The freeze order was issued by the FCA, tying up over £100 million in client funds. Those funds are still frozen.

Now ePayments has announced it’s shutting down.

As per ePayments’ September 12th announcement;

ePayments has begun the process of closing its doors and entered into an orderly, solvent wind-down.

As you will be aware, the business has been closed for the past three years after our regulator (the UK Financial Conduct Authority (the FCA)) identified some weaknesses in our financial crime controls.

We have over this period been working hard to ensure these are up to the required standard, but in these extremely challenging and unprecedented global economic conditions, and with the business being restricted for such an extended period we can no longer sustain the business to build back to what the FCA require and a ‘business as usual’ state.

In practice, this means that we will not return to full operations and will now focus entirely on providing customers with refunds and working through the process of closing your accounts as we close down the business.

Your funds with us remain in safeguarded accounts. The FCA is aware of our decision and this communication.

In lieu of it closing down, ePayments has directed clients to request refunds.

The interesting tie between ePayments and MLM is OneCoin.

Prior to being appointed to ePayments, Courtneidge was Global Head of Cards and Payments for the law firm Locke Lord.

In January 2018 Courtneidge left Locke Lord to sign on as CEO of Moorwand, another payment processor.

Courtneidge’s appointment as an ePayments Systems Director took place six months later in July.

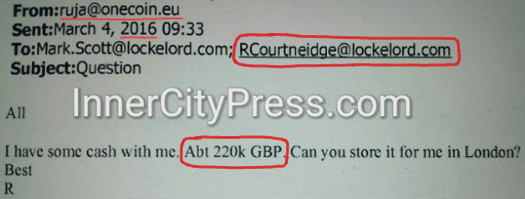

Locke Lord meanwhile, is the same law firm who in the UK counted OneCoin founder Ruja Ignatova as a client.

Robert Courtneidge worked closely with Mark Scott to launder OneCoin funds:

When the Financial Times approached Courtneidge for comment on the ePayments freeze, he told them he “was not legally able to comment on the company”.

Courtneidge resigned from ePayments on February 17th, 2020 – six days after the FCA freeze took effect. Since March 2020, Courtneidge refers to himself as an “Independent Payments Industry Advisor”.

This was my conclusion on the FCA ePayments freeze, as published in 2020;

In order for Courtneidge to be appointed a non-executive Director of ePayments Systems in January 2018, presumably there had to have been some sort of working relationship.

Did that relationship involve laundering vast amounts of money for Ruja Ignatova, in Courtneidge’s capacity as Locke Lord’s Global Head of Cards and Payments, through ePayments Systems?

And is that behind the FCA now shutting down ePayments Systems indefinitely over money laundering concerns?

Beyond initiating an asset freeze and effectively severing ePayments business operations in 2020, the FCA has taken no further action – at least not publicly.

The specific details behind the FCA’s ePayments freeze remain unknown.