensic analysis of seized evidence, the Receiver’s team has established

there are at least 62,000 active EminiFX user accounts, of which the Receiver has been informed that between 25,000 and 50,000 were actively “trading” on the EminiFX platform.

“Trading” refers to investor accounts participating in EminiFX’s Ponzi scheme.

Since taking over EminiFX, the Receiver reports he has received over 8000 emails from investors.

While recovery is still a long ways off, $62 million seized is looking promising for investors. To some extent however this does hinge on how much is held up in Echange 4, whether that will be recovered and whether Alexandre had any additional as of yet unknown crypto accounts.

With respect to verification of investor claims (which again is a long way off), the Receiver writes;

It appears that the user data recently recovered from EminiFX contains substantial contact information which the Receiver and his team will be able to use to create a notice and claims process.

However, it is possible that the assertion of the Fifth Amendment by Defendant Alexandre and other parties may significantly impede the Receiver’s attempt to collect data and information.

What has been recovered should go some way to streamlining the victim claim process when the time comes.

It will also likely provide the Receiver with ammo for clawback litigation against EminiFX’s top net-winners.

The Receiver has begun the process of turning over the EminiFX accounts to the Receivership estate, which will result in over $53 million

in cash, the vast majority of which the Receiver expects will be available for eventual distribution to investors.The Receiver, working with his experienced counsel, intends to investigate the underlying fraudulent conduct, using both the email and other communications recovered, interviews with witnesses, and review of documents obtained from third parties.

The Receiver intends to use the result of such investigation to pursue any and all cost-effective claims of the receivership and to disallow any claims submitted by culpable parties.

The Receiver will keep the Court advised of his investigation and intentions relating to any third party litigation claims.

Looking forward, the EminiFX preliminary injunction hearing remains scheduled for June 7th.

There have been discussions between the CFTC and Alexandre though, suggesting that a consent preliminary injunction may be reached.

That is, the granting of an agreed preliminary injunction without the need for Alexandre to get steamrolled in court.

If an agreement is reach, the court has directed the parties to file the proposed preliminary injunction by June 3rd.

I’ve scheduled our next docket check for June 4th and will report back then.

Update 4th June 2022 – At the request of Eddy Alexandre’s attorney, the preliminary hearing has been pushed back to June 17th.

Defendant Eddy Alexandre was detained between May 12 and May 31, 2022, with limited access to counsel.

The requested adjournment will allow time for Mr. Alexandre to consult with counsel regarding the allegations in this action and the CFTC’s motion for a preliminary injunction.

If an agreement is reached on the preliminary injunction, it is to be filed by June 15th.