The company was founded in 2013. A corporate address in Connecticut is provided.

As per Meaike’s LinkedIn profile;

After I graduated with my Masters Degree I obtained a job with the state of CT as a social worker and I also obtained a real estate license to supplement my income.

For 15 years I worked two jobs to just keep my head above water.

When I was introduced to this opportunity, I was excited about one thing at first.

NAA had thousands of leads that we’re filled out and signed by clients that WANTED insurance and I got paid on average $550 for each person I helped.

In 2008 I worked part time with NAA and earned $296,000 in my first 12 months… I was FIRED up!!

I quit both my jobs and worked with NAA full time and the year after I earned $602,000.

This past year I 1099’d 1.4 million dollars.

I never dreamed about being a millionaire, I just wanted to help people and I was afraid to be broke.

Andy Albright the president and CEO of NAA personally mentored me and taught me how to follow the very simple system NAA has in place.

“NAA” is National Agents Alliance, another life insurance MLM.

While Maike’s LinkedIn profile might sound rosy, his split with NAA in 2013 was messy.

As alleged by NAA;

On December 12, 2013, Meaike notified NAA that he was terminating his employment.

NAA asserts that prior to Meaike ending his employment with NAA, Meaike formed FFL and actively recruited other agents employed by NAA to join FFL.

Later in December 2013 NAA’s parent company, Superior Performers, filed suit against Maike and several former NAA agents.

In their lawsuit, NAA alleged;

The solicitation of NAA’s agents was a violation of the Agent Agreements by each Defendant.

Upon information and belief, Meaike, (Marc) Meade, and (Bryant) Stone have also each violated the non-competition provisions in their Management Agreements.

Meade is a top Family First Life affiliate. I couldn’t find any current information on Bryant Stone.

NAA’s lawsuit against Meaike was lengthy, coming in at just under 400 filings.

The case was settled following mediation proceedings in January 2017.

In May 2014 NAA filed an additional trademark infringement lawsuit against Family First Life.

That case was dismissed relatively early on in February 2015.

Naturally it follows that Meaike’s time at NAA influenced the launch of Family First Life.

That said Meaike appears adamant in marketing presentations that he’s running the company his own way.

Read on for a full review of Family First Life’s MLM opportunity.

Family First Life’s Products

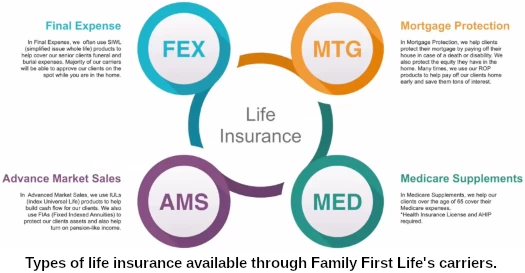

Family First Life market life insurance policies written by third-party carriers.

There is absolutely no specifics about life insurance policies anywhere on Family First Life’s website.

Instead Family First Life’s website is dedicated to marketing the company’s income opportunity.

Family First Life’s Compensation Plan

Family First Life don’t provide a copy of their compensation plan on their website.

I tried to source this information elsewhere but came up blank.

What Family First Life do provide is a vague breakdown of their compensation plan.

Cross-referencing this with official marketing videos, here’s what I was able to ascertain.

First Year Policy Commissions

Family First Life affiliates earn a first-year commission on each policy they sell.

The company’s website details a 90% commission paid on first-year monthly premium fees.

Further research reveals Family First Life’s first year policy commission rate ranges from 80% to 140%.

Specific first year policy commission rates are determined by monthly personal policy volume or total downline monthly policy volume.

Note that in both instances a commission rate is qualified for by satisfying required policy volume for two consecutive months.

Personal volume first year policy commission rates range from 80% to 110%.

- starting first year policy commission rate – 80%

- generate $5000 a month in policies for two consecutive months and earn 85%

- generate $10,000 a month in policies for two consecutive months and earn 90%

- generate $15,000 a month in policies for two consecutive months and earn 95%

- generate $20,000 a month in policies for two consecutive months and earn 100%

- generate $30,000 a month in policies for two consecutive months and earn 105%

- generate $40,000 a month in policies for two consecutive months and earn 110%

Downline volume first year policy commission rates are tracked via a unilevel compensation structure.

A unilevel compensation structure places an affiliate at the top of a unilevel team, with every personally recruited affiliate placed directly under them (level 1):

If any level 1 affiliates recruit new affiliates, they are placed on level 2 of the original affiliate’s unilevel team.

If any level 2 affiliates recruit new affiliates, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Downline volume (GV) is capped at up to 50% of required volume per unilevel team leg. It also includes an affiliate’s own policy volume.

- generate $15,000 GV for two consecutive months and receive a 90% first year policy commission rate

- generate $20,000 GV for two consecutive months and earn 95%

- generate $25,000 GV for two consecutive months and earn 100%

- generate $75,000 GV for two consecutive months and earn 105%

- generate $100,000 GV for two consecutive months and earn 110%

- generate $125,000 GV for two consecutive months and earn 115%

- generate $150,000 GV for two consecutive months and earn 120%

- generate $200,000 GV for two consecutive months and earn 125%

- generate $250,000 GV for two consecutive months and earn 130%

- generate $300,000 GV for two consecutive months and earn 135%

- generate $350,000 GV for two consecutive months and earn 140%

Note that once a first year policy commission rate is qualified for, it is kept regardless of future monthly policy volume production.

Family First Life calculates direct commissions based on the projected total annual fee payment.

75% of the calculated annual policy commission is paid upfront.

The remaining 25% is paid across monthly ten to twelve of the policy.

For the 100%+ commission rates, presumably there’s some “borrowing” of policy fee payments beyond the first year.

Second Year Onwards Policy Commissions

Family First Life are vague when it comes to commissions paid on policies after the first year.

Renewal Commissions are paid Annually on certain types of policies when the contract renews at the end of the year.

The average renewal commission is 5% of the Annual Premium.

Commissions are only paid on “certain” policies and no specific percentages are provided.

Residual Commissions

Family First Life are equally opaque about the MLM side of their business.

We know residual commissions are paid as overrides, in that higher ranked affiliates collect percentage differences against lower ranked affiliates in their downline, but specifics again aren’t provided.

The override commission is equal to the difference of commission levels between you and your agents.

The average override commission is 15% of the Annual Premium.

This would suggest that the 90% example cited for First Year Policy Commissions is not fixed.

Typically override style commissions are tied to rank. Such that there are ranks within Family First Life, details aren’t provided on the company’s website.

Bonuses

In one Family First Life marketing video I cited Shawn Meaike referencing bonuses, awarded to affiliates when those under them hit 140% commission rates.

No specific information beyond that was provided.

Joining Family First Life

Family First Life affiliate membership is free.

The company emphasizes that it does not have its affiliates sign any contracts.

Conclusion

I get the sense from the Family First Life marketing videos I watched, that Shawn Meaike is a pretty straight-forward guy.

I don’t know him from a bar of soap but he came across as pretty candid about the business. Which begs the question why is there no detailed compensation material provided?

I found this strange seeing as Meaike was otherwise upfront about various figures pertaining to the business.

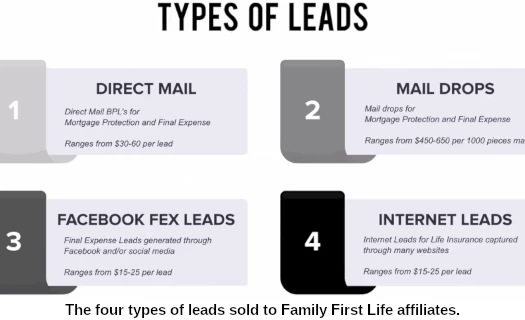

Family First Life’s basic business model is sign up, purchase leads and sell life insurance policies.

The leads are purportedly provided through third-parties, with Meaike claiming Family First Life doesn’t get involved.

Apparently this is a successful marketing strategy, with Meaike boasting Family First Life affiliates have access to “hundreds of thousands of leads”.

[9:02] We get millions (of leads). I mean we can produce leads like we couldn’t hire… if a hundred thousand people watched this and everybody joined and everybody sold, we’d have enough leads.

Meaike claims these are warm leads, i.e. the “leads came to us”.

Attached to this is what the company refers to as “aggressive compensation”, topping out at 140% per policy. Family First Life claims the “average paycheck per policy is $675”, which is “well above the industry average”.

What Family First Life comes down as an MLM opportunity is whether you can capitalize on the leads provided. Or get your downline to.

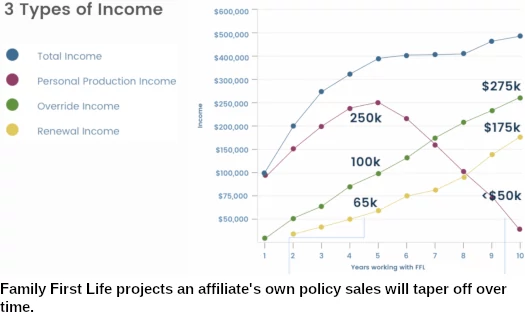

Indeed personal policy sales will only get you so far. If you want to max out Family First Life’s compensation plan you’re going to have to build a downline.

This is an MLM company after all so that’s not a negative.

Theoretically Family First Life can wade into pyramid scheme territory, if the majority of policy holders are affiliates.

Given the company pushes the “buy leads, sell to leads” marketing so heavily, I don’t think that’s the case. Hell given the required policy volume it’d be a hefty challenge even if you tried.

What I can’t attest to or even gauge is the quality of Family First Life’s leads (provided through undisclosed third-parties).

And this leads us into a trap you should very much be aware of. With Meaike talking up provided leads up the wazoo, this sets the stage for “it’s not us, it’s you”.

While that might very well be true in some cases (selling life insurance isn’t going to be for everyone), it also can trap people in an endless cycle of buying leads that don’t go anywhere (for whatever reason).

Signing up for Family First Life might not cost anything but buying leads does. And that’s a financial trap to watch out for.

Based on what you’re comfortable spending (whatever you do don’t go into debt buying leads), set specific lead purchase goals for a few months and stick to them.

See where you’re at then and evaluate. If the leads aren’t converting, don’t get bogged down on assigning blame. It could be you, it could be the leads. It could be both.

Cut your losses and move on.

Falling into the “if I just buy a few more leads I might make a sale” trap, is the biggest financial risk with respect to Family First Life as an MLM opportunity.

Needless to say if you’re not comfortable with buying leads and following up on them, Family First Life isn’t for you. That’s their business model, there’s no changing it.

Something else to keep in mind is a 140% commission doesn’t come out of nowhere. You’re banking on your clients to keep their policies for over a year.

If that doesn’t happen, you’re on the hook for a clawback (remember, that 75% commission is paid out upfront).

Personally I’d like to see some transparency with respect to Family First Life’s compensation plan on their website. I get insurance is complicated but even some basics would go a long away.

To illustrate how this leads to confusion, the compensation example provided on Family First Life’s website details a 90% commission.

In a September 2020 Family First Life marketing video, Meaike positively rubbished this amount.

[0:31] I didn’t want anybody to be at forty, fifty, sixty, seventy, eighty percent compensation, ninety percent compensation.

I don’t care where you go but if you’re at that compensation you should quit.

Maybe that’s not the message you want to be putting out there, when 90% is the only commission example your company website provides.

One thing Family First Life do extremely well is maintenance of their YouTube channel. It’s full of content and actual training.

At the very least have a run through it before committing to anything. It should give you a sense of what the company culture is about.

I certainly think there’s a missed opportunity to integrate a lot of what’s hidden away there on Family First Life’s website.

Finally one last thing to watch out for is an affiliate looking to recruit you, hoping you and others recruited will do all the work.

There’s no minimum personal policy volume requirements across Family First Life’s upper ranks.

Make sure whoever you sign up under is actually generating personal policy volume each month, or you could be joining a dead end.

For reference, Shawn Meaike claims Family First Life’s average personal monthly policy volume is $9200 (September 2020).

Broadly speaking, insurance MLMs are complicated and there’s a lot to digest. Take your time.

Update 5th April 2022 – Sometime in the last week Family First Life has deleted the YouTube video in which Shawn Meaike rubbishes 90% commissions.

The cited video was linked in this article but as a result of the video’s deletion, I’ve disabled the previously accessible link.