In an attempt to appear legitimate, Qtrade represents it is incorporated as Qtrade Limited in St. Vincent & the Grenadines.

St. Vincent & the Grenadines is a dodgy jurisdiction in the Caribbean. MLM companies typically incorporate in dodgy jurisdictions to avoid regulators.

Any MLM company representing it is incorporated in St. Vincent & the Grenadines raises an automatic red flag.

Raising further questions is Qtrade’s official FaceBook page, which is managed from two locations in Jordan.

Jordan isn’t on the same tier as St. Vincent and the Grenadines, but it isn’t a jurisdiction known for active MLM regulation.

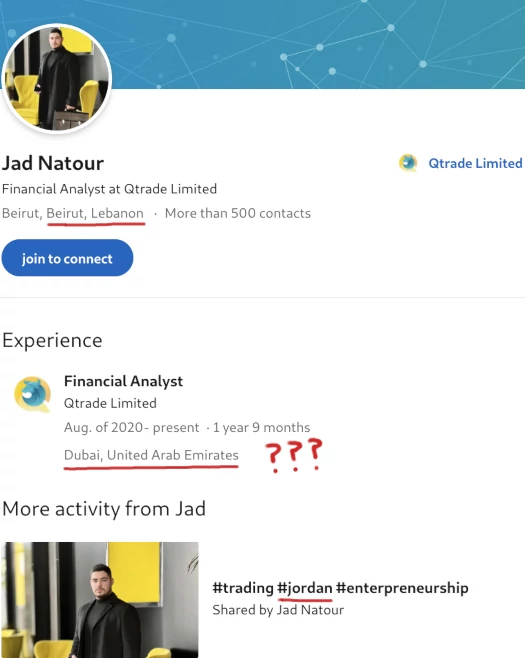

Qtrade has an official YouTube channel on which marketing videos featuring Jad Natour are uploaded.

Natour’s last Qtrade marketing video is dated December 2021.

On LinkedIn Natour cites himself as a Financial Analyst for Qtrade.

On this profile Natour is purportedly from Lebanon, Qtrade is based out of Dubai (the MLM scam capital of the world), and he’s hashtagged Jordan in a shared post.

On Twitter Jad Natour represents he is based out of Saudi Arabia:

On FaceBook Natour recently posted a photo geotagged in Jordan:

I’m going to go out on a limb here and suggest Natour is running Qtrade out of Jordan. Whether he’s working alone or with others is unknown.

Qtrade’s website domain (“qtradeltd.com”), was privately registered on January 5th, 2021.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Qtrade’s Products

Qtrade offers access to a forex trading platform.

With over 120+ instruments such as FX pairs, Indices, Commodities and Share CFDs, trade your way with Qtrade.

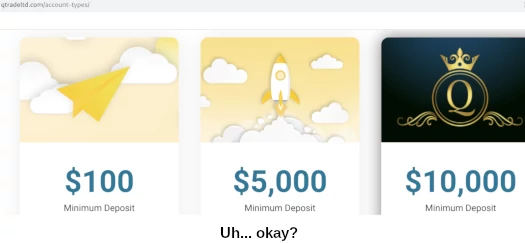

Qtrade’s offered accounts are split into minimum deposit amounts:

No other details about the accounts are given.

Qtrade’s Compensation Plan

Qtrade’s compensation plan is geared around trading volume by referred customers and recruited affiliates.

Qtrade pays commissions on margin range volume down three levels of recruitment (unilevel):

Commission rates are determined by downline trading volume:

- generate $5000 in margin range volume = 100% commission rate on level 1, 35% on level 2 and 10% on level 3

- generate $5001 to $15,000 in margin range volume = 110% commission rate on level 1, 56% on level 2 and 20% on level 3

- generate $15,001 to $50,000 in margin range volume = 120% commission rate on level 1, 77% on level 2 and 35% on level 3

- generate $50,001 to $130,000 in margin range volume = 140% commission rate on level 1, 98% on level 2 and 53% on level 3

- generate $130,001 to $400,000 in margin range volume = 160% commission rate on level 1, 115% on level 2 and 68% on level 3

- generate $400,001 to $1,050,000 in margin range volume = 190% commission rate on level 1, 133% on level 2 and 78% on level 3

- generate $1,050,001 to $2,500,000 in margin range volume = 230% commission rate on level 1, 147% on level 2 and 88% on level 3

- generate $2,500,001 to $5,000,000 in margin range volume = 280% commission rate on level 1, 161% on level 2 and 95% on level 3

- generate $5,000,001 or more in margin range volume = 350% commission rate on level 1, 175% on level 2 and 100% on level 3

Margin range refers to trading with funds effectively borrowed from a broker, which in this case would be Qtrade.

For the purpose of commission rate calculation, margin range volume is tracked over the last ninety days.

The standard commission provided in Qtrade’s compensation material is $15.

The Standard Commission (the base value used in calculating partner commission): 2.4 pips (5-decimal pricing) per trade in an STP account and 15% of the Qtrade commission for a trade performed in an ECN or a Crypto account.

It is this amount that the percentages above are calculated against. E.g. 100% = $15, $230% = $34.50 etc.

Note that Qtrade caps maximum daily commissions earned at $100 per trade order, $1000 a day in total commissions and $10,000 per referral over any time.

Also note that higher commission rates are available for Qtrade affiliates who “attract many referrals with large trade volumes”. No specifics are provided.

Joining Qtrade

Qtrade affiliate membership appears to be free.

Qtrade Conclusion

There’s nothing particularly offensive about Qtrade’s MLM offering. You’ve got a standard trading platform and, as far as I can see, no automatic trading capability.

This sees Qtrade steer clear of securities fraud concerns and operate legally.

The MLM side of the business is tied to margin trading, which is something you definitely want to read up on if you’re not familiar with it.

One thing to note is while commission rates are varied, the daily cap might hurt a heavy promoter. Also the $10,000 cap per referral (retail or recruited affiliate), takes a bite out of Qtrade’s long-term viability.

Where Qtrade falls apart is the shadiness behind company ownership. Jad Natour appears to be running the show but that’s not confirmed on Qtrade’s website.

Shell incorporation in St. Vincent & the Grenadines is another red flag that should not be ignored.

Given how big the forex space is and general availability, Qtrade’s red flags drastically reduce appeal from a trading perspective.

If you weren’t an affiliate promoting Qtrade, why would you use it over the bajillion other platforms out there?

As a trader I’d feel much more comfortable going with a platform that wasn’t incorporated in a tax haven, and I could verify company ownership details of. Especially when we’re talking $5000 and $10,000 minimum deposit ranges.

Qtrade has been around for just over a year but that’s no indication of long-term stability.

Approach with caution.