Despite claiming it was formed in 2016, TechVision’s website domain registration was last updated in July 2019.

This is likely when the current owner took possession of the domain, as Alexa started tracking traffic a few months later in September.

Supporting this is the shell incorporation of the New Zealand company TechVision Limited on July 26th, 2019.

Long story short, TechVision didn’t exist until July 2019.

Listed as the owner of TechVision’s website domain is Benjamin Lengyel, through an address in Auckland, New Zealand.

Further research reveals this address actually belongs to virtual office merchant Regus.

Benjamin Lengyel doesn’t exist outside of TechVision’s marketing and what appears to be a recently created LinkedIn profile.

Given this, it’s unlikely Lengyel exists outside of TechVision’s New Zealand shell incorporation.

Benjamin Lengyel is played by what appears to be an actor in TechVision marketing material.

The actor has a distinct European accent, suggesting TechVision is in fact a European company pretending to operate out of New Zealand.

The video Lengyel features in is the usual spotless office tour with “paid to look busy” extras.

In one scene, a supposed “poker expert” whose supposed to be “implementing (Techvision’s) software”, is just someone pretending to read a public website and doodling with a pen.

One can safely assume what’s shown on the screens of TechVision’s other actor experts is similarly doctored content.

As to where TechVision is actually being run from, one possibility is the Netherlands.

Next month TechVision is gearing up to hold its first “leadership summit” in Uden.

The “main guest” of the event is Christel van Der Steen, credited as “the leading development leader of Techvision in the Netherlands”.

Van Der Steen’s partner (husband?) Ardy van Breugel is also credited as a Netherlands leader.

Van Der Steen’s LinkedIn profile joined TechVision in September 2019. Prior to Techvision Van Der Steen was promoting the FutureNet and Cannerald Ponzi schemes.

Also attending TechVision’s leadership summit is “investor” Klemen Andlovec.

Andlovec began promoting TechVision on YouTube five months ago, which places him also joining in September 2019.

All of this points to TechVision likely being operated out of the Netherlands.

Read on for a full review of TechVision’s MLM opportunity.

TechVision’s Products

TechVision has no retailable products or services, with affiliates only able to market TechVision affiliate membership itself.

TechVision’s Compensation Plan

TechVision affiliates invest funds on the promise of advertised returns.

Below are TechVision’s investment tiers, listed by maturity period:

- First Step – invest $75 to $525 and receive 124% in 20 days

- Quick Step – invest $2275 to $11,500 and receive 145% in 30 days

- Quick Money – invest $13,250 to $23,250 and receive 172% in 40 days

- Steady Job – invest $25,000 to $55,000 and receive 200% 50 days

- Quick Revenue – invest $56,750 to $125,000 and receive 232% in 60 days

- Primary Stability – invest $1000 to $75000 and receive 224% in 80 days

- Primary Currency – invest $10,000 to $55,000 and receive 272% in 85 days

- Primary Revenue – invest $70,000 to $150,000 and receive 306% in 90 days

- Primary Profitability – invest $175,000 to $550,000 and receive 360% in 100 days

- Compounding All-In – invest $100,000 to $500,000 and receive 993% in 190 days

- Compounding Revenue – invest $50,000 to $99,999 and receive 820% in 200 days

- Compounding Apps – invest $15,000 to $49,999 and receive 667% in 210 days

- Compounding Primary – invest $100 to $14,999 and receive 584% in 220 days

TechVision pays returns Monday through Friday.

Referral Commissions

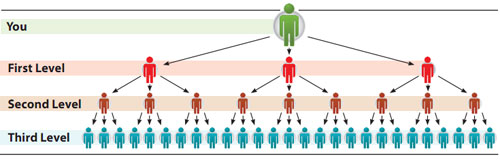

TechVision pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

TechVision caps referral commissions down sixteen levels of recruitment.

How many levels an affiliate can earn referral commissions down depends on how much downline investment volume they’ve generated:

- no requirement – 3% on level 1 (personally recruited affiliates), 2% on level 2 and 1% on levels 3 to 7

- generate $50,000 in downline investment volume – 4% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 to 9

- generate $500,000 in downline investment volume – 5% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 to 11

- generate $5,000,000 in downline investment volume – 6% on level 1, 3% on level 2, 2% on level 3 and 1% on levels 4 to 13

- generate $50,000,000 in downline investment volume – 7% on level 1, 4% on level 2, 3% on level 3 and 1% on levels 4 to 16

Joining TechVision

TechVision affiliate membership is free.

Participation in the attached income opportunity however requires a minimum $75 investment.

Conclusion

TechVision promises affiliate investors “guaranteed success”.

The Company’s powerful and constantly growing technical and software and hardware resource, showing incredible performance since 2015, combined with a team of professionals in the field of programming, investment-trading analysis and betting, guarantee profit for each TECHVISION Client.

No evidence of TechVision’s software or hardware resources exist. Nor is there any evidence of external revenue of any kind being actually used to pay affiliates.

Furthermore TechVision’s business model fails the Ponzi logic test.

If the company’s owners were able to 124% every 20 days, even a modest capital amount compounded would soon explode.

More importantly, why sell access to these incredible returns for just $75?

On top of all this TechVision is committing securities fraud.

TechVision markets a passive investment opportunity, which for regulatory purposes constitutes a securities offering.

Securities in the Netherlands and New Zealand are regulated by the AFM and Securities Commission of New Zealand respectively.

TechVision provides no evidence it has registered with the AFM, Securities Commission of New Zealand or any other securities regulator.

This means that regardless of anything else, TechVision are illegally soliciting investment in every country they operate in.

While the AFM are unlikely to do anything other than issue a warning, and New Zealand are irrelevant as TechVision doesn’t exist there outside of a shell incorporation, the same is not true of their largest investor market.

At the time of publication Alexa estimates the US is the largest source of traffic to TechVision’s website (38%).

Securities in the US are tightly regulated by the SEC. And no, TechVision is not registered with the SEC either.

So why would a clearly European company, pretending to be a New Zealand company and soliciting investment primarily from the US opt to operate illegally?

As it stands the only verifiable source of revenue entering TechVision is new investment.

Using new investment to pay affiliates returns makes TechVision a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dies off so too will new investment.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.