On his LinkedIn profile, Georgy Katsanov (right) refers to himself as a “private entrepreneur” with over seven years experience.

Language-barriers made tracking Katsanov’s MLM history difficult. I was however able to peg him to promotion of the TelexFree Ponzi scheme.

A Georgy Katsanov from Portugal filed a TelexFree victim claim for $590.20.

The TelexFree Trustee disallowed the claim, on the basis Katsanov (right) was a net-winner.

How much Katsanov stole from TelexFree victims is unknown.

I wasn’t able to find anything concrete on Jorge Nieto (right).

There is a Jorge Nieto on Twitter who’s at least familiar with TelexFree, however I’m not 100% sure it’s the same guy:

Other than LinkedIn profile links (Nieto’s is broken), FluxOn Club itself provides no information on its executives.

FluxOn Club claims it’s registered in Tbilisi, Georgia. Georgy Katsanov’s LinkedIn profile claims FluxOn Club is based out of Spain.

Katsanov himself lists his LinkedIn profile location as Lisbon, Portugal.

If Katsanov is based out of Portugal, that’s where in fact FluxOn Club is being operated from. Any ties to Georgia and Spain appear to only exist on paper.

Read on for a full review of FluxOn Club’s MLM opportunity.

FluxOn Club’s Products

FluxOn Club has no retailable products or services, with affiliates only able to market FluxOn Club affiliate membership itself.

FluxOn Club’s Compensation Plan

FluxOn Club affiliates invest in FON tokens on the promise of advertised returns.

Buying FON tokens, you will get your lifelong revenue from the company’s activity.

No specifics are provided on FluxOn Club’s website.

FluxOn Club Affiliate Ranks

There are ten affiliate ranks within FluxOn Club’s compensation plan.

Along with their respective qualification criteria, they are as follows:

- Partner – invest $100 and generate $200 in weaker binary team side volume

- Agent – invest $250 and generate $2000 in downline investment volume

- Consultant – invest $500 and generate $10,000 in downline investment volume

- Supervisor – invest $750 and generate $25,000 in downline investment volume

- Junior Manager – invest $1500 and generate $75,000 in downline investment volume

- Manager – invest $2500 and generate $200,000 in downline investment volume

- Administrator – invest $10,000 and generate $1,000,000 in downline investment volume

- Director – invest $25,000 and generate $2,000,000 in downline investment volume

- General Director – invest $50,000 and generate $5,000,000 in downline investment volume

Note that required volume for

- Partner and Agent is counted up to 50% per unilevel team leg

- Consultant to Top Manager is counted up to 40% on two unilevel legs and 20% from a third

- Administrator to General Director is counted up to 30% on three unilevel legs and 10% from a fourth

Referral Commissions

FluxOn Club pays affiliates a 5% referral commission on funds invested by personally recruited affiliates.

Residual Commissions

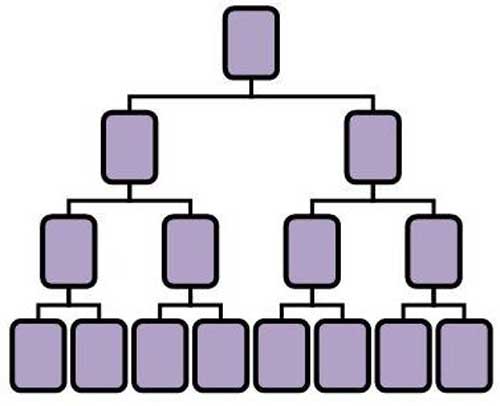

FluxOn Club pays residual commissions via a binary compensation structure.

A binary compensation structure places an affiliate at the top of a binary team, split into two sides (left and right):

The first level of the binary team houses two positions. The second level of the binary team is generated by splitting these first two positions into another two positions each (4 positions).

Subsequent levels of the binary team are generated as required, with each new level housing twice as many positions as the previous level.

Positions in the binary team are filled via direct and indirect recruitment of affiliates. Note there is no limit to how deep a binary team can grow.

At the end of each day FluxOn Club tallies up new investment volume on both sides of the binary team.

Affiliates are paid a percentage of funds generated on their weaker binary team side, based on rank:

- Partner to Consultant ranks receive 5%

- Supervisor and Junior Manager ranks receive 8%

- Manager to General Director ranks receive 10%

Once paid out on, weaker binary team volume is matched with the stronger side and then flushed.

Any leftover volume on the stronger binary team side is carried over.

Matching Bonus

FluxOn Club pays a Matching Bonus via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

FluxOn Club caps the Matching Bonus at five unilevel team levels.

The Matching Bonus is paid out as a percentage of residual commissions earned across these five levels as follows:

- Supervisors receive a 5% match on level 1 (personally recruited affiliates)

- Junior Managers receive a 5% match on levels 1 and 2

- Managers receive a 5% match on levels 1 to 3

- Top Managers receive a 5% match on levels 1 to 4

- Administrators receive a 5% match on levels 1 to 5

Reinvestment Commissions

FluxOn Club pays commissions on downline reinvestment using the same unilevel team as the Matching Bonus.

Reinvestment commissions are capped at nine unilevel team levels, based on rank:

- Partners earn 1% on levels 1 to 3

- Agents earn 1% on levels 1 to 3 and 2% on levels 4 to 6

- Consultants earn 1% on levels 1 to 3, 2% on levels 4 to 6 and 3% on level 7

- Supervisors earn 1% on levels 1 to 3, 2% on levels 4 to 6, 3% on level 7 and 5% on level 8

- Junior Managers and higher earn 1% on levels 1 to 3, 2% on levels 4 to 6, 3% on level 7, 5% on level 8 and 7% on level 9

Rank Achievement Bonus

Starting at the Agent rank, FluxOn Club rewards affiliates with the following Rank Achievement Bonuses:

- qualify as an Agent and receive $100

- qualify as a Consultant and receive $250

- qualify as a Supervisor and receive $500

- qualify as a Junior Manager and receive $2500

- qualify as a Manager and receive $5000

- qualify as a Top Manager and receive $15,000

- qualify as an Administrator and receive $25,000

- qualify as a Director and receive $50,000

- qualify as a General Director and receive $100,000

If a FluxOn Club affiliate qualifies at Agent to Supervisor within the following set time frames, the following additional bonuses are paid out:

- qualify as an Agent within your first 30 days and receive an additional $150

- qualify as a Consultant within your first 60 days and receive an additional $350

- qualify as a Supervisor within your first 90 days and receive an additional $1500

FluxOn Pool Bonus

FluxOn takes 1% of company-wide investment volume and places it into a bonus pool.

Junior Manager and higher ranked affiliates receive a share of the split pool as follows:

- Junior Managers receive a share in a 0.4% pool

- Managers receive a share in a 0.3% pool

- Top Managers receive a share in a 0.2% pool

- Administrator and higher ranks receive a share in a 0.1% pool

Joining FluxOn Club

FluxOn Club do not detail affiliate membership costs on their website.

A minimum $100 investment is required to participate in the attached MLM opportunity.

Full commission and bonus qualification requires an investment of at least $50,000.

Conclusion

Create an ERC-20 shitcoin, convince people to hand over money for it, pay returns in said ERC-20 shitcoin… pay withdrawals until new investment runs out.

That’s pretty much all FluxOn Club is.

The MLM side of the business is pure pyramid scheme. Nothing is marketed or sold to retail customers. You recruit, your recruits spend money and you get a cut.

They recruit, you get a cut of that and so and so forth. Again, zero retail.

FluxOn Club commits its investment fraud their FON token.

FON is not publicly tradeable and although FluxOn Club claims 1 FON is worth $1, there’s literally nothing backing this claim.

FluxOn Club claims it manages crypto assets and

also provid(es) a range of services in the cryptocurrencies mining with the usage of the most advanced systems and technologies.

The FluxOn company deploys its Mining farms and Masternodes in the Georgian Free Industrial Zone (FTZ) and Xinjiang (Uyghur Autonomous region), that ensures benefits and loyalty to the company’s activity by the government.

No evidence of these activity is provided. At least nothing that counts for anything.

Being a passive investment opportunity, in order to operate legally FluxOn Club has to register itself with financial regulators in every country is solicits investment in.

Nowhere on FluxOn Club’s website or in their marketing material do they indicate they have done so.

Putting aside FluxOn Club is operating illegally for just a second, registering would require the company to provide audited financial accounting reports.

These reports would confirm FluxOn Club is actually doing what it says it is. That is using external revenue to pay affiliates.

The only reason FluxOn Club would opt to operate illegally, is if the company is in fact not doing what it claims to be.

I can’t stress this enough, incorporation in Georgia and other dodgy jurisdictions is not a substitute for securities registration. Nor is social media content of any kind.

As it stands the only verifiable source of revenue entering FluxOn Club is new investment.

Using new investment to pay FON token ROI withdrawals via an internal exchange makes FluxOn Club a Ponzi scheme.

As with all MLM Ponzi schemes, once affiliate recruitment dries up so too will new investment.

This will starve FluxOn Club of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of investors lose money.