Viiva operates in the weight loss and travel MLM niches and are based out of Utah in the US.

Viiva’s website fails to provide management details, however a linked press-release identifies Joe Zhou as its founder.

Zhou appears to have bought into Viiva about a year ago, which is when the company changed its name from Tavala.

Tavala launched back in January 2017 and was headed up by CEO Kent Wood. Viiva’s October press-release identifies Wood as Viiva’s ‘chairman and one of the company’s co-founders.’

Joe Zhou appears to have his MLM roots in NuSkin China. Viiva distributors “Dave and Joy” claim Zhou was

the top distributor for NuSkin in China during the time China represented 30-32% of NuSkin’s revenues and 80% of that came from Joe’s downline.

Nu Skin would later come under fire in China for operating as a pyramid scheme.

moved to an executive position with another company and set up a direct sales network team that grew a feminine hygiene product to over 1 Billion in sales.

Oddly enough, the company name is not disclosed.

In 2009 Zhou launched JM, which would later go on to merge with Ocean Avenue in 2014.

By 2015 the merger had devolved into a corporate disaster.

BehindMLM reviewed what was left of JM Ocean Avenue a year later in 2016.

Based on its business model, we concluded JM Ocean Avenue was a pay to play autoship recruitment scheme.

Although its completely dead in the US, JM continues to operate elsewhere in the world. Whether Joe Zhou is still involved is unclear.

Analysis of Tavala’s old website properties suggest nothing much was going on prior to the Viiva reboot.

According to Viiva’s website, the company is active in the US, Canada, the Bahamas, China, Hong Kong, Taiwan and Thailand.

Read on for a full review of Viiva’s MLM opportunity.

Viiva’s Products

Viiva continues Tavala’s product range of weight loss supplements, with an emphasis on breakfast.

Viiva sells healthy tasty nutritious breakfast and weight loss products.

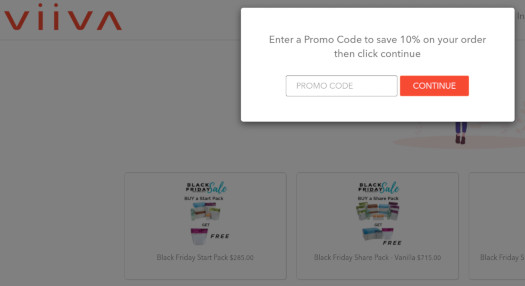

No idea what the logic is behind it, but when I went to browse Viiva’s online store as a retail customer the site demanded a promo code.

Without a promo code I could not browse Viiva’s product range.

I had to waste my time searching for a promo code, which was not appreciated.

The cynic in me believes Viiva’s promo codes are in fact just affiliate referral links in disguise. I’m also not sure why a 10% discount is offered if promo codes are mandatory.

- P3 Probiotic Kiiks – “helps balance healthy flora in your digestive system”, retails at $55 for a box of thirty single-serve sachets

- Plant Base (Chocolate and Vanilla) – “a nutritious protein base to keep you feeling full, focused and energized”, retails at $100 for a box of thirty single-serve pouches

- Amazon Superfruit Kiiks – “antioxidants help protect cells, balance the immune system and fight signs of aging”, retails at $75 for a pouch of thirty single-serve sachets

- Trim Max Kiiks – “assists with weight management, appetite suppression and energy but with a little more intensity”, retails at $75 for a pouch of thirty single-serve sachets

- Trim Kiiks – “assists with weight management, appetite suppression and energy”, retails at $75 for a pouch of thirty single-serve sachets

- Green Power Kiiks – “greens improve mental clarity, physical energy and digestive health”, retails at $75 for a pouch of thirty single-serve sachets

- Extra Smile – “fluoride and peroxide free and brings together a unique combination of oral care ingredients to help protect your teeth”, retails at $22 for a twin pack

Viiva weight loss breakfast products are also available in various bundle packs. The company claims all of its weight loss ‘products are manufactured in FDA GMP facilities.’

Viiva also markets access to a discount travel booking platform, although for some odd reason its hosted on a separate website.

Through Viiva Travel, the company markets

a membership service which provides unbeatable discounts on all things travel: flights, hotels, rental cars, cruises, activities, and more!

Viiva Travel retail membership costs $79.95 and then $70 annually.

Viiva’s Compensation Plan

Viiva fail to provide the public compensation documentation on their website.

The following analysis has been put together based on a 2019 compensation plan presentation by Viiva COO and CFO Devin Glazier.

Recruitment Commissions

Viiva pays a Fast Start bonus on first orders places by personally recruited affiliates.

Initially recruitment commission rates for Viiva affiliates are determined by how much PV they generated in their first 30 days.

- generate 250 to 999 PV in your first thirty days and earn a 10% Fast Start bonus

- generate 1000 PV or more and receive a 15% Fast Start Bonus

After a Viiva affiliates first thirty days, recruitment commission rates are determined by their monthly autoship order:

- have a standing 120 to 249 PV monthly autoship and earn an ongoing 10% Fast Start bonus

- have a standing 250 PV or higher monthly autoship order and earn an ongoing 15% Fast Start bonus

Residual Commissions (binary)

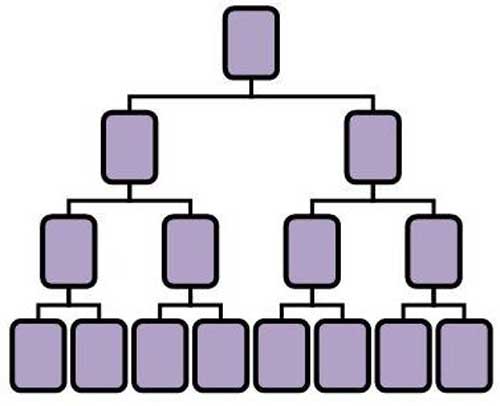

Viiva pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each week Viiva tallies up new sales volume on both sides of the binary team.

Affiliates are paid “up to 10%” of sales volume matched on both sides of the binary team.

Any leftover volume on the stronger binary team side is carried over into the following week.

Matching Bonus

Viiva pays a Matching Bonus on residual commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Viiva caps the Matching Bonus down nine levels of recruitment.

- Ranks 1 and 2 with a standing 60 PV autoship order earn a 5% match down three levels of recruitment (doubled to 10% if they have a 240 PV autoship order)

- Ranks 3 to 6 with a standing 120 PV autoship order earn a 5% match down three levels of recruitment (doubled to 10% if they have a 240 PV autoship order)

- Ranks 7 to 12 with a standing 240 PV autoship order earn a 10% match down six levels of recruitment

- Ranks 13 to 18 with a standing 240 PV autoship order earn a 10% match down six levels of recruitment and 5% down another three levels

Note that Viiva do not provide rank qualification criteria to the general public.

Pay+ Bonus

The Pay+ Bonus is a matching bonus on sales volume generated down four levels of recruitment on your largest personally recruited affiliate (by sales volume).

The Pay+ Bonus is capped at $1500 a month.

The specific matching bonus paid out is determined by a Viiva affiliates monthly autoship order:

- maintain a standing 120 PV monthly autoship order and receive a 5% Pay+ Bonus rate

- maintain a standing 240 PV monthly autoship order and receive a 10% Pay+ Bonus rate

Global Bonus Pool

Viiva takes 2% of company-wide sales volume and places it into the Global Bonus Pool.

The Global Bonus Pool is paid out each quarterly based on shares, which affiliates ranked 13 to 18 can acquire:

- Rank 14 affiliates receive one share

- Rank 15 affiliates receive two shares

- Rank 16 affiliates receive three shares

- Rank 17 affiliates receive four shares

- Rank 18 affiliates receive five shares

Viiva affiliates earn an additional share in the Global Bonus Pool per

- each personally recruited Elite Brand Partner; and

- each personally recruited Elite Manager.

Elite Brand Manager and Elite Manager are ranks within Viiva’s compensation plan. Again, Viiva fails to disclose affiliate rank qualification criteria.

Note that total obtainable Global Bonus Pool shares per quarter per Viiva affiliate are capped at twenty.

Joining Viiva

Viiva affiliate membership is $35.

Optional Enrollment Packs are available, ranging in price from $200 (Start Pack) to $1500 (Build Pack w/ Travel).

The primary difference between Viiva’s Enrollment Packs is bundled products.

Note that a standing 120 PV autoship order is also required in order to gain complete access to Viiva’s compensation plan.

This equates to roughly $120 in product spend each month (can be as much as $225).

Conclusion

Our primary criticism of Joe Chou’s JM Ocean Avenue opportunity is sadly retained in Viiva.

This is straight from Viiva’s company website FAQ:

1) Q: What is a monthly subscription?

A: It is an automatic order created online or via phone that ships automatically every month.

2) Q: How long does my subscription order keep me active?

A: 30 days.

That is mandatory affiliate autoship, which Viiva refer to as “subscriptions”.

By forcing affiliates to purchase products each month Viiva undercuts the retail side of the business.

Historically when an MLM company forces affiliate product purchases, retail is ignored in favor of building downlines of affiliates on autoship.

As per FTC guidelines, an MLM company without significant retail activity taking place is a pyramid scheme.

On the product side of things Viiva is much what you’d expect from a weight loss themed MLM company.

Although I will say the focus on breakfast does differentiate Viiva somewhat.

I’m not sure if there’s meal plans for the rest of the day included. If not, that might be a lost opportunity for the company to look into.

The travel side of Viiva appears to be a “me too” offering. This is evidenced by there being nothing about travel on Viiva’s main website.

The retail focus of Viiva’s travel engine is practically zero. It appears to be little more than an option for affiliates to add to their monthly autoship quota.

Given the current regulatory focus on MLM companies without significant retail sales activity, AdvoCare and Neora (disputed) come to mind, it boggles why Joe Zhou thought it a good idea to launch Viiva in the US.

Regulation of affiliate autoship recruitment pyramid schemes is much more lax in Asia, which I presume like JM is Viiva’s core focus market.

As with all recruitment focused MLM opportunities, Viiva will fall apart once said recruitment dies down.

The first step of this is those at the bottom of the company-wide affiliate base being unable to recruit to make up their losses.

Eventually they stop paying for their monthly autoship order, which means those above them stop getting paid.

Once this chain effect has filtered up high enough, an irreversible collapse is triggered.

As evidenced by court filings in both the AdvoCare and Neora FTC cases, MLM pyramid schemes inevitably result in the majority of participants losing money.