At stake are the millions in ill-gotten gains Capuci allegedly stole through his Mining Capital Coin Ponzi scheme.

The SEC’s Mining Capital Coin case was filed under seal on April 7th. We don’t usually see MLM related SEC cases filed under seal.

In this instance, the SEC filed under seal to prevent the MCC defendants from “safeguarding” or “locking down” assets before judicial relief was granted.

Relief sought be the SEC included

(1) repatriation of ill-gotten gains back to the United States;

(2) an order requiring Capuci and Pires to surrender their passports to the Clerk of Court; and

(3) an order prohibiting Capuci and Pires from leaving the United States until they have fully complied with the Court’s Orders.

The SEC believes Capuci and Pires are both Brazilian citizens currently residing in Brazil.

Capuci also holds United States citizenship.

So I believe the requested relief was a hedge against the possibility Capuci and Pires remained in the US.

Criminal charges have since been filed against Capuci. He hasn’t been arrested so it appears he has indeed fled to Brazil.

Supporting declarations accompanying the SEC’s Complaint state;

Capuci left his residence in Florida and moved to Brazil in July 2021, after the SEC issued subpoenas in the Investigation on June 29, 2021.

According to the SEC, Capuci returned briefly to Florida in March 2022 before leaving again for Brazil.

At the root of the SEC’s concerns is ongoing conduct by Capuci and Pires with respect to their Mining Capital Coin ill-gotten gains.

In their complaint, the SEC detailed

a web of entities and bank accounts controlled by Defendants and used to siphon investors’ funds.

Defendants allegedly spent millions of dollars on travel, luxury cars, a yacht, and real estate, among other things.

The SEC also alleges that Capuci received about $18.5 million in cryptocurrency assets.

After the SEC issued subpoenas in its investigation, Capuci began to close bank accounts and liquidate a number of assets.

Capuci’s wife, Stephanie Cassia Capuci (aka Stephanie Lira), is alleged to have assisted Capuci launder funds through bank accounts held and shell companies registered in her name.

Stephanie Cassia Capuci is believed to have fled to Brazil with Capuci and their son after his March 2022 visit to Florida.

Documented spending of MCC investor funds by Capuci includes;

• $9,700 on apparel, which includes luxury stores like Louis Vuitton, Salvatore Ferragamo, and Gucci;

• $23,400 on marina fees and other boating expenditures;

• $26,700 on one year of child support to an individual (believed to be) Capuci’s first ex-wife;

• $33,110 in additional payments, via various electronic payment apps, to Capuci’s first ex-wife;

• $5,200 for pool construction and maintenance;

• $21,900 on entertainment, including golf club memberships, streaming services, and Apple products;

• $30,650 on meals;

• $141,745 on domestic and international travel;

• $221,000 on payments related to motorcycles, luxury automobiles, and other car rentals;

• $36,000 in Zelle payments to Capuci’s current spouse; and

• $36,500 in Zelle payments to E&J Granite Install LLC, which is controlled by Pires.

Pires spent

• $1 ,737 at Half Price Mattress;

• $2,742 at Ashley Home Stores;

• $260 for Disney World tickets;

• $15,600 on airline tickets;

• $3,800 on hotels;

• $10,500 on purchases from stores that appear to be located in foreign countries, including in China, Korea, Poland, Turkey, United Kingdom, Germany, and Spain; and

• $7,000 at Diamond Vault.

Both lists are by no means exhaustive. They only cover two bank accounts related to MCC between 2018 and 2020.

Throughout the course of the SEC’s investigation Capuci worked to actively hide evidence. This includes threatening investors.

In one transcript, detailing statements allegedly made by Capuci upon learning of potential investor complaints to the SEC, Capuci stated;

If they want to help to go to SEC I can help them, I can block their account and then they go to SEC without the proof they have against MCC and myself.

Especially the proof they … go to MCC and sign up without any restriction.

Based on evidence submitted to the court by the SEC, a Temporary Restraining Order was issued against the MCC defendants on April 21st.

The apparent lack of remorse shown by Defendants, their continued possession of investors’ funds, and the ease with which they may revive a similar scheme via the internet gives this Court reason to believe that injunctive relief is necessary to prevent Defendants from engaging in future violations of the securities laws.

Accordingly, the SEC has made a sufficient showing in support of a TRO.

The SEC informs the Court that Defendants began disposing of their assets as soon as they received SEC subpoenas.

At least one Defendant, Capuci, is actively winding down his assets in the United States.

The Court finds that there is good reason to believe Defendants will hide, transfer, or otherwise dissipate their ill-gotten assets unless those assets are restrained.

A freeze of all Defendants’ assets is therefore appropriate at this time.

A preliminary injunction hearing, with the aim of making relief granted in the TRO permanent, has been scheduled for May 19th.

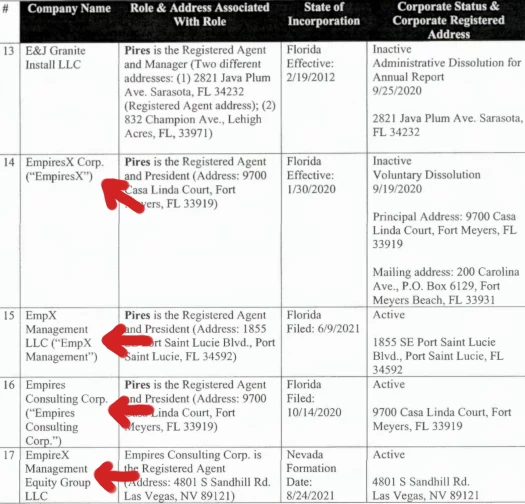

Two additional notes is that firstly SEC filings detail EmpiresX accounts under the control of Emerson Pires:

EmpiresX was a follow-up Ponzi scheme Pires launched with Flavio Goncalves in mid 2021.

EmpiresX collapsed after a few months but, based on a data leak, is believed to have defrauded consumers out of at least $60 million.

Similar to threats made against Mining Capital Coin investors by Capuci, Pires threatened EmpiresX investors who complained with legal action.

Beyond detailing EmpiresX bank and Coinbase accounts, EmpiresX itself is not part of the SEC’s Mining Capital Coin litigation.

The second note pertains to appearances by attorneys representing Capuci from Wellman & Warren.

Scott W. Wellman entered an appearance for Capuci on May 9th. Putting aside Wellman & Warren’s questionable association with MLM Ponzi schemes over the years (USFIA, Crypto World Evolution, iPro Network, Enigma Network), Wellman’s appearance isn’t otherwise noteworthy.

MLM Ponzi scammers need representation and someone has to do it.

What is noteworthy is a blog post on Wellman & Warren’s website, dated September 25th 2020.

Chris Wellman of Wellman & Warren defended Mining Capital Coin International Inc. (“MCC”) and its members against the Securities Exchange Commission (“SEC”).

In this litigation, the SEC claimed that MCC and its members were operating a business in violation of securities laws.

After a year of defending MCC, the SEC concluded they would not be recommending an enforcement action.

This is a great win for MCC and its members. Wellman & Warren wishes them the best on their endeavors.

Whether the SEC actually disclosed to Wellman what its plans were back in 2020 is unclear.

Probably not, given a year and a half later they would go on, in fact, to file suit against Mining Capital Coin.

It appears Wellman & Warren didn’t see the DOJ coming either…

Update 20th May 2022 – There’s been a bit of a changeup with respect to the preliminary injunction but, pending any objections, it’s looking like the injunction will be granted in June.