Capuci, aka Jr. Caputti, Junior Caputti and Junior Capuci, co-founded Mining Capital Coin with Emerson Souza Pires back in 2017.

The DOJ filed Caputti’s indictment under seal on April 28th. Across three counts of fraud, the indictment alleges Mining Capital Coin was a $62 million Ponzi scheme.

After being served a subpoena as part of a parallel SEC investigation, Caputti fled to Brazil.

On May 5th the DOJ moved to unseal Capuci’s indictment, noting;

Capuci is believed to be in Brazil.

On or about May 2, 2022, Capuci was scheduled to travel to the United States on a flight from Brazil to Miami, Florida.

Capuci did not board the plane.

On or about May 5, 2022, the SEC plans to unseal a civil action against Capuci.

At this time Capuci will be put on notice regarding the indictment in this case.

Based on previous statements of Capuci, the Government believes that Capuci, a dual Brazil-United States citizen, will stay abroad to remain out of reach of United States authorities.

Capuci is aware that Brazil does not extradite its citizens.

The Government submits that unsealing the indictment is in the interest of justice and will provide notice to – and help identify and prevent future – victims regarding the allegations charged in the indictment.

The court approved the DOJ’s motion to unseal on May 5th.

As per Capuci’s indictment, Mining Capital Coin was a $62 million dollar Ponzi scheme.

In or around late 2017, LUIZ CARLOS CAPUCI JR. and CC-I created MCC.

From the beginning, CAPUCI and CC-I aggressively marketed MCC to prospective investors as a lucrative investment opportunity.

“CC-1” refers to Capuci’s partner in crime, Emerson Pires.

CAPUCI and CC-I falsely and fraudulently touted MCC’S purported investment programs involving cryptocurrency mining, cryptocurrency trading, and other investment activity, including foreign exchange trading.

Capuci, CC-1 and MCC falsely and fraudulently obtained approximately $62 million from retail investors around the world.

Mining and trading are the “go-to” ruses of MLM crypto Ponzi schemes.

Capuci represented that MCC had “technological mining facilities with the best equipment located in the United States,” when Capuci knew that MCC was not operating such mining facilities, let alone using the best mining equipment in the United States.

BehindMLM maintains any MLM company claiming to engage in trading and/or mining that isn’t registered with financial regulators is a Ponzi scheme.

We routinely remind readers that social media is not a substitute for the legal requirement of filing financial reports with regulators.

Mining Capital Coin is a classic example of why;

To persuade investors to invest, Luiz Carlos Capuci Jr. and CC-1 posted videos to social media … regarding MCC’s purported network of mining machines.

On or about December 26, 2018, MCC published a video to the internet via a social media platform regarding MCC’s mining operations.

During the video, Capuci filmed a room containing what appeared to be numerous mining machines in operation.

Capuci then stated, “you guys like the noise? It’s mining, it’s mining, making money for you guys.”

Later he stated, “I didn’t spend money to go to Africa, Nigeria, or whatever, to do a Ponzi scheme,” and falsely claimed to have seven other offices where MCC conducted mining as well.

On or about December 26, 2018, MCC published (another) video.

During the video, CC-1 explained that MCC’s mining machines “[were] mining right now, alright, all the time for you… MCC working with the investments, working with the money, working with your money, making your money work for you.”

Contrary to Capuci’s representations to investors, MCC was not operating a large network of cryptocurrency mining machines to generate returns for investors.

Instead, Capuci was operating an illicit investment scheme in which he was falsely and fraudulently diverting investors’ fund to cryptocurrency wallets and financial accounts under his control and not investing the funds in MCC’s operations as he had falsely represented to his investors.

In fact, to draw attention away from the fact he was committing securities fraud because MCC was a Ponzi scheme, Capuci made all sorts of claims:

- “that MCC had partnered with the World Bank to secure an investment in eco-friendly power generators and used wind turbines to power its mining facility” (legitimacy via association)

- “that MCC had submitted applications to have Capital Coin … listed on at least one prominent cryptocurrency exchange” (legitimacy via association)

- “that MCC was licensed by the North Carolina Commissioner of Banks as a “Virtual Currency Dealer” (legitimacy via association and also meaningless with respect to securities fraud)

- “that MCC had a partnership with the Clinton Foundation … so that MCC could help bring schools to children in Africa and share the successes that MCC had enjoyed” (legitimacy via association and using charity to justify fraud)

- “falsely and fraudulently representing to investors that he was a former agent with the FBI” (legitimacy via association)

- “falsely suggested that MCC was the “biggest cryptocurrency mining business in the world””

Of course none of these representations were true. They were fabrications that made up Mining Capital Coin’s marketing machine.

Mining City Capital’s Ponzi scheme revolved around the sale of mining packages and trading bots.

Mining Packages

MCC offered 52 week returns on Mining Package investments, purportedly derived from cryptocurrency mining.

To share in these purported mining profits, Capuci and CC-1 falsely and fraudulently offered and marketed MCC’s “Mining Packages” as a lucrative investment opportunity.

Upon purchasing such a package, Capuci promised investors a weekly return based on the amount of the package, to be distributed automatically and bi-monthly to the investors’ cryptocurrency wallets.

Capuci promoted the Mining Packages as an investment of money into a common enterprise with other investors, with the reasonable expectation of profits from the efforts of MCC.

The Mining Packages therefore qualified as “securities” under the rules and regulations governing the offer and sale of securities in the US and required registration with the SEC.

Capuci never registered MCC’s investment program … as an offering and sale of securities with the SEC; nor did Capuci have a valid exemption from this registration requirement.

Trading Bot Packages

BehindMLM reviewed Mining Capital Coin in mid 2018. At the time Mining Capital Coin represented external revenue was generated via trading and other means, but only Mining Packages were offered.

That changed in 2019.

Beginning in or around 2019, Capuci and CC-1 also aggressively touted and falsely and fraudulently marketed MCC’s purported “Trading Bots” as an additional investment mechanism for investors.

Capuci and CC-1 misled the public by stating that MCC offered, owned, and controlled Trading Bots that could generate significant profits for prospective investors in the cryptocurrency trading market.

Capuci stated that trading bots then available on the market were not generating “positive results”.

In contrast, Capuci claimed MCC joined with “top software developers in Asia, Russia, and the U.S.A. to create an improved version of Trading Bot[s] that [were] tested with new technology never seen before.”

Capuci further represented that MCC”s Trading Bots … would generate daily returns to investors, which ranged from between 1% and 3.5% a day.

Instead, Capuci was falsely and fraudulently diverting investors’ funds to cryptocurrency wallets and financial accounts under his control for his own personal use and the use of his co-conspirators.

The Mining Capital Coin exit-scam

Shortly after its trading bot investment plans were introduced, Mining Capital Coin initiated its shitcoin exit-scam.

In or around 2019, MCC ceased paying investors’ returns in bitcoin, which was the original model.

Instead MCC began distributing returns to investors with Capital Coin, MCC’s own cryptocurrency.

Then came the KYC exit-scam…

In or around 2020, Capuci also told investors that they were required to pay a $100 “Know Your Customer” fee for each MCC account in order to participate in a “swap” of Capital Coin for bitcoin.

This took place through “Bitchain Exchange”, an internal MCC exchange that Capuci controlled but claimed he didn’t.

Capuci fraudulently represented that Bitchain Exchanges was not affiliated with MCC when, in fact, Capuci exercised control over Bitchain Exchanges, including through Capuci’s registration of the Bitchain Exchange website.

After Capital Coin was introduced, investors were left bagholding a worthless token. Mining Capital Coin collapsed the moment it stopped paying out in bitcoin.

The Ponzi scheme was later abandoned.

Criminal Charges

As a result of running Mining Capital Coin, an alleged $62 million Ponzi scheme, Capuci has been indicted on three counts of fraud:

- conspiracy to commit wire fraud;

- conspiracy to commit securities fraud; and

- conspiracy to commit international money laundering.

The DOJ is seeking forfeiture of “certain property” Capuci has an interest in.

If convicted on all three counts, Capuci is facing 45 years in prison.

Closing Thoughts

I have two closing thoughts for you; the first is Capuci running back to Brazil means we’ve got another Carlos Wanzeler on our hands.

While it took a while for Brazilian law to catch up, that plan didn’t pan out for Wanzeler.

Wanzeler was stripped of his Brazilian citizenship in 2018 and arrested at the behest of the US government in 2020.

Extradition proceedings against Wanzeler are believed to be ongoing.

I’m thinking the DOJ has thought this through if they’ve filed to unseal the indictment. I can’t say for sure what the plan is at this stage (following on from Wanzeler this is very much uncharted territory).

The second thought is Capuci’s partner in crime; Emerson Pires.

BehindMLM published its Mining Capital Coin review in May 2018, at least seven months before it collapsed.

Having researched and analysed Mining Capital Coin’s business model, here’s what I concluded four years ago:

First and foremost if Mining Capital Coin is indeed based out of Massachusetts in the US, they need to register their passive investment opportunity with the SEC.

A search of the SEC’s Edgar database however reveals Mining Capital Coin is not registered.

This means that at a minimum Mining Capital Coin are engaged in securities fraud.

Part of this is the high probability Mining Capital Coin are simply shuffling around newly invested funds to pay off existing investors.

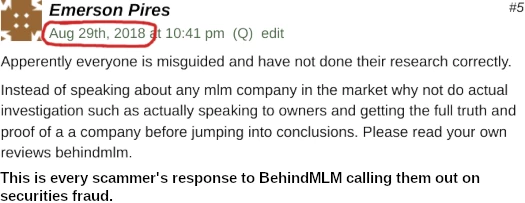

In August 2018 Emerson Pires showed up in the comments section to defend his Ponzi scheme.

You can find these comments left on every Ponzi scheme BehindMLM reviews that gains traction.

Having bilked consumers out of an alleged $62 million with Capuci, Pires would resurface with EmpiresX in June 2021.

EmpiresX saw Pires team up with new partners but very much run the same MLM crypto Ponzi scheme.

Said Ponzi scheme collapsed on or around October 2021. A data leak suggests consumers again lost over $60 million.

The SEC have revealed, like Capuci, Pires has recently fled Florida for Brazil. He’s probably not coming back willingly either.

Whether Pires has been or has an indictment pending is unclear. Ditto whether he’ll face additional charges over EmpiresX.

Both the DOJ and SEC state in their respective press-releases that the case is still under investigation.

Update 20th May 2022 – As of May 16th, Luiz Capuci’s criminal case docket reflects he is a wanted fugitive.